10 Of The Best Apps For Tracking Your Vehicle's Mileage

You might want to keep track of your car's mileage for a couple of reasons. First off, it's a great way to stay on top of your expenses, especially if you're a business owner, an employee, or an independent contractor working with Uber, Lyft, or similar organizations.

Another common reason is to get tax deductions. Tax authorities like the IRS allow you to deduct your expenses on mileage from your taxable income. Over time, this can constitute a significant amount of money and allow you to save thousands of dollars in a year. You can also use these apps to get reimbursements from your organization for costs incurred on mileage.

In addition, tracking your mileage can help you manage costs generally, whether as a business owner or for personal reasons. You might want to know how much money is being spent on fuel, how to improve efficiency, ways to optimize vehicle maintenance, and so forth. And while most mileage apps come with additional finance or vehicle management tools, some can be more holistic, cost-effective, and user-friendly than others. With that said, here are 10 of the best apps for tracking your vehicle's mileage.

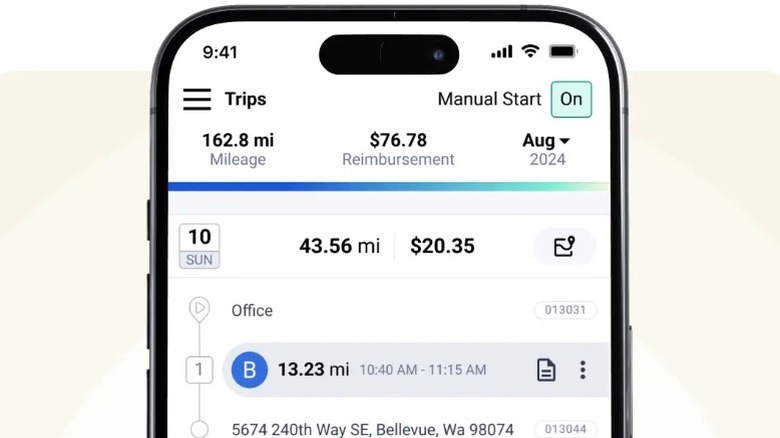

TripLog

TripLog is a mileage-tracking app specifically designed for businesses and freelance workers. It comes with finance solutions that lets you keep a mileage log for taxes and provide detailed reports on driving, earnings, and spending.

Using its trip detection feature, the app logs your mileage automatically, but you also have the option to do so manually. In addition, you can incorporate optional hardware components like the TripLog Drive and TripLog Beacon. The Beacon is described as the most reliable tool for trip detection on the mobile app. It uses Bluetooth and can instantly detect when your vehicle is in motion. TripLog Drive, on the other hand, is a device for offline mileage tracking that uses GPS data, allowing you to sync with the app later.

Apart from tracking your trips, the app also lets you classify them easily, either for individual or business use. Although there's a free version of the app, opting for the premium offers some perks, like unlimited access to tax compliance reports, which let you maximize tax deductions. The premium version also enables fuel tracking so that you can monitor your expenses easily. TripLog is available on iOS and Android.

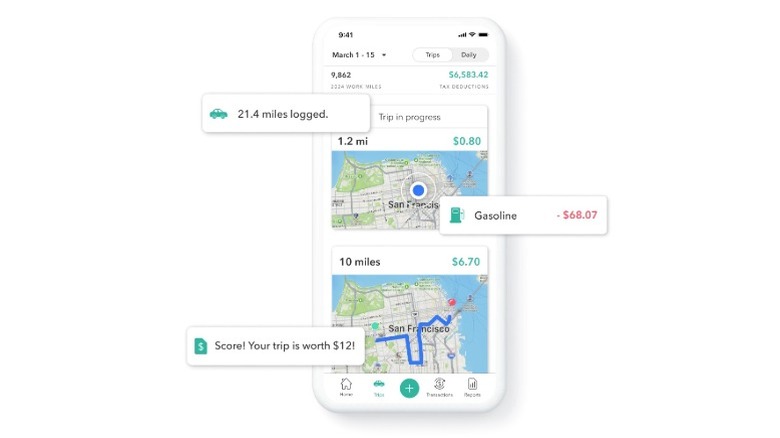

MileIQ

MileIQ, which started in 2012, is a cloud-based software for mileage tracking, available on both Android and iOS devices. The app offers tax-compliant mileage rates and the option of inputting custom rates to help you monitor your expenses and tax deductions.

