Big Myths About Used Cars You Need To Stop Believing

Buying a car, even a used one, can be a perilous process. It is a major purchase for most people and is also something that will be relied on day after day and will usually enable its owner to continue to earn a living. There are many pitfalls you may come across on the journey to car ownership and just as much advice on how to avoid them. The thing about advice is that it is only as good as its source. You are just as likely to hear bad advice as good — however, bad advice can cost you thousands.

Most people also have a story about how they got screwed over when buying a car or how they won in the negotiation. What is more important is to begin the process with as much good information as possible. Do not heed advice just because it came from your uncle and he is usually a good guy. His advice may have worked for him but can work against you. And still, many tidbits of advice come from myths that have been bouncing around for ages. We have all heard them at one time or another, but how many are actually worth listening to? Some myths may be worthy of consideration while the majority are probably best ignored. Many car-buying myths persist; here are some you are better off not believing.

Used cars are unreliable

Just like people, cars come in a spectrum: some are terrible and some are great. It is up to you to determine which one you are looking at. There was a time when just about any car with 100,000 miles was used up and would not last much longer. Few manufacturers included odometers that read past 99,999 miles until the mid-'80s, but that has changed, all cars now have six-digit odometers, and few of them fail so early in their lifespans.

Modern cars are built with tight tolerances in large part by robots, and that provides fewer opportunities for weak points in the assembly. Cars last well over 200,000 miles these days with relatively few problems. U.S. News lists the most reliable used cars that are offered for under $10,000, including the Kia Soul, Chevrolet Cruze, and Nissan Versa with high marks for cars that are 7 to 9 years old. Likewise, Motor Biscuit rounded up the 20 most reliable cars of the past decade and Toyota took the top eight slots. Just do some research before forking over your hard-earned cash.

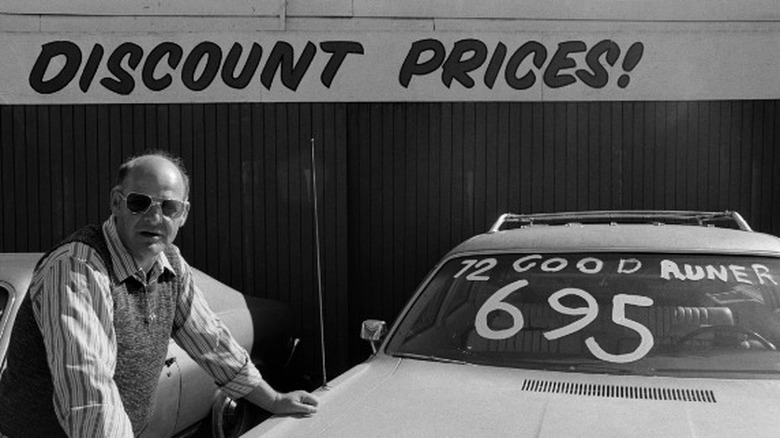

You should avoid used car dealers

The advice to avoid used car dealers is rooted in some truth. Stories of shady used car dealers and shadier used car salesman abound in popular culture and most come from true tales of terrible troublemakers. Back in the day, car buyers were often at the mercy of the dealers for most information about a car, the financing, and the market price. But today, consumers have all the information they need thanks to the internet. We can research the market, get financing deals, and even look up the history of a specific vehicle before ever stepping foot on a lot. This has also changed how dealers operate as they now live and die based on reviews. Enough bad reviews on Google can sink a disreputable dealer.

Another reason it is okay to buy from a dealer is the selection. With the vast majority of newer trade-in cars going to dealer-only wholesale auctions, the car that you want will likely be represented in this pipeline of auto inventory. Private sellers are going to be spread out and if you don't like a particular car, the next one won't be readily available. The Conway Daily Sun talks about dealer auctions being the best way for large numbers of cars to be sold quickly, and the independent dealers assume all of the risks in buying them. The profit they make on your car helps them mitigate that risk. Researching the dealers as well as the cars will pay for itself in spades.

You need cash

This is a myth that may have partial truth backing it up. When looking for newer late-model cars, new car dealers may be the best place to find a car. They will usually have cars that are around 5 years old or less and with relatively low miles. They will also have a finance department ready to get you on the way, hopefully with a reasonable payment and fair terms. For those who need a car for less money and who are willing to take one with a bit more age and mileage, there are plenty of other choices.

