Samsung Money Is A Debit Card For Your Samsung Pay Account

We may receive a commission on purchases made from links.

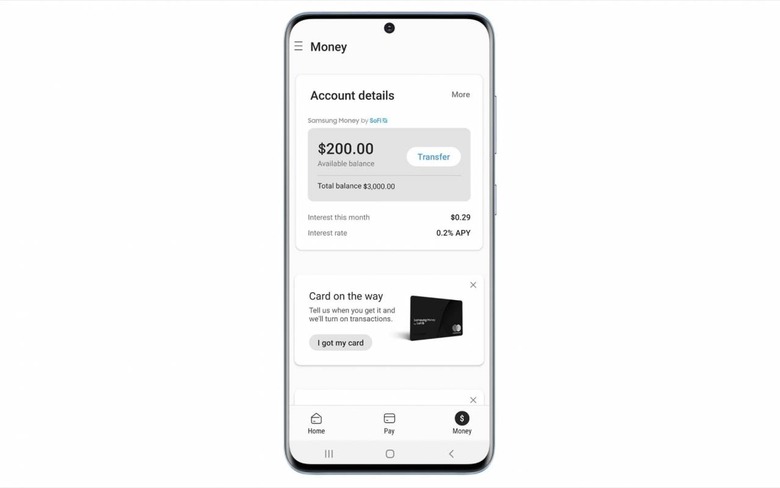

Samsung has launched Samsung Money by SoFi, a mobile-linked debit card designed to work with Samsung Pay. The sleek new black card builds on the phone-based mobile payments Samsung Pay offers, and will come with finance management tools – including physical card control – and no monthly or annual account fee.

Unlike Apple Pay, Samsung Money is a debit card, rather than a credit card. Users will be able to choose either an individual or a joint cash management account, and they'll instantly get a virtual debit card when they sign up, which they can start using straight away from their phone.

A physical card – which follows the lingering trend for black, minimalistic design, and which is powered by MasterCard's network – will follow on in the mail. That can be activated through the Samsung Pay app, rather than having to call a number. There's no card number, expiration date, or CVV number on the card itself, which are instead listed within the "Money" tab in the app; you'll need a PIN or to clear biometric authentication to see that.

The app can also be used to freeze and unfreeze the card and change the PIN, as well as assign a trusted contact, flag suspicious activity, and pause or restart spending. It'll also have the current balance, transaction search, and an archive of past statements.

Since it's a debit card, it'll work in ATMs for cash withdrawals. If they're done within the Allpoint network – which consists of over 55,000 ATMs, Samsung says – those withdrawals won't incur a fee.

As for where your money is actually held, that's arguably the most interesting part. As a cash management account – aka a brokerage product – SoFi isn't actually a bank. Instead, your cash is distributed across one or more of six banks that the company has partnered with. Each is covered by $250,000 in FDIC insurance; you could have, in theory, up to $1,500,000 of such insurance covering your total balance.

However, if you already have an account with assets held at one of those banks, your total amount of coverage for a Samsung Money balance would be less. FDIC insurance also only applies when SoFi delivers funds to those partner banks, and the rate of interest each offers will vary, too.

Samsung Money will be launching in the US later this summer, the company says. There's a wait list that interested would-be users should be able to sign up for today.