One of the most highlighted features of MileIQ is the automatic mileage tracking. This means you don't have to manually set up or log your trips, and you can even add multiple vehicles and track them individually. In addition, the app lets you classify your trip as individual or business with just a swipe. You can even indicate the specific purpose of your trip, like attending meetings, visiting customers, or getting a meal.

MileIQ is also great for personalization and customization. If there are locations you visit regularly, you can add name tags to them, like "home" or "office." And if you specify your work hours on the app, it'll classify your trips within those periods under business automatically.

MileIQ is free for the first 40 drives in a month on the free plan. Paying $89.99 annually will give you access to unlimited drives, and if you get the team plan, there are even more options, such as a reporting dashboard.

Everlance

Everlance gives you highly specialized tools not just to track your mileage but also all your expenses and revenue. The app works using GPS satellites, so you get accurate location reporting and functions automatically, with the option to log your trips manually.

Moreover, Everlance combines helpful features like one-swipe classification and auto-classification to categorize your trips, custom tags for labeling, and favorite place detection to identify locations you commonly visit.

The app caters to companies as well as independent contractors like delivery drivers and shoppers, helping them to automatically calculate their expenses and tax deductions according to IRS standards. Drivers using the app are able to save $6,500 annually through tax deductions, while employees see a 15% increase in take-home pay.

Everlance is available on iOS and Android and offers a free version with some basic features. The Starter plan, priced at $69.99 per year, includes additional perks like custom IRS-compliant reporting. For the most comprehensive features, the Professional plan costs $99.99 annually, offering an AI-powered tax deduction finder and automatic expense tracking.

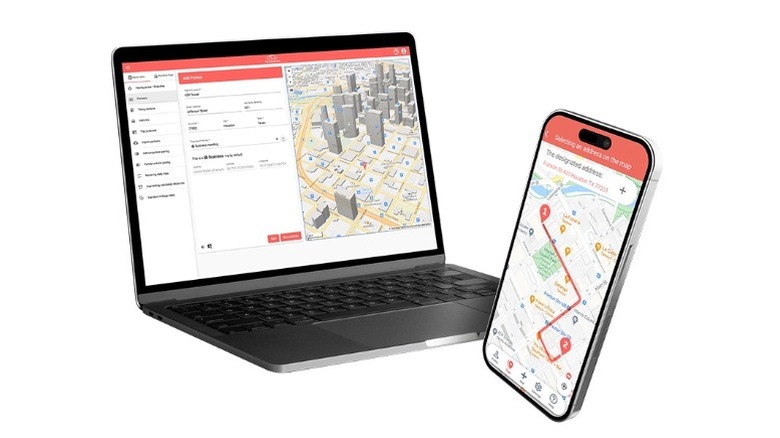

Mileage Tracker by MileageWise

MileageWise ensures you have an IRS-proof mileage log that accurately reflects your trips to get the tax deductions you need. It's a user-friendly app that automatically records your trips, tracks and classifies them, with the option for manual entry.

One of the major perks of this app is that it integrates with Google Maps, so you have records of trips you didn't log even years before. You can then import these trips to the app and convert them into IRS-compliant logs. It also has the Mileage Log Tax Preparation Service, so you can build and rebuild your logs from scratch. All you have to do is feed it relevant information, and it'll prepare a document you can present to the IRS.

MileageWise comes with an AI Wizard and an IRS auditor, both working together to ensure your log is IRS compliant. The AI Wizard ensures that all gaps are filled in and recommends trips for you based on your habits while the auditor identifies and corrects any contradictions and errors. This app is available on the App Store and the Google Play Store.

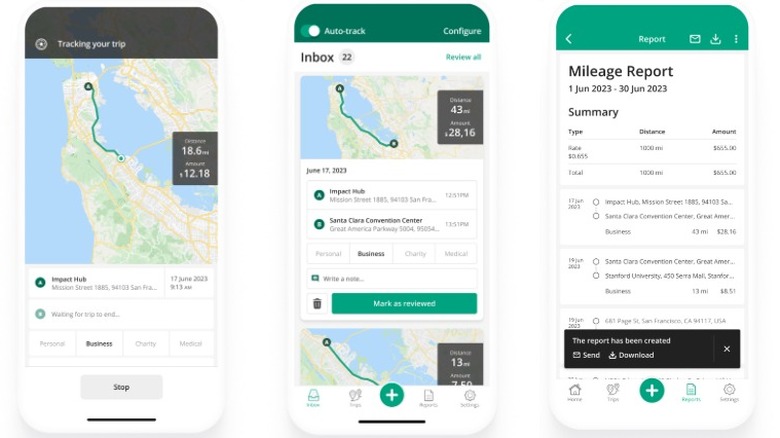

Driversnote

Driversnote is another great mileage tracking option. It lets you track your trips automatically using motion detection and also allows manual logging. Aditionally, you can get the iBeacon, which, when attached to your vehicle, ensures that only trips taken in your car are recorded in the app.

