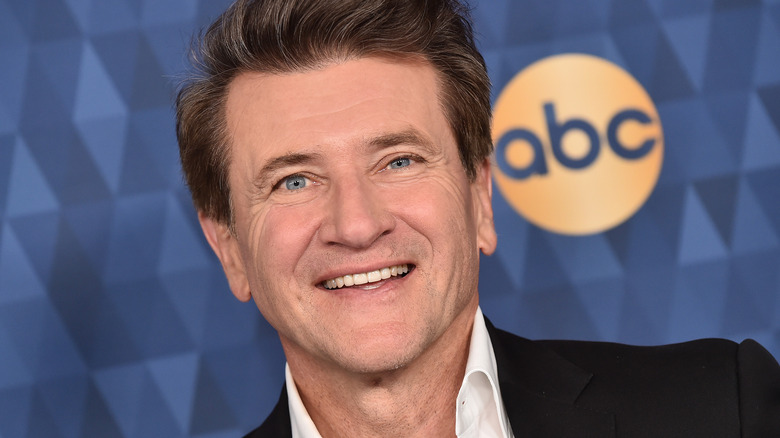

How Much Stocks Could Continue To Fall, According To Shark Tank's Robert Herjavec

The U.S. stock market has lost more than $7 trillion since the beginning of 2022. Tech stocks have taken a particularly hard hit, with the NASDAQ tumbling more than 25%. Individual tech stocks that have taken a major hit include Tesla, Meta, Apple, Microsoft, and Alphabet. Streaming service Netflix has seen its share price fall by more than 70%, making it the S&P 500's worst performer so far in 2022. The NASDAQ's biggest drop this year, around 20%, happened during a 30-day period stretching from early April to early May. Bespoke Investment Group claims the NASDAQ has suffered similar drops 11 times before, and nine of those times were "associated with recessions," as noted by CNN Business.

With the NASDAQ deep into what is considered bear market territory (a decline of over 20%), America's other two major markets aren't far behind. Between December 2021 and early May 2022, the S&P 500 had declined by around 18% (via NYT), and the Dow Jones was down by over 13%. Several factors are causing the market to decline, including the war in Ukraine, rising commodity prices, high inflation, rising interest rates, supply chain issues, and higher labor costs (via U.S. News). There are also a number of leading figures in finance claiming the decline is not over yet, and we could be heading deeper into bear market territory. Shark Tank's Robert Herjavec is one of them.

What the Shark Tank star has to say about the market

Share prices are expected to take even more of a hit according to Cyderes CEO and "Shark Tank" star Robert Herjavec. The investor recently made a bold prediction about how much further share prices could tumble despite some U.S. markets already dipping by more than 25% since the end of 2021. Speaking to Fox Business, Herjavec said he expects the markets to drop a further 20% to 30% before the current economic downturn ends.

Herjavec points to "fear, uncertainty, and doubt" as reasons for the downward trend in share prices. He also says small businesses are unsure of what to do amid higher interest rates and during a time when attracting workers is becoming increasingly difficult. "They can't get people to show up," he said. "It's going to take a few months for that to work itself through the system."

Other leading financial figures have an even grimmer outlook, with GMO co-founder Jeremy Grantham predicting U.S. stocks could plummet as much as 80% in the near future (via CNBC). Grantham previously said we are in a financial bubble, that both stocks and the housing market have been raised to "unsustainable levels," and that a "day of reckoning" is due (via Fortune). Michael Burry, who had previously predicted the 2008 financial crash, tweeted his thoughts on the current market. The man behind "The Big Short" said a further large decline in stock prices is due, before later deleting his tweets, as noted by Insider.