5 Mistakes To Avoid When Buying A Used Car

When money's tight but you need a new car, it's natural to consider buying one used. While used cars aren't getting cheaper, when compared to the price of a new car you can often walk away with substantial savings. According to Edmunds, in the third quarter of 2024, the average price difference between new and used vehicles was $20,365. If you're shopping on a budget, that just can't be ignored.

But as attractive as these savings are, most of us have heard horror stories about buying used cars. Whether these tales are exaggerated or really happened doesn't matter much; what we know is that we must take precautions to avoid costly mistakes.

From the first online search to the final handshake, buying a used car is full of potential pitfalls. Once your search is underway, you'll want to understand concepts like whether age or mileage is more important when buying a used car, and how to spot signs of wear and tear that could point to future trouble. Buying a car, whether new or used, is a big investment, and you don't want to regret your choice down the road. That's why it's so important to know what mistakes to avoid when shopping for a used car.

Not researching the car's value and history

It's easy to become overwhelmed when thinking about all of the things you need to look out for when buying a used car, but your hard work will pay dividends when you drive away with one that's in good working order, not a lemon that ends up draining your wallet. Your biggest defense is conducting in-depth research on the car you're thinking about buying.

Several resources are available on the internet to help you do just that, including Kelley Blue Book, which provides comprehensive information on used-car value and pricing, taking into account factors like condition, mileage, and regional market trends. You can use its Fair Market Range and Fair Purchase Price to help you determine if you're getting a good deal. Edmunds' True Market Value is another helpful tool that can show you what a car is really worth and help you negotiate a fair price.

You should also look into the vehicle's history before deciding whether to buy. Carfax and AutoCheck are two services that provide vehicle history reports that list things like accidents, title issues, and discrepancies in odometer readings. There are several red flags you can't ignore on a Carfax report when buying a used car, and you'll want to watch for the same issues if you're using a report from AutoCheck. While these reports aren't foolproof, they'll help you make a more informed decision about the car you're thinking of buying.

Skipping a full mechanical inspection and test drive

Just because the interior and exterior of the car you're considering buying look perfect doesn't mean there aren't serious issues lurking under the hood. That's why it's important that you do more than go for a quick spin in the car if you're seriously thinking about buying it.

Test driving a car is your chance to thoroughly evaluate it. You'll want to check its ability to accelerate and see how the engine responds when going from a complete stop to merging into traffic on the freeway. You should also use the test drive to see whether the brakes are responsive to light taps and sudden stops. Steering and handling are other things you should check during a test drive, ensuring the car is easy to control. And as you drive, listen for any odd sounds, and check both rear and front visibility.

The test drive can uncover a lot of problems, but you'll also want to pay a professional mechanic to inspect the car. You have no idea how the previous owner of the vehicle maintained it, and even the most reliable used cars might have hidden problems that aren't obvious during a test drive. When a mechanic performs a pre-purchase inspection, they'll check for current problems, let you know about things that might cause trouble down the road, and make sure any previous repairs were done correctly. You can use this information to decide whether the car is right for you.

Only focusing on the monthly payment

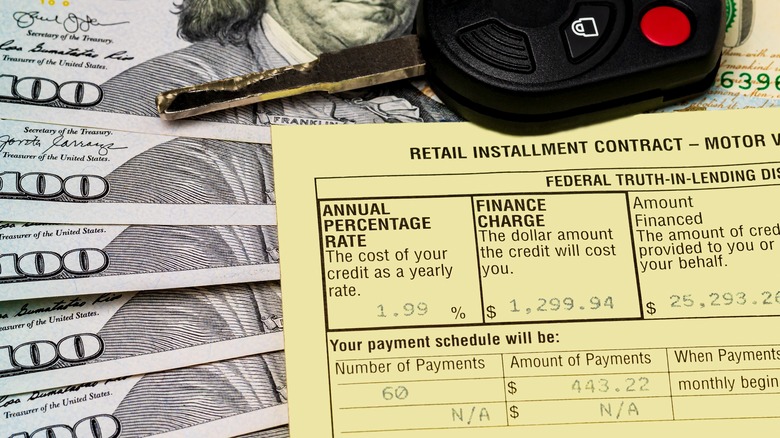

A big part of the reason people consider buying a used vehicle is to save money, so it makes sense that they'd focus on the car's monthly payment when deciding whether to buy. However, if you've ever dealt with a car dealership's finance department, you know it can be littered with landmines, including inflated interest rates, unnecessary add-ons, and extended loan terms that cost you more in the long run. It's easy to make mistakes when buying a car at a dealership, such as basing your decision on the monthly payment. For example, extending a loan from 60 to 84 months can significantly increase the total amount paid, even if the monthly payments are lower.

Dealers get you to concentrate on the monthly payment to make the car they're trying to sell you appear more affordable, even if a longer loan term means you'll end up paying a lot more overall. If you're not careful, you could find yourself in the unenviable position of having an upside-down loan, where you owe more than the car's value. So rather than the monthly payment, look at the vehicle's total cost, including purchase price, interest rate, and loan duration, to get a more accurate picture of the full amount the car will cost you over time.

Not securing financing ahead of time

If you can avoid financing your loan through a dealership's finance department, you'll improve your chances of locking in a lower interest rate and staying in control of your budget. The finance options dealerships offer usually don't come with competitive interest rates. Dealers often mark up interest rates to increase their profit margins, which could mean you end up paying more over the life of the loan than you would have if you'd gone with outside financing.

Your best bet is applying for preapproval for a car loan from a bank or credit union before you set foot in a dealership. By doing so, you'll be able to compare rates and terms, and negotiate with confidence. This holds true whether you're buying a used Mercedes G-Wagon or a budget-friendly car to get you to and from work. With a pre-approved loan, you'll have a better understanding of what you can afford to spend and be able to better resist upselling tactics and stay focused on vehicles within your price range.

In the end, you might find that a dealer offers you the best price. However, going in with a preapproval in your pocket gives you a benchmark to compare against and makes it less likely you'll be talked into a bad deal.

Letting emotions guide your decision

While it's easier said than done, don't let your emotions cloud your judgment when buying a used car. After days or months of shopping for the right car, it's easy to let your feelings take over the moment you lay eyes on what feels like "the one." But resist that urge and do your due diligence before signing on the dotted line, or you risk regretting your decision down the line. If you fall in love with a particular model, you'll be more likely to overlook red flags or accept a deal that isn't actually in your best interest instead of considering cars that initially might not be at the top of your list but are a better match for your needs.

If you let your emotions guide you, you may end up making an impulsive buying decision instead of asking those important questions to ask when buying a used car. The best way to keep yourself from getting caught up in emotion is to consider multiple options, compare features, and think about how much the vehicle will cost you in the long term. Bringing along a trusted friend, family member, or mechanic can also help you be more objective and keep you grounded.