How Much Has Motor Vehicle Production Declined In The U.S. Over The Past Two Years?

Henry Ford did not invent the concept of the assembly line, but he did use it to increase the efficiency of his fledgling company and make motor vehicles more affordable. Since Ford first ramped up production at his Detroit factory in 1913, the United States has been a hotbed of vehicle manufacturing. Now, more than a century later, Ford is plotting the downfall of dealerships as we know them and suing professional wrestlers.

Ford isn't taking these actions because everything is going well in the automotive world. Like many manufacturers, it is struggling to get cars and trucks off the production line and onto the sales floor. Since 2019, a string of global crises has had a major effect on individuals, businesses, and governments worldwide. The automotive industry was not immune to the effects of these challenges and has seen production drop drastically several times over the past couple of years.

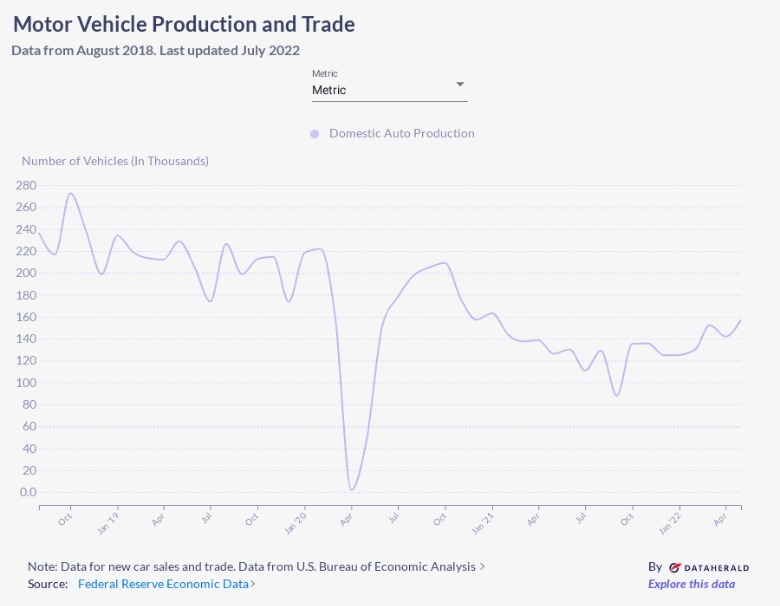

So just how bad is the industry suffering? Are we over the worst of it? And when will the automotive industry get back to normal? To answer these questions, SlashGear has unpacked some in-depth production figures supplied by DataHerald. So let's take a close look at what has happened between August 2018 and now.

The coronavirus pandemic halted vehicle production

Aside from the occasional peak and trough, vehicle production in the United States has generally hovered above the 200,000 per month mark over the last few years. The most productive month during the time period measured occurred in October 2018, when close to 273,000 cars were manufactured. As you can see from the statistics we are quoting, annual car production seems to peak in October. This may be because new models are usually released toward the end of the year (via US News) and manufacturers increase production in order to stock dealerships and meet pre-order demand. Aside from a couple of notable dips in July and December, production remained consistent throughout 2019.

Then the coronavirus pandemic happened. Vehicle production essentially ground to a halt in April 2020 as measures to help combat COVID-19 were implemented in the United States. Major manufacturers GM and Ford also shifted manufacturing resources towards ventilator production, in an attempt to save as many lives as possible. Fewer than 2,000 vehicles were produced that month nationwide. However, things soon sprung back. In May, just under 50,000 vehicles rolled off the production line, and by June, production numbers were just shy of those reported in March. Production increased again in July, and by October figures were around the 200,000 mark — roughly the same as they were pre-pandemic.

Production dropped again, but for different reasons

Following the October boom, we witnessed another sharp decline in production. The cause this time was not a global pandemic but a worldwide semiconductor shortage. While at its core a car is a mechanical object, a modern vehicle is heavily reliant on electronics. Everything from the engine's tuning, to comfort features, to a car's electric windows requires a bit of processing power. A lack of computer chips hits the modern automotive industry every bit as hard as a steel shortage would. Vehicle manufacturing isn't the only industry that is reliant on semiconductors. Every electronic device uses them, so car makers had plenty of competition while trying to secure a supply line. The shortage led to a situation where one manufacturer had 95,000 vehicles sitting unfinished and unsellable.

Production levels seemed to find the bottom in September 2021, and things have been steadily increasing over the past 10 months. While average production is still down by around 6 million vehicles per year, production over the past year is the most stable it has been since 2019 — and things are still trending upwards. The demand for new cars is definitely there, and will undoubtedly cause a surge in supply as soon as manufacturing ramps back up. Customers are so desperate for vehicles that some people are paying above 2022's MSRP for used 2021 models (via Money.com). In total, the shortage may have cost the U.S. car industry over $200 billion — and until it is addressed, that figure will continue to grow.