IDC Smartphone Shipment Data Testify To Xiaomi's Rise

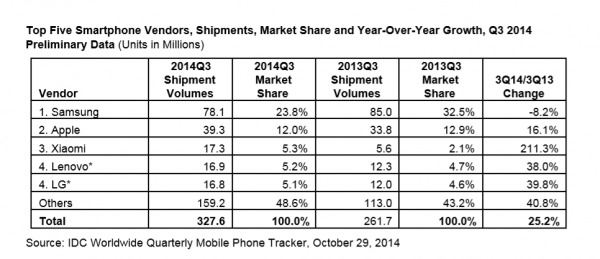

Some would have us believe that the smartphone craze is starting to settle down and that the industry has reached its plateau. That might be true for some markets, especially developed ones, and some vendors. The smartphone shipment figures for the third quarter of 2014 from IDC, however, reveal that there is still lots of room to grow, especially when the market just shipped 327.6 million smartphones, a growth of 25.2 percent from the same third quarter last year and 8.7 percent from the 301.3 million smartphones shipped just last quarter.

Bulk of the growth came from emerging markets, once ignored by high-end device makers and now the darling of more enterprising companies. According to IDC, these markets are experiencing a collective growth of 30 percent, while developed markets are now stuck at single digits. Previously, emerging markets were thought to be served sufficiently enough by feature phones, but lower smartphone prices are starting to drive even feature phones out of the picture, giving smartphone vendors a fresh new battleground.

The dynamics between vendors is equally interesting. While Samsung remains the top smartphone vendor when it comes to shipments, it has posted rather disappointing revenue figures for the first time many years. It needs a new strategy that doesn't involve simply flinging innumerable models and seeing which ones stick. Incidentally, it was the company's bottom and middle ranges that kept its shipment volumes up. Apple, on the other hand, is of course enjoying a good quarter after just unveiling the iPhone 6 and iPhone 6 Plus. That said, because these are still quite new, it isn't surprising that the 5s and 5c still comprise the bulk of its shipments.

The biggest surprise of all, however, is Xiaomi. Although not the first Chinese OEM to reach the top 5, unlike Lenovo, Xiaomi's focus has been mainly limited to China, only venturing outside to parts of Asia just recently. The Xiaomi Mi4, which it launched last August, was credited for its success, giving buyers a high-end option for a lower price tag. As a result, Xiaomi was able to more than double its market share, rising to become the world's third biggest smartphone seller. Lenovo and LG are left at fourth and fifth place, but it will be interesting if Lenovo's rumored new mobile phone business in China will change that next year.

With that said, IDC's numbers focus on the volume of smartphones shipped, which, at the very least, could hint at the demand for these devices. They do not directly translate to smartphones sold, which end up in users' hands, much less profits gained, which is what companies will be interested in. The figures do imply that the smartphone market isn't stagnating around big brands and that makers and vendors have ripe new territory to battle it out for smartphone supremacy.