Coinbase's New Tax Dashboard Helps Users Report Crypto Gains

Coinbase, a popular platform used for buying and selling cryptocurrencies, has added a new dashboard that makes it easier for users to track their gains and losses. The dashboard is intended to help users when it's time to report their crypto-asset activity to the IRS, though Coinbase notes it doesn't report gain/loss information to the agency.

The average person treats cryptocurrency the same way they would money, but the IRS views it differently. According to the taxation agency, bitcoin and other digital crypto are considered property, meaning users are expected to report their gains and losses when filing their annual taxes. Tracking that information can be difficult, however, and exchanges historically haven't helped with the matter.

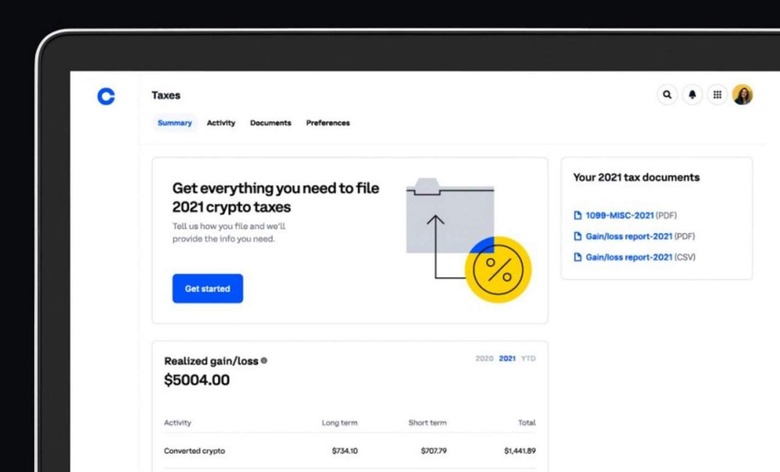

Coinbase aims to change that with its newly introduced tax dashboard. Though the information may not be entirely what you need when reporting your crypto assets to the IRS, it does provide a snapshot of the transactions and valuation changes that have taken place through the Coinbase account, and that's a solid start.

Viewing your Coinbase tax dashboard

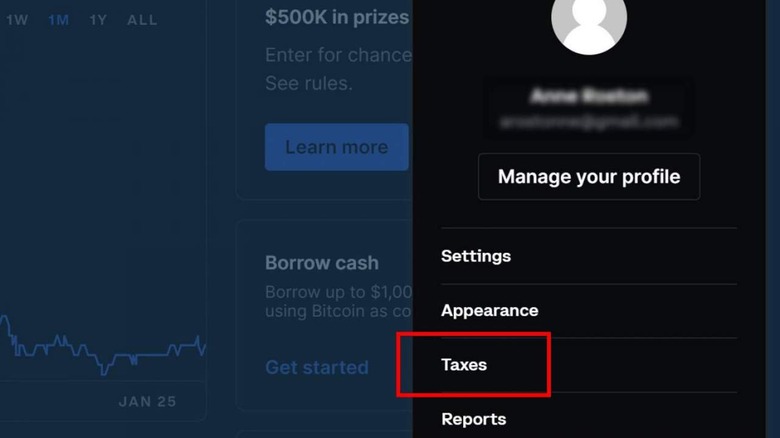

Coinbase users can access the tax dashboard from the platform's website or app. On the website, users can click their profile picture in the upper right corner of the screen and select "Taxes" from the drop-down menu. On the app, users must tap Profile & Settings to open the menu with the tax dashboard link.

The dashboard provides a snapshot look at the transactions made using that Coinbase account during the previous year, including crypto assets that were converted from one digital coin to another, the quantity of crypto sold, the quantity of crypto that was spent, and any "advanced trading" transactions.

Based on the transactions, the dashboard also provides an estimated loss or gain, though Coinbase is careful to note the figure is "calculated based on assumptions." Users are also presented with "miscellaneous income" information, which includes transactions based on things like rewards and interest.

Some users who received income in the form of rewards or from staking will be able to download a 1099-MISC form. This taxation form is issued to both the user and the IRS if the account earned at least $600 in cryptocurrency during the previous year.

Crypto enthusiasts who have conducted multiple transactions, including getting crypto through external wallets, are advised to check out CoinTracker, which will provide a tax report with up to 3,000 crypto transactions for free.