On Driversnote, you can categorize your trips as personal or business, and if you set your specific working hours on the app, it will categorize them for you automatically. The good thing is you can always come back to review each of your trips later to approve or delete. With this information, the app prepares a report for you, which can be used to obtain reimbursements or tax claims.

Many users enjoy Driversnote due to its ease of use and personalization features. For instance, you can decide to log your vehicle's odometer readings and include them in your report. Also, you can track multiple vehicles and create separate logs for each. If you visit certain locations frequently, you can save them on the app to make tracking easier and faster.

Driversnote is available on both iOS and Android. The biggest downside is that the free version only gives you access to 15 trips per month.

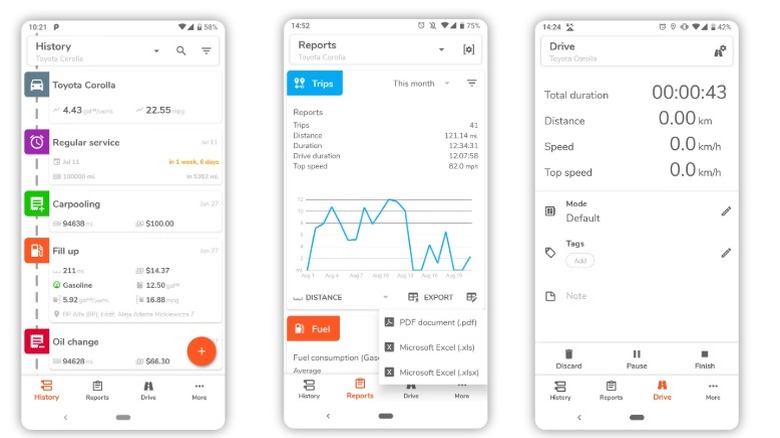

Fuelio

Unlike most applications on this list, Fuelio is not particularly designed to help with tax deductions. Instead, it's a vehicle management app. So, if you want to monitor how you use your car, your fuel consumption, the expenses incurred, and other relevant data on one platform, Fuelio is a great option. This software lets you track all of this information and is very user-friendly.

Fuelio's mileage tracker uses GPS and can monitor your trips both manually and automatically. Its mileage log consists of information like fill-ups, gas costs, fuel economy, etc. It can also monitor multiple vehicles and provide reports on each of them. You also get useful stats and information that guide your financial decision-making, such as notifications on different gas stations and their prices.

The best part of Fuelio is that the free model does not come with any ads, so you get a seamless and uninterrupted experience. However, with the premium version, there are added perks, such as tracking expenses beyond fuel and backing up data to Google Drive. Unfortunately, the app is only available for Android and not iOS.

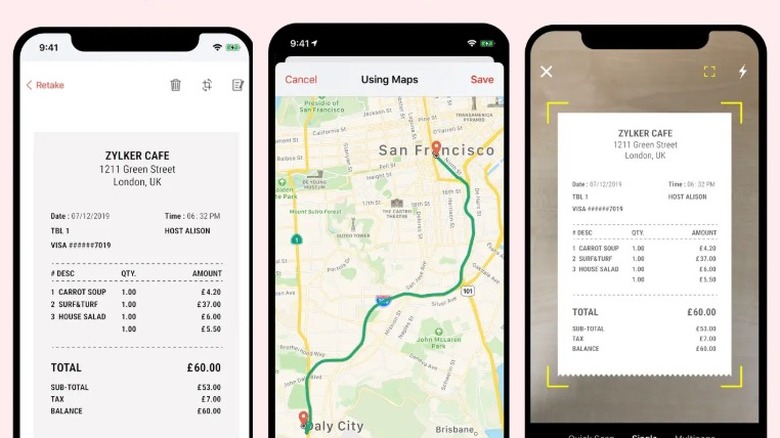

Zoho Expense

Zoho Expense is designed for employees and organizations looking to keep track of their expenses. It's a holistic tool that focuses on improved financial health through various extensive insights. Apart from mileage tracking, it's useful for monitoring expenses, receipts, and travel management.

