Tesla Sets Elon Musk A 10 Year Roadmap To $650bn

It's tough to imagine Tesla without Elon Musk at the helm, and clearly the automaker isn't willing to risk a change, announcing a $70bn compensation package for the next decade. The company – which in addition to making electric cars is also the owner of SolarCity, a solar panel firm – won't be paying Musk any guaranteed compensation, it said today. Instead, what the outspoken billionaire will make will depend on how valuable Tesla gets.

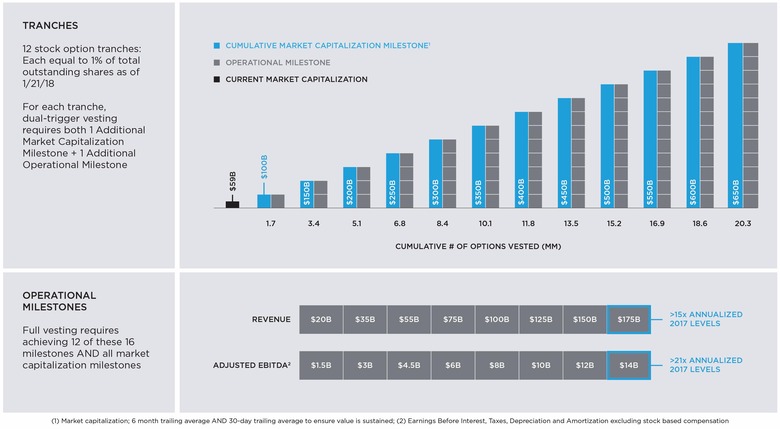

Currently, it's worth around $59bn, but it has some huge ambitions. In order for Musk to maximize his return, Tesla will need to grow to $650bn in the next ten years. In addition, there'll be operational milestones that the company will have to hit.

It's a system that mimics Musk's 2012 performance award, and which fueled his ambitious "Master Plan" of electrification. Then, Musk was challenged to increase Tesla's market cap in $4bn increments, while also hitting Model X and Model 3 production and development milestones along the way. Although aggressive, the chief executive rose to the challenge, hitting all of the market cap targets and nine of the ten operational milestones.

Now, with the "Master Plan, Part Deux" underway, the stakes are even higher. Musk faces a ten year grant of stock options, vesting in 12 tranches. Again, each tranch depends not only on Tesla's market cap, but operational milestones too.

First off, Musk needs to increase the company's market cap to $100bn. After that, it needs to bump up in at least $50bn increments for the remaining eleven milestones. Simultaneously, a series of escalating revenue and adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, in this case excluding stock-based compensation) targets must also be hit.

What there won't be is any salary, bonus, or regular time-based equity involved. In short, if Musk is to make Tesla pay, he'll need to deliver on things like the Solar Roof, Tesla Semi electric truck, and autonomous updates for cars like the Model S, Model X, and Model 3. It'll also involve schemes that allow Tesla owners to share their vehicles when not in use, opening up another revenue stream in the process.

That said, there's a little flexibility baked into the plan. For example, Musk must either be Tesla's CEO or both its Executive Chairman and Chief Product Officer, with all leadership ultimately reporting into him. While the company says there's no plan to bring replace its chief exec, "this ensures that Elon will continue to lead Tesla's management over the long-term while also providing the flexibility to bring in another CEO who would report to Elon at some point in the future."

It's an ambitious and aggressive target for a company which, while not short on advocates and flashy announcements, has sometimes struggled to get the basics right. Production of the Model 3, Tesla's most affordable car, failed to ramp quite as Musk & Co. hoped it would, hamstrung with manufacturing hiccups. Some critics have accused the company of trying to mask its more mundane problems with attention-grabbing launches like the second-generation Tesla Roadster, though it's worth noting that, like the hundreds of thousands of Model 3 reservations, the company is securing cash with each Roadster reserved.

Tesla shareholders will be voting on the performance award in late March. Elon and Kimbal Musk will be recusing themselves from that vote.

MORE Tesla