Many used car dealers are set up with some kind of relationship that allows them to connect you with a lender on site. Others participate with big-name national brand lenders and approval online can be processed in their offices. Also, your personal bank or credit union probably has options to get preapproval to allow you to go shopping for a car with a specific budget in mind. These may require you to buy from a dealer while others allow private party purchases, as well. Using guides from resources like Nerd Wallet can make life a bit easier. Also, for entrepreneurs, keeping cash fluid to use for business may bring in a higher return than what you will pay in interest. Again, a little leg work will go a long way toward making the process an easy one.

New cars are a better value

This may not be the most widespread myth, but it does exist. It is also a somewhat convoluted topic as cars and their values not only vary widely but also fluctuate with changes in the market. The choice of buying used is not necessarily a bad one, nor is the choice to buy a new car. It really depends on your unique situation.

Car and Driver lists some of the pros and cons for weighing which to buy, but states that by the time a new car ends up on the used market, it will have lost as much as 40 percent of its value. That represents significant savings. With the reliability and longevity of modern cars, used cars can represent a considerable bargain. Another benefit is that the money saved from depreciation can get you more car for the same money as the new one. That means stepping up to a higher model or trim level for a car you will likely own for just as long. The idea that you should only buy new really comes from the time when new cars would only last a few years and used lots really were full of junk on their last leg. Fortunately, those days are gone.

Vehicle history will tell you everything

Ever since CarFax appeared, which started in 1984 when you actually received the information by fax machine (via Crunchbase), consumers have had better tools for shopping. With a long history of serving the used car market, CarFax is a useful service with a huge amount of data available and has been joined by competing services, such as AutoCheck and Bumper. Getting a history is a great idea but is not the final say in whether you should buy a car.

The companies providing the history are only as good as their data; they draw from several sources including motor vehicle registrations, police reports, and reporting by participating shops. They will not include repairs done by owners and work done by shops that do not participate, and there can be errors and omissions in official documentation, according to Motor Biscuit. That is not to say they should not be used — just remember that there is no substitute for a mechanical inspection performed by a professional.

Cash buyers get a better price

This myth is probably another holdover told by well-meaning uncles who have driven the same car since Reagan's second election. Negotiating cars in the old days was an arduous and opaque process, where savvy consumers entered the building on the defensive with smarmy salesmen ready to tear them down, just like in the movies. Modern dealerships rely on the internet as well as consumers, and successful ones work hard to earn your trust and make the process smooth as possible.

The truth is that most dealers will get the same amount of money paid for the car whether it is cash from your pocket or cash from the lender. The only exception to this is "buy here pay here" lots, which are a different story for another article. Cars Direct says that paying cash will likely have zero effect on the final price. Furthermore, dealers may get some funding from arranging the financing from the lender, which means they have an incentive for you not to pay cash. The best advice is to just be a shrewd negotiator and show up armed with the knowledge to get the best deal, regardless of how you will pay.

Don't mention your trade-in until the last minute

Sometimes people really need to stop indulging their uncles and all their bad advice, because this is about as bad as it gets. For some reason, folks have got it in their heads that if a dealer knows you will be trading in a car, the final price will be affected. Again, in the modern era with all the information available at the click of a button, all the figures can be laid out in clear, easy-to-understand terms. Trade-ins will just be a part of the final calculations.

There is one thing that bringing up the trade last minute will do: make everything take longer. At a competent dealer, processes are established to streamline the deal so that it can be as efficient as possible. Buying a car can still take a while. If the trade is not mentioned until near the end of the process, many things will have to be changed, new forms printed, and many feathers ruffled. Do yourself and the people trying to assist you a favor and be upfront and open in your negotiations. That doesn't mean you have to put all of your cards on the table, just reasonable expectations of your intentions. Edmunds has a handy guide to trading your car, and it does not say anything about withholding information.

Go when the weather is bad

There are several reasons why this will backfire; it seems to be commonly expressed as a myth about used cars but there are not many sources about its origin. However, it is easy to spell out why shopping during poor weather is bad advice. The tale goes that on days with bad weather, fewer people will be out shopping for cars so dealers will be eager to get your business and make deals to close a sale. They won't. Their sales targets are based on monthly targets, not daily. One bad day will not get managers up in arms ready to sell everything at a discount just to move some metal for that one day.

