Venmo's Credit Card Is Finally Here With An Interesting Rewards System

Around this time last year, Venmo announced it planned to release a credit card. After that, the company went more or less silent about its credit card plans, but today Venmo finally broke that silence. Venmo is now rolling out its credit card to select customers in the US, and what might help it stand out from the crowd is the way its handles cash back rewards.

Venmo explains that users will get 3% cash back on purchases in their top spend category for each billing period, 2% cash back for their second-highest spend category, and then 1% on everything else. So, the categories you'll get 3% and 2% back on will change each billing cycle along with your spending priorities. For the purposes of determining cash back, Venmo has split potential spending into eight categories: grocery, bills and utilities, health and beauty, gas, entertainment, dining and nightlife, transportation, and travel.

Venmo says that it will automatically deposit any cash back you earn into your Venmo account, and from there, it's yours to do with what you wish. Unsurprisingly, the Venmo app plays a central role in the whole credit card experience, as that's where you'll manage the card, make payments, and track your spending.

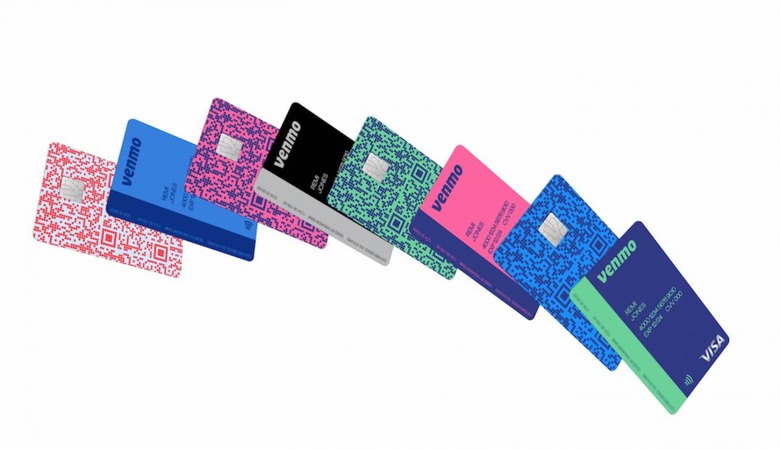

The card is backed by Visa and comes in five different colors that each have a unique QR code printed on the front. Scanning that QR code is how you'll begin setup of your card and it can also be scanned by other Venmo users to send you money or split purchases. Venmo's credit card also comes with an RFID chip that allows you to tap to pay at terminals that support it.

All in all, it sounds like a mostly run of the mill credit card, but that shifting cash back scheme could help it get some attention at a time when it seems like everyone is offering a credit card. Select customers can apply for the card in the Venmo app beginning today, with Venmo saying it'll invite all users in the US to apply in the coming months. Before you apply, be sure to read the terms and conditions for the card, as well as an in-depth explainer about how cash back works.