Mileage tracking on Zoho Expense works in four ways. First, you can use the app to auto-calculate mileage expenses with GPS. You just need to indicate when your trip starts and ends, and it'll calculate your mileage expenses. Second, you can also select your origin and destination on the map and choose a route, which will also provide your mileage cost. The third option is to track odometer readings and input them into the app. Lastly, after you've taken your trip, you can indicate on the app how much distance you covered, and you'll get the results you need.

Although Zoho Expense has two subscription-based models, if you are a freelancer or small business, the free version works just fine and can accommodate up to three users. However, for growing businesses, the standard version ($5 per month) gives you access to additional financial tools, while large-scale businesses can subscribe to the premium version, priced at $9 a month. Zoho Expense is available on iOS and Android.

Motolog Mileage Tracker

Motolog is a mileage tracker and vehicle log designed for users who also want to monitor their fuel economy, car expenses, and other vehicle maintenance info. It tracks trips on a state-by-state basis, providing feedback and information in a comprehensive format. The app is available for both iOS and Android users.

With Motolog, you can calculate your fuel consumption in the city and on the highway to keep your usage and expenses in check. You also get reminders about vehicle servicing, along with other helpful notifications. If you have fuel and car expense information on a different platform, Motolog allows you to import it into the app for a more updated report.

The app comes with GPS tracking for businesses, car route tracking, and trip logs. One of its best features, however, is automatic car detection, which identifies your car and tracks your trips seamlessly. In addition, it has an International Fuel Tax Agreement (IFTA) tracker, which helps you calculate your mileage and determine your tax.

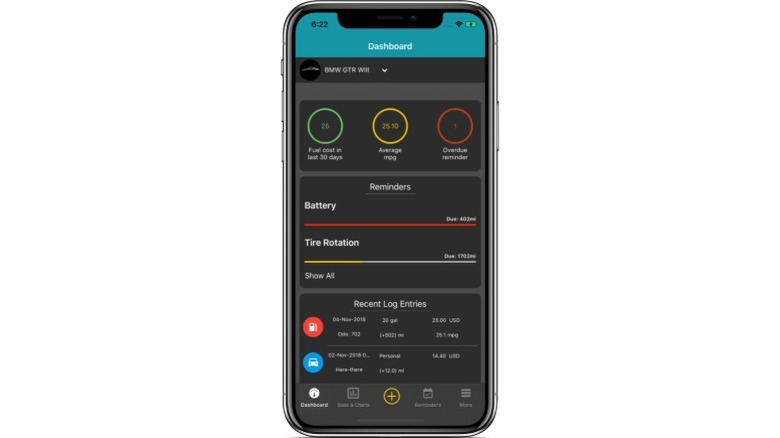

Simply Auto

Simply Auto is specifically built for car maintenance and expense management. The app comes with numerous helpful tools, including those for mileage tracking. It uses GPS or Bluetooth to record your trips, letting you sort the purpose of your movement — whether for business or personal reasons. It can also track mileage automatically, recording your information in the background once you're on a trip.

However, Simply Auto is not just designed for business owners. If you're a car owner who cares about your vehicle's well-being and also wants to know exactly how your money is being spent, you can record your car fill-ups, schedule reminders for servicing and maintenance, and generate routine reports on your vehicle. The app enables fuel consumption tracking by fuel brand, octane, and even filling station.

Although you can access Simply Auto on both iOS and Android, many of its great features are behind a paywall. The Gold package, which is a one-time payment of $9.99, includes GPS tracking for manual trips, which you don't get on the base model. You also don't get scheduled automated reports unless you subscribe to the Platinum package at $9.99 annually.

Hurdlr

If you're looking for a platform to easily monitor your expenses and income, Hurdlr is one of the apps you should consider. It is one of the most popular mileage-tracking and finance apps accessible to both Android and iOS users. It specifically caters to entrepreneurs and independent contractors.

Hurdlr has simple accounting features, income reports, invoicing, a tax deduction finder, and a bunch of other helpful tools. It also breaks down state, federal, and self-employed business tax estimates and helps you with tax filing.

Like its competitors, this app also allows you to categorize your trips under business or personal use. And when trips are tagged for personal use, you can further indicate if they are for medical purposes, charity, or moving, since the IRS has different reimbursement rates for each category.

The options for tracking on Hurdlr are manual, semi-automatic, and automatic. Unlike automatic tracking that runs in the background, with semi-automatic mode, you can push a button to start or stop the trip. However, note that with semi-automatic tracking, your trip is automatically classified as business, whereas with automatic tracking, you have to categorize your trips manually. Many of the app's features are only available on the premium version, which costs $9.99 a month or $99.99 a year.