Tesla Motors Suffered A Massive Decline In A Major Area Over The Past Few Years

It's been an up and down year for Elon Musk, but one statistic gathered about the company he is most often associated with might cause some concern for the world's richest man. Musk currently owns a number of high-profile businesses, including Tesla, SpaceX, and The Boring Company. The South African billionaire also co-founded Paypal and heavily backed Open AI, a non-profit based around the development and study of artificial intelligence.

A big positive for Musk is related to the recently passed Inflation Reduction Act. The act changes the way tax credits are applied to the purchase of new and used electric vehicles. Although the exact rules don't seem like they were thought through properly and there is a chance no currently available vehicles will qualify for a full or even partial tax credit, Musk still stands to benefit. The old system came with a threshold: tax credits could only be claimed on the first 200,000 qualifying electric vehicles a company sold. Perhaps unsurprisingly, as Tesla has historically been the most successful electric vehicle manufacturer, it hit the threshold a long time ago — Tesla was actually the first company to do so back in 2018.

None of the vehicles it has sold since have been eligible for a tax credit. So the current qualifying factors won't affect Tesla in the short term, while they may affect the company's competitors — GE and Toyota are the only two other companies to have passed the old threshold. But the real win comes in another of the act's clauses; the cap on tax credits has been removed entirely. Tesla buyers will once again be able to claim money back on their vehicle purchases once the other conditions of the bill have been met.

Musk has faced some legal trouble

The world's richest man is no stranger to controversy or the inside of a courtroom. Musk's actions have again landed him in legal trouble this year, and he is currently facing a number of lawsuits for several different reasons. The most high-profile suit relates to his attempted purchase of Twitter. Musk initially revealed himself to be the social media platform's largest shareholder and proceeded to initiate takeover proceedings. Tweeting throughout the entire process, Musk proposed several changes at the company; some related to profit, others involved promoting free speech — and not everyone was happy with the changes put forward.

Musk eventually pulled out from the deal after posing questions about the number of Twitter accounts that are authentic and the number that are run by bots. Twitter claims only 5% of its userbase are bots, but Musk has cast doubt on this figure and demanded large amounts of data along with the process Twitter used to get its estimate. Twitter believed the amount of data requested was unreasonable and refused to hand it over. Musk then pulled out, but the saga did not end there. The billionaire agreed to a $1 billion break fee before serious discussions took place, but Twitter wants to force him to complete the deal. Musk has filed a countersuit against the social media giant, and the case could result in a judge finding in his favor, ordering him to pay a large amount in damages, or forcing Musk to complete the purchase under the original terms. The world's richest man is also being sued for more than his net worth by someone who has likened Musk's support of meme-currency Dogecoin to a pyramid scheme.

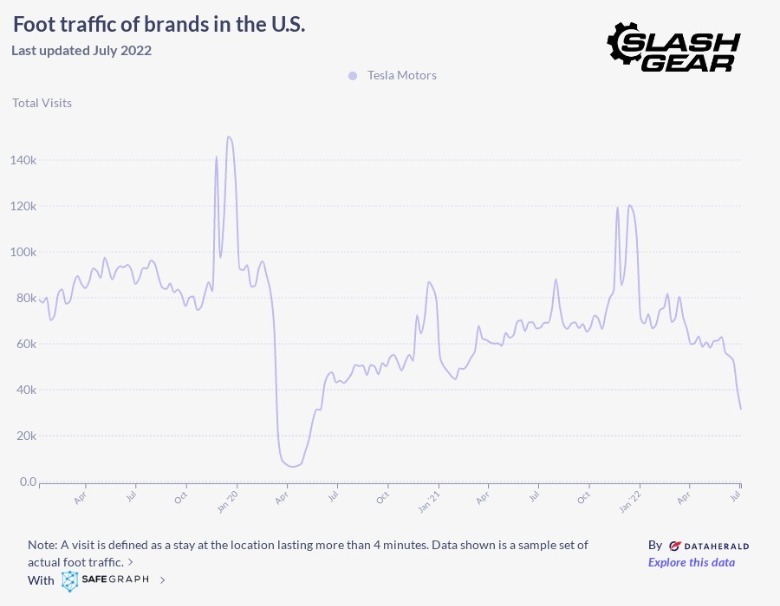

Fewer people seem to be visiting Tesla showrooms

The bulk of Musk's net worth is tied up in Tesla stock. Some of this stock was used as collateral when Musk was gathering capital for his proposed purchase of Twitter, and it's the Tesla share price surge that saw him take the title of "world's richest man" in the first place. According to Forbes, Musk owns around a quarter of Tesla, which in turn has a market cap of just under $900 billion. So obviously, anything that is bad news for Tesla is bad news for the man who owns it, which is why Musk may be concerned about the drop in foot traffic Tesla has faced in recent years.

Statistics on foot traffic gathered for SlashGear by DataHerald show a decline in the number of visits to Tesla locations since the coronavirus pandemic resulted in large-scale lockdowns. Unsurprisingly, April 2020 saw the lowest amount of foot traffic at Tesla showrooms as those lockdowns began to be implemented. Average footfall has recovered somewhat but remains, at best, around three-quarters of what the locations experienced pre-pandemic. There was also a concerning dip this summer. Foot traffic figures have dropped below 20,000 visits for the first time since June 2020, and there is a chance the post-pandemic recovery period could be over.

For the purposes of this study, footfall is defined as someone visiting a location and staying for four minutes or more. It does not require an individual to make a purchase or use one of the company's services. However, as Tesla dealerships aren't based in malls, it is unlikely many people showed up to browse the products on offer and kill a few minutes.

It could be a symptom of a wider problem

The automotive industry as a whole has been suffering the effects of a number of global crises. First, the pandemic closed showrooms and production facilities, then a global semiconductor shortage wreaked havoc on supply lines. Despite growing demand, automotive sales on the whole have declined following the pandemic. Although the sales chart doesn't overlap exactly with the decline in foot traffic at Tesla locations, both issues may share a common set of causes.

Both the pandemic and the semiconductor shortage may have hit Tesla harder than most other companies. The manufacturer's vehicles are almost all electric, so while companies like Dodge can attempt to navigate supply line issues by reducing the number of features its vehicles come with, Tesla may not have that option. The automaker doesn't have a mechanical base it can strip down to, and its customers expect outlandish features as standard. Then there is the pandemic, which hasn't gone away and caused major issues for Tesla earlier this year. A lockdown at the company's Shanghai plant, which is one of its main suppliers, resulted in a huge drop in production. The lack of supply led to Tesla's share of global EV sales plummeting from 27% to just 10%. It also saw the company temporarily dethroned from its spot as the world's biggest EV supplier.