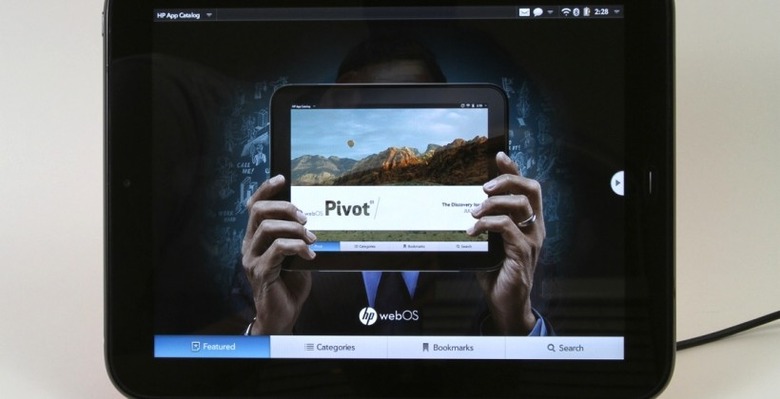

HP TouchPad: Desperately Discounted

How much did you pay for your tablet? If you picked up an HP TouchPad in the past day or so, you could have shaved anything up to $200 off the list price for the webOS slate, as HP and its retail partners kick off a round of aggressive discounting. It's a risky way to boost sales: the TouchPad is a mere month into the market and met with mixed reviews, and it would be easy to see this as HP's tablet project falling flat on its touchscreen face.

Reactions from industry watchers and consumers were mixed, with plenty seeing the negative in HP's strategy. Comments to the discounting included suggestions that even $299.99 would be $299.98 too much for the TouchPad, that webOS had shown its inherent shortcomings, and that HP had spat in the face of early-adopters by running price promotions so soon after launch.

[aquote]Comparable deals suggest this was strategy, albeit one fueled by desperation[/aquote]

This wasn't some spare pallet of TouchPad refurbs Woot was offering, though, quickly burned through like many of the eye-catching offers on the deal-a-day site. The 16GB TouchPad units it had listed were brand new, with full HP warranty, and – judging by how stock remained through the day – with no shortage of supply, either. Comparable deals at Staples, Best Buy, Amazon and even HP's own web store suggest this was strategy, albeit one fueled by desperation, rather than a fire-sale.

HP's calculated risk was devaluing the TouchPad in an attempt to build the user base: not so that it could dispose of unsold stock for warehouse space or to free even a little of the tied-up margin in each unit, but to get, one way or another, webOS in more hands and in front of more eyes. Apple's market dominance with the iPad, and Google's established Android ecosystem and bullish brand have left slim pickings for the rest of the tablet players. RIM believes it has the enterprise to fall back on and Microsoft hasn't even attempted to leverage Windows Phone on larger-screen devices. HP, though, hasn't even a significant cache of webOS smartphone users and developers to fall back on.

If you're a niche manufacturer, scything off your profit margins so as to shore up your user-base isn't generally an option: you need the cash from each initial sale to keep the business going. HP, as one of the biggest computing firms in the world, doesn't struggle with those same limitations. It can afford to miss out on short-term profit with an eye on the bigger picture, and it's arguably used to operating in a low-margin market.

What it needs more than instant profits right now is developer support, and the only way to encourage coders to write webOS apps is to offer them a potentially worthwhile market to sell to. That means users, and HP has shown it's willing to pinch its bottom line significantly in the fight for them.

[aquote]We should be able to tell the future by how HP treats existing TouchPad owners[/aquote]

Viewed from that perspective, HP's aggressive cuts aren't a sign of short-term floundering but of long-term commitment. Gone is the opportunity to build your tablet offering organically – if HP wanted to do that, Palm would have needed to already have a webOS slate on the market before it was acquired – instead you need an obvious hook to distinguish you from the automatic choice of an iPad. Hacking $200 off the sticker price is a pretty unsophisticated way of doing that, but don't conflate rudimentary with ineffective.

It's not the first example of apparently desperate discounting we've seen in recent weeks, again for similar reasons. Nintendo announced last week that its 3DS would, as of midway through this month, see an $80 cut – almost a third – from its original price, despite having only been on sale in the US since late March. Nintendo president Satoru Iwata followed up the move with an apologetic open letter to existing owners who paid full-price, pointing to the need to reach a tipping point of ownership before retailers and game studios would take the 3DS seriously. "If the software creators and those on the retail side are not confident that the Nintendo 3DS is a worthy successor to the DS and will achieve a similarly broad (user) base" Iwata wrote, "it will be impossible for the 3DS to gain popularity, acquire a wide range of software, and eventually create the product cycle necessary for everyone to be satisfied with the system."

HP's strategy will continue to play out this weekend. The company is already pushing a $100 instant discount on both versions of the TouchPad, and that tempting extra $100 off at Staples should be good until August 7, assuming you can find a store with stock on hand. With no promise of publicly released sales figures, it'll be hard to know whether it proved a success or otherwise in that respect; however, we should be able to tell the future somewhat by how HP treats existing TouchPad owners.

If HP ignores them, and their complaints, then the signs point to this being a stock-shifting exercise, not a platform-building one. If, as Nintendo has done, HP salves the early-adopter frustration with free apps or services, attempts to keep them "on side" even as new users join the fray, then that would indicate a broader commitment to webOS. Given HP's previous suggestions that it sees a future for the software on desktops and notebooks – a segment within which it's notoriously difficult to differentiate, and where even a small advantage can lead to significant pay-outs in sales – it seems likely that this TouchPad promotion is an early step at the beginning of a broader battle, not the concession of the tablet war.