Also, as a consumer, you should not go during bad weather because you should be able to test drive the car under normal conditions without holding back due to road conditions. This goes double for snowy conditions. Also, car buying is not usually done on a whim and weather does not have a huge effect on customer traffic. People generally buy a car when they need one and the time spent shopping is valuable.

Never use dealer financing

New car dealers and many independent used dealers offer financing, although the options for loans vary widely from one store to another. Some folks will advise you to get your financing arranged at your personal bank before stepping foot onto any lot to make sure you don't get ripped off. That is good advice when it comes to avoiding "buy here pay here" dealers, but not in other circumstances.

Most finance departments in franchise dealers have many options available to buyers such that nearly any car deal can be closed in a single visit. They have finance professionals who deal with nothing but auto financing all day and have vast knowledge that can be to your benefit. Finance managers may know about alternatives to your local bank that could save you finance charges or alter the terms to get a lower monthly payment (via Auto Trader). These alternate institutions may not be as convenient as your local bank, but the saving may make it worth it.

The one caveat, mentioned by Go Banking Rates, is that dealers sometimes have incentives to write loans with a particular lender. They may receive bonuses or other incentives and drive customers to the financial product that is best for the dealer rather than the consumer. This is yet another reason researching the dealer's reputation and ratings is imperative to avoid getting caught in a bad situation.

Go just before closing time

The hypothesis working here is that if you show up near closing time with a wad of cash in your pocket, you will be greeted with the best deal so that the manager can add another sale to their quota. Sales quotas for managers are monthly goals. Being in a commission-driven work environment, sales staff are always eager to put another sold unit on the board, but within reason. Also, when the price of a car is marked down, so is the commission.

Edmunds offers good advice on when to buy a car. For example, if you arrive late on a Monday morning, foot traffic is likely to be low and you will receive more attentive service. That does not mean getting a killer deal, but you can expect attentive care and having your needs addressed properly. There are also certain times of the year, such as holidays, when dealers run promotions that can help ease the sting of committing to years of costly car payments.

The biggest reason to not deliberately show up at closing is that it is rude. Your sales staff will stay as long as it takes to get the deal done and that can take hours. The only thing you are doing by showing up late is keeping working people away from their families and forcing them to work late for no reason.

KBB or NADA will tell you what your trade is worth

Living in a free market means that nothing in commerce is guaranteed. We have no price controls for most goods and services, so prices tend to fluctuate. The National Automobile Dealers Association has been around since 1917 as an auto dealer lobbying group and, in 1922, started publishing a guide for used car values, per its official website. Kelley Blue Book was started by a Los Angeles car dealer that sprang up from his business buying cars for resale, with the first guide published in 1926, according to KBB.com. The guides have served as valuable tools originally intended for dealers, but both eventually created products for the general consumer market, too.

For around a century, these guides have been invaluable tools used by dealers when assessing trade-in value as well as determining what prices to set for their own inventory. In an age where information was transferred mostly by paper and its movement was slow, these guides were good predictors of value. Slow-moving information is gone. The truth about value is that, no matter what is printed in any book, the true value of anything is only what someone is willing to pay for it. Investopedia notes that while these guides are good, they cannot account for some variables. Some slightly older cars that have drawn a niche fanbase may sell for much more is one example of how the data can be skewed. The best thing to do is study the market and match what you see with the stated values before accepting an offer for your trade.

Extended warranties are a scam

Of the many facets involved in buying a car, extended warranties offer the most landmines to look out for. What makes them potentially perilous is the large number of companies offering warranties and the many variations offered. Also, manufacturers include warranties on new products, and added protection plans are called service contracts. They are functionally similar, but are separate products, legally speaking.

The best ones are offered by the manufacturer to lengthen what is covered straight from the factory, such as one from GM extending the 3-year warranty to 5 years. Others are offered by dealers. CarMax is well-known for its warranty service and The Drive breaks it down with some pros and cons. They found that CarMax offers excellent coverage, but the information offered publicly is a bit opaque, meaning you should read one over thoroughly before signing.

Consumer reports conducted a survey that found few owners of extended warranties received more in benefits than they paid, but the same could be said of collision insurance. If you are not using it, that is a good thing. Some dealers of older cars offer limited warranties, such as CARS protection plus, that may only cover the engine and transmission for a few months, offering minimal protection. Extended warranties can be beneficial and have helped countless people avoid huge repair bills. However, some companies may find any reason to refuse a claim so that makes it incumbent upon you to research, as always, before paying for any contract.