10 Mint App Alternatives To Help You Stick To A Budget

Intuit purchased Mint in 2009, and it held in its hands one of the best personal finance apps of its generation. The app would continue on for 15 years before Intuit decided to shutter it in March 2024. Since then, millions of people have been surfing for Mint alternatives. Since smartphones have become an integral part everyday finance from sending money to managing it, it's natural that many are looking for alternatives for their smartphones. After all, we carry these little computers all day every day, so it's one of the best ways to manage finances.

Many contenders have taken up the mantle to become the next Mint. There are mainstays in the finance sector like Quicken that still offer personal finance apps along with a host of up-and-comers that can do many of the same things Mint once did. Unlike ye olde days, companies are also doing an increasingly good job of putting apps on both Android and iOS, taking the difficulty out of finding a reasonable alternative no matter which platform the user is wielding at the moment.

So, if you're still searching for a Mint alternative, the list below should give you a good idea of where to start. Even if none of them are direct one-to-one replacements, it's still a good idea to have something for personal finance. After all, the act of budgeting alone can save you money since you'll be much more aware of where your money is going.

Cashew

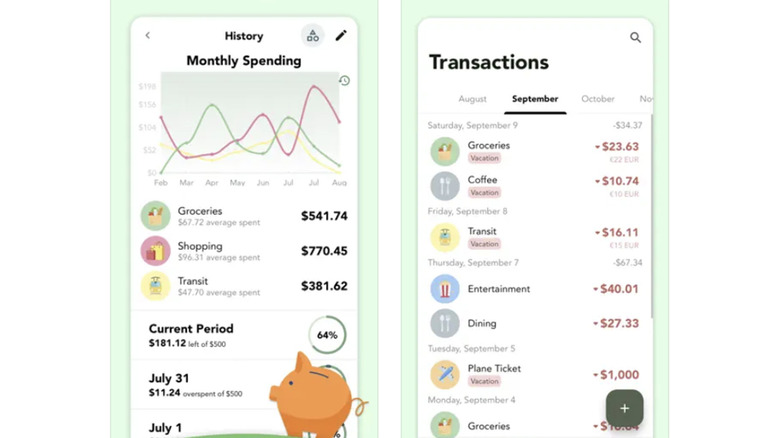

Cashew is a reasonable place to start your search. The app is available on Google Play and iOS and both versions have high scores from user reviews. In terms of pure functionality, you get the kinds of things you expect from a personal finance app. That includes the ability to create a budget and stick to it with a slew of charts and graphs to show you how you're spending your money over weeks and months. It also has a good spending history where you can look at prior purchases to identify periods of heavy or light spending to see what happened.

Beneath the surface, Cashew is still quite good. The UI is light, colorful, and fairly easy to read once you get used to it. In addition to its basic personal finance features, it also has a subscription tracker to help you keep track of those, a currency converter in case you need to manage your money in multiple countries, and things like a transaction history so you can see exactly where your money is going.

Most of Cashew's features are free but there is a subscription service available too. It's on the less expensive side of things at $1.49 per month and $11.99 per year. We also applaud Cashew's $19.99 lifetime price, meaning you can buy this app once and never have to pay for it again. When you're on a budget, it's good to be able to knock a subscription off the list with single purchases.

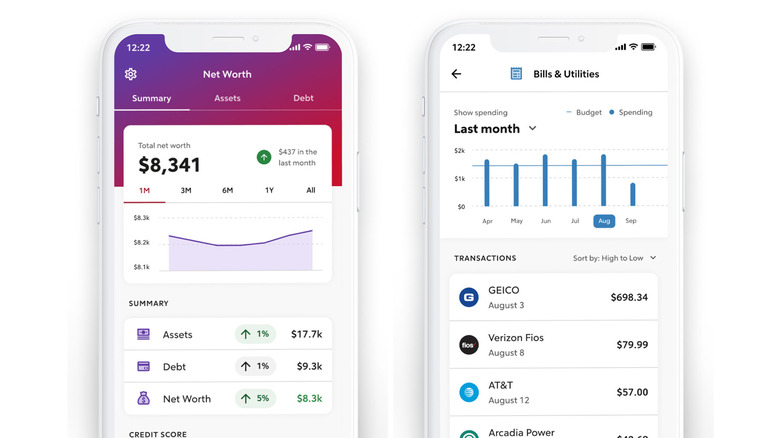

Empower

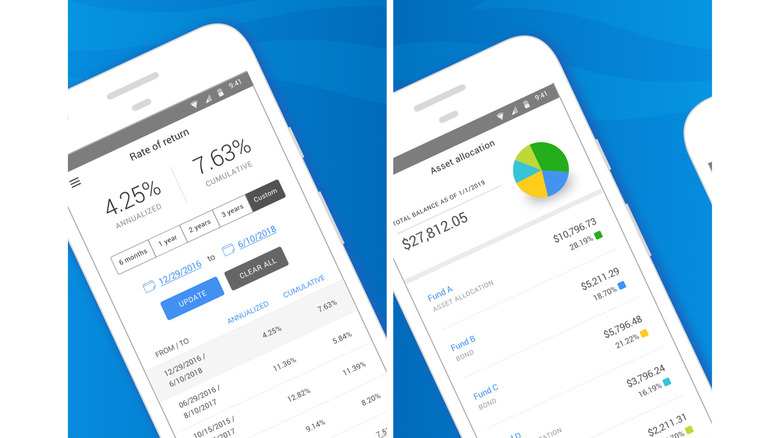

Empower is one of the bigger dogs in the personal finance space. It's on Google Play and iOS and both apps mirror each other in terms of functionality. This one works for personal finance, but it's more for keeping track of your entire net worth than it is for daily stuff. Thus, you get the day-to-day features like creating a budget and seeing your various expenditures over time. However, it adds in things like investment tracking so you can not only save money but also watch it grow.

That's the big draw with Empower. You can do things like use the debt paydown tool to help relieve yourself of credit card debt while simultaneously keeping track of your retirement accounts to watch them grow. The idea is that Empower lets you view your entire financial life and not just one part of it. Thus, a lot of folks refer to Empower as a wealth tracker rather than a personal finance app. It does both, but it definitely skews to one side a little more than the other.

Of course, the downside is that this can be overwhelming for folks who have never done that before. Additionally, younger folks may not have enough accounts to warrant such a powerhouse app and may be suited for something simpler. The app and all of its features are free so at least you don't have to worry about paying for it.

EveryDollar

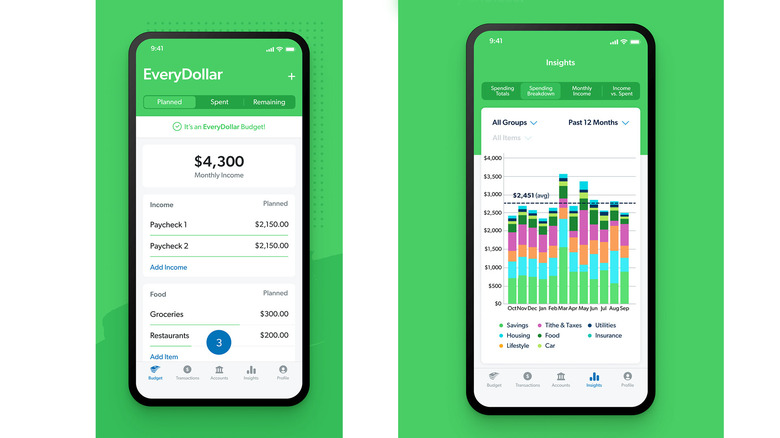

EveryDollar is an up-and-comer that seems to hit the spot for both Google Play and iOS users. Unlike Empower, this one focuses almost entirely on the day-to-day aspects of maintaining your bank account and budget. The app lets you quickly create a budget based on your paycheck and various bills so that you can manage your money better. It also allows the user to set goals so that they gamify saving money and feel better about hitting those types of savings goals.

While EveryDollar focuses a lot more on the everyday stuff, it does still have long-term finances in mind as well. Users can log in with their various financial accounts and view things like investments, retirement accounts, and other accounts set aside for the future. Those pair well with the budgeting features to help you prepare for long term financial success. Plus, with features like the hidden subscription finder, it can also help you save money by paying attention to your transactions and narrowing down where it's all going.

Of course, all of those features come at a cost. EveryDollar has three subscription tiers which include Plus, Premium, and the Ramsay Plus. They range in price from $7.99 to $17.99 per month with the yearly costs ranging upwards of $129.99 per year with the Ramsay Plus tier. Thus, the app does price out some folks at the lower end of the financial spectrum, and that is arguably its biggest weakness.

Google Sheets

