The Big Crypto Crash Enters Another Week

Times are tough for cryptocurrency aficionados. After a very strong second half of 2021, we're now seeing what seems to be an endless downward trend as the crypto market crash continues. Be it Bitcoin, Ethereum, or another kind of crypto, currencies are plummeting one after another with only brief reprieves that happen on a case-by-case basis. Is this going to be the new normal for the crypto market, or will it rise and recover as it always seems to do?

Cryptocurrencies, as a whole, are known to be volatile. Seasoned crypto veterans have seen both the mountain-high highs and the crushing lows. The crypto market fluctuates, as does the regular stock market, but the crashes that semi-regularly take place on the crypto market are the perfect presentation of just how volatile it truly is.

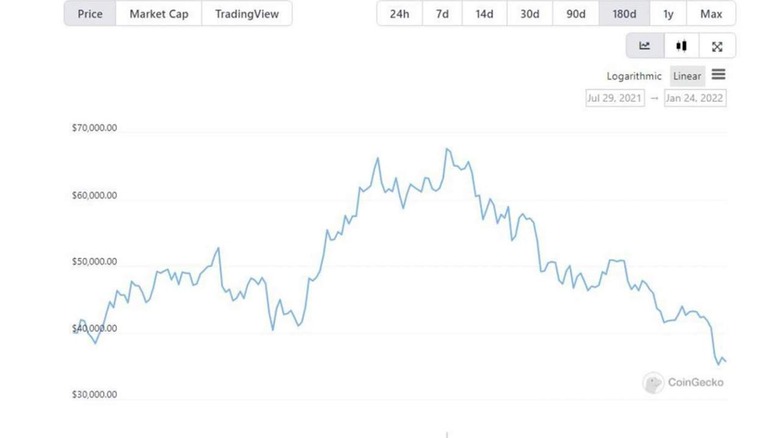

The crash is not limited to just one cryptocurrency. Bitcoin may be the poster child of crypto, but other currencies were hit just as hard — if not harder. That is not to say that Bitcoin (BTC) didn't suffer a devastating loss, because it certainly has. According to CoinGecko, BTC has hit an all-time high at the beginning of November 2021, reaching a value of $67,617. The price has steadily gone down since, but it truly plummeted in January, dropping as low as just above $35,000 on January 23.

As reported by The Economic Times, this most recent crypto crash erased over $1 trillion in market value. That's right: $1,000,000,000,000, a whole twelve zeroes, in US dollars has just disappeared over the course of just a few months. Which currencies suffered the biggest losses?

Which currencies are affected by the 2022 crypto crash?

Screenshot from: CoinGecko

As mentioned above, Bitcoin has suffered a massive loss, and we may not have seen the end of it yet. Since its November peak, BTC has lost over 45% of its value. While things are dire for Bitcoin, other currencies are not doing any better.

Ethereum (ETH,) the second most popular coin, is taking huge blows too. Ethereum's value (vs USD) has fallen hundreds of dollars on an hourly basis in the recent past, only to temporarily regain some ground later — and then it drops again. Much like Bitcoin, ETH has reached its peak in November 2021, reaching a value of $4,815 (via CoinGecko.) Although the coin never quite hit that high again, it stayed in the $4,500 ballpark through the end of November and part way through December 2021 – but those days seem to be long gone now. Just within the last week (January 17-January 24, 2022,) ETH has dropped from $3,356 down to $2,381.

We've just recently reported a huge success for Dogecoin, which is now officially recognized as a currency in the Tesla merch store, but the high was brief. Dogecoin is now at its lowest value since its unexpected rise in April 2021. In other words: The crypto crash is affecting currencies across the board, be it the massive behemoths (BTC and ETH) or the smaller coins.

Bull market vs bear market

Before we delve into what happened to the cryptocurrency market in the last few weeks and months, it's important to note that this is just what the crypto market does. It goes up and down in waves and only looking at the bigger picture of more than a year shows which market cycle we are currently in. That's right, the crypto market (although it's not exclusively a crypto thing) recognizes two market cycles: The bull market and the bear market.

A bull market takes place when the investments are generally on the rise. There may be some hiccups along the way, but we're observing a general upward trend — that's a bull market. A bear market is the exact opposite of that and represents a time when securities fall for a prolonged period of time.

Many investment experts agree that we have been in the midst of the bull market for quite some time now. The majority of 2021 consisted of the bull market. Now, with the current crash, some analysts are saying that the bull market is over for good — at least until the next cycle. As Opeoluwa Dapo-Thomas, a market analyst, said to NairaMetrics: "I'm afraid the bull market has come to an abrupt end. Key support levels broken, a trillion dollars wiped off the entire crypto market value."

The pandemic affected markets all over the globe

Whether the bull market is over for good or not, it's hard to deny that things are rough right now. There could be many reasons for the 2022 crypto market crash. Financial Express cites the uncertainty faced by all markets as a direct result of the Omicron variant of the novel coronavirus. Two years into the pandemic, the effect on the market is as strong as ever, acting as another consideration in this most recent crypto crash.

The cryptocurrency market is also responding to the state of the global market, which has also been seeing a downward trend: Once again, this is most likely directly related to the ongoing pandemic. Many governments are currently taking measures to reduce the inflation of the past two years, and as they pull the brakes on previously instated emergency measures, the market suffers.

As reported by USA Today, the Federal Reserve started creating dollars from scratch at a much faster rate back in 2020 in order to rescue the economy at the beginning of the pandemic. Governments all around the world have, in many cases, done the same. There was no way that this wouldn't catch up to the market eventually.

Will cryptocurrency recover from this crash?

Many crypto nay-sayers are rejoicing as the markets hit their lowest points day after day, but is this downturn here to stay? It's hard to say with any certainty, but previous instances of the bull and bear cycles suggest that the crypto market will bounce back eventually. So far, it always has, and the gains were massive each time.

Just looking at Bitcoin prices on CoinGecko gives a very basic overview of the way the cryptocurrency market ebbs and flows. A year ago, back in February 2021, Bitcoin was at an even lower price than it is right now, oscillating around $32,000. We've seen it rise to $60,000 and above around March and April 2022, only to crash again in May 2022 all the way down to $30,000 in June. We know what came next: The gigantic rise of November 2021.

Whether the cryptocurrency market will recover quickly or take its sweet time, odds are that things will go back to normal sooner or later. Time will show whether Bitcoin and other coins will be able to hit the numbers of 2021 once again.