Logitech Admits Just $5m In Google TV Profits; Hopes "Next-Gen" Will Save It

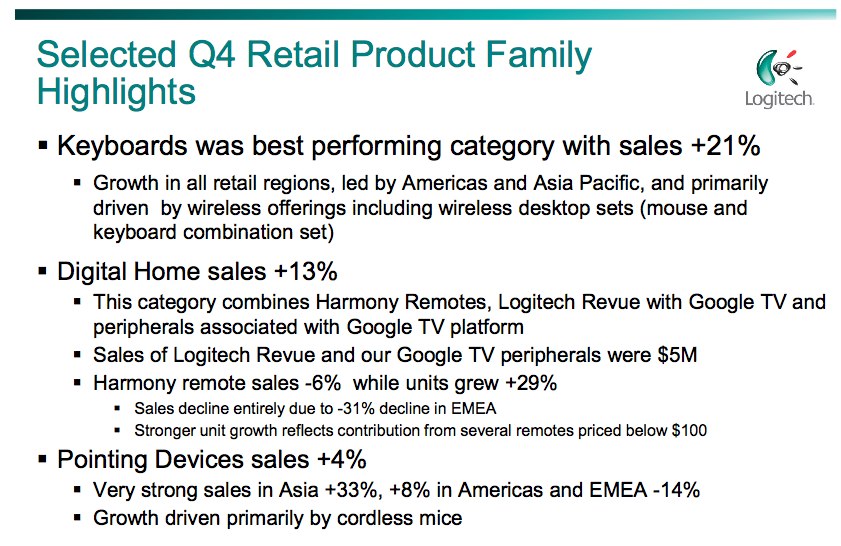

Logitech has confirmed a mere $5m in sales of its Google TV product range, centered around the first STB for the Android-based project, the Logitech Revue. Revealed in the company's recent financial report [pdf link], the sluggish sales were accompanied by a slump in Harmony universal remote profits, despite overall sales being up.

Logitech blames that disparity on an increasing number of sub-$100 remotes gaining traction. In fact, low-cost and mainstream peripherals were the stand-outs in Logitech's ranges, with keyboards the best performing category and cordless mice driving up pointing devices sales.

The company now says it is looking to the "next generation of Google TV" to kickstart digital home sales. Google has been tipped to consolidate Google TV with its Android smartphone and tablet strands, creating a single AOSP which would allow the company to accelerate development and more quickly push out much-needed functionality like Android Market access.

We've laid out our opinions on how Google could fix Google TV before, and made no disguise of the fact that in its current iteration it's on shaky ground. We found the Revue to have promise in our initial review, but since then the platform has seemingly been left to idle, with little outward sign of movement or progression from Google itself.

Press Release:

Logitech Announces Fourth Quarter and Full-Year Financial Results for FY 2011FREMONT, Calif., April. 27, 2011 and MORGES, Switzerland, April. 28, 2011 – Logitech International (SIX: LOGN) (Nasdaq: LOGI) today announced financial results for the fourth quarter and full year of Fiscal Year 2011.

Sales for Q4 FY 2011 were $548 million, up 4 percent from $525 million in the same quarter last year. Excluding the favorable impact of exchange rate changes, sales increased by 3 percent. Operating income was $3.6 million, a decrease of 87 percent compared to $27.7 million in the same quarter a year ago. Net income for Q4 was $2.8 million ($0.02 per share) compared to $24.5 million ($0.14 per share) in Q4 of FY 2010. Gross margin for Q4 FY 2011 was 32.8 percent, down from 35.8 percent one year ago.

Logitech's retail sales for Q4 FY 2011 grew by 2 percent year over year, with an increase in Asia of 32 percent, an increase in the Americas of 11 percent, and a decrease in EMEA of 17 percent. OEM sales decreased by 10 percent. Sales for the LifeSize division grew 88 percent, reaching a record high for a quarter. For the full fiscal year, sales were $2.36 billion, up 20 percent from $1.97 billion in FY 2010. Operating income was $142.7 million, up 82 percent from $78.4 million a year ago. Gross margin for FY 2011 was 35.4 percent compared to 31.9 percent in FY 2010.

"FY 2011 was a strong year for the company, with sales growth of 20 percent and operating income nearly doubling, driven by our LifeSize division and our Americas and Asia retail regions," said Gerald P. Quindlen, Logitech president and chief executive officer. "The disappointing conclusion to FY 2011 – which resulted in lower-than expected full-year sales, operating income and gross margin – was due to weaker than anticipated demand in the second half of Q4 for our products in EMEA. The weakness in demand in EMEA was compounded by poor execution of channel pricing and promotional programs within the region, which we have begun to remedy."

Outlook

For Fiscal Year 2012, ending March 31, 2012, Logitech expects sales of approximately $2.6 billion, operating income of approximately $185 million and gross margin of approximately 35 percent. The tax rate is expected to be approximately 15 percent.