Volkswagen Reveals Its Money-Maker Plan For EVs And Autonomous Services

Volkswagen has revealed its New Auto 2030 strategy, its roadmap for the rest of the decade, and the automaker is hoping you'll be willing to pay handsomely for software and autonomous services. Margins on electric vehicles should reach parity with combustion vehicles within 2-3 years, VW predicted today, helping close the gap in the transition, and potentially putting a new audience of shoppers in front of the automaker's store.

Internal combustion engines are on the wane, VW says, though will still be around until 2030 depending on market. However declining demand, tighter emissions regulations, and tax disadvantages are expected to coax drivers into EVs.

As a result, VW plans to trim its combustion range by 60-percent in Europe by 2030. It'll rely on the MQB platform – which underpins models like the VW Atlas, Audi A3 and Q3, and many more – to build differently-branded vehicles in a more cost-effective manner.

All the same, it's clear that VW sees electrification as the main event. 50-percent of its total investments through 2025 will be on electrification and digitalization, totaling 73 billion euro ($88 billion). Beyond that, the number is set to increase. By 2025, VW expects EVs to comprise around 20-percent of its global sales; by 2030/31, that should be around 50-percent.

For the moment, it's costing VW more to build its EVs than its traditional combustion vehicles. Over the next 2-3 years, though, the combination of lower research and development costs thanks to platform sharing, battery cost savings, economies of scale, and shared factory advantages, that margin gap should close.

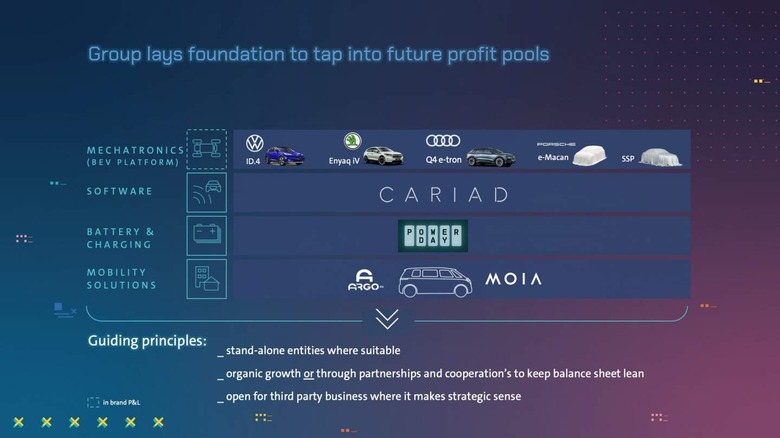

To achieve that, VW is shifting to a new platform. The VW "Scalable Systems Platform" (SSP) mechatronics platform – succeeding MQB, MLB, MEB, and PPE – will eventually be a single architecture for the entire electric vehicle portfolio, across the group. Described by Herbert Diess, chairman of the Volkswagen AG board, as "our super-platform," it will underpin everything from 85 kW city runabouts through 850 kW high-end performance models.

The SSP will be 100-percent electric, and "ready for autonomous driving," Diess says. It'll also be open to other automakers, should they be looking for a shortcut to EVs, much as the MEB platform is today.

It's software, though, where VW sees huge potential. While vehicles will still account for 85-percent of its business, software-enabled sales could contribute a further 1.2 trillion euro ($1.45 trillion) by 2030. If that aggressive goal is to work out, it'll need to figure out a way for its CARIAD team to not only develop appealing software, but persuade people to pay for it. That includes, VW says, recurring revenue such as subscriptions.

Currently, there's the E3 1.1 software stack for the VW ID. family of EVs. By 2023, E3 1.2 is expected to launch for the PPE platform used by Audi and Porsche; it'll support OTA updates among other things. From 2025, though, the E3 2.0 version will be ready for a group-wide rollout, VW insists, complete with Level 4 autonomous driving support.

Among the offerings will be mobility and transport as a service, including a fleet of autonomous vehicles that can be booked through VW's app. The automaker is testing fleet operations in Hamburg, Germany, under its MOIA brand; eventually, it plans to use the ID. Buzz AD autonomous electric minivan – the self-driving version of the upcoming ID. Buzz – in that fleet, but with "more specific designs for driverless operations and more convenience" in the pipeline, Diess promises.

The first autonomous mobility service will launch in Europe in 2025, VW says, "shortly followed" by a US launch. The long-term goal is to bundle together not only brands but mobility options under a single umbrella: one fleet could cover everything from renting and car subscriptions, through sharing and ride-hailing, with the potential for manually and autonomously driven options. Earlier this week, Audi showed off the latest handiwork of its Artemis division, a Level 4 concept car which the company insists is headed to a production version in 3.5 years time.