Bitcoin Price Has No Place In The Bubbles Of Tulip Mania [Opinion]

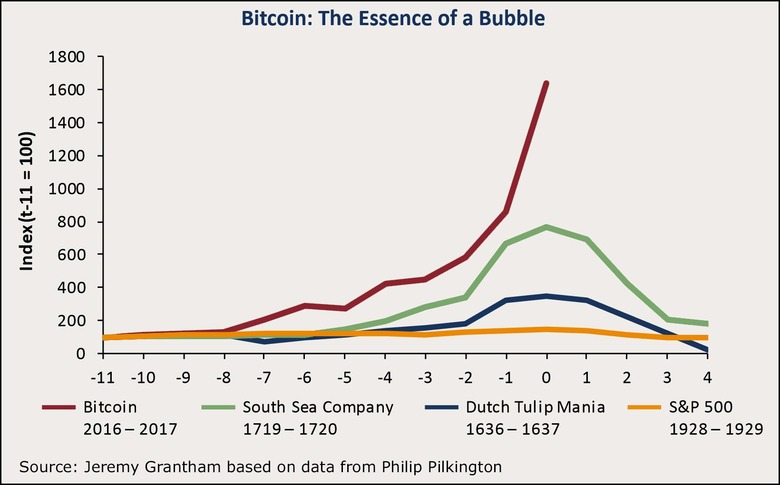

This week Bitcoin was compared to "other famous bubbles" in the history of sales and stock. In a chart created by Jeremy Grantham, we see several "bubble" situations on some rather bonkers axis, showing each over a period of two years. The chart points directly at Bitcoin going up at a rate much faster than the "other bubbles," ending at zero. But the price of Bitcoin, as they show it here, is measured only in USD.

In the paper "Bracing Yourself for a Possible Near-Term Melt-Up (A Very Personal View)" by Jeremy Grantham, Grantham suggested that Bitcoin has no intrinsic value. That's posted on GMO. That lack of intrinsic value is the basis for Grantham's comparison of the cost of Bitcoin compared to other "bubbles." To suggest Bitcoin has no intrinsic value is to have not understood the reasons why the blockchain exists.

The price of Bitcoin cannot be measured only in USD – not if one wants to fairly track the worth of the coin. This is not a piece of gold, it's not a bubble bursting because of deals in government debt. The intrinsic value of a single tulip bulb is nothing like the value of a bitcoin – you couldn't buy a fraction of a bulb back in the Dutch Golden Age.

Just because these bubbles of the past have risen and fallen in a similar fashion doesn't mean Bitcoin is headed down the same path. Bitcoin could fall a whole lot harder than that. Bitcoin could also stop being compared to USD altogether if our Dear Leader taps his bigger button with his McDonald's Cheeseburger-stabbing baby fingers.

Maybe USD won't be worth the gold it used to be based on, and the worth of Bitcoin won't be directly comparable to the dollar at all. Price of dollars per Bitcoin might just become too volatile for any exchange to work with. We'll just have to see.

Also, watch the throne. Watch which users compare Bitcoin to their favorite bubbles of the past. Warren Buffet's afraid of Bitcoin, but at least once said it was wise to buck that trend. "You want to be greedy when others are fearful," said Buffet at least once.* "You want to be fearful when others are greedy. It's that simple."

*In a PBS interview with Charlie Rose, on the 1st of October 2008.

NOTE: This stream of consciousness is part of a series on Bitcoin, blockchain, and cryptocurrencies. As it is with all articles on SlashGear, nothing here should be taken as financial advice. Seek out professionals that are willing to take responsibility with your hard-earned cash money – it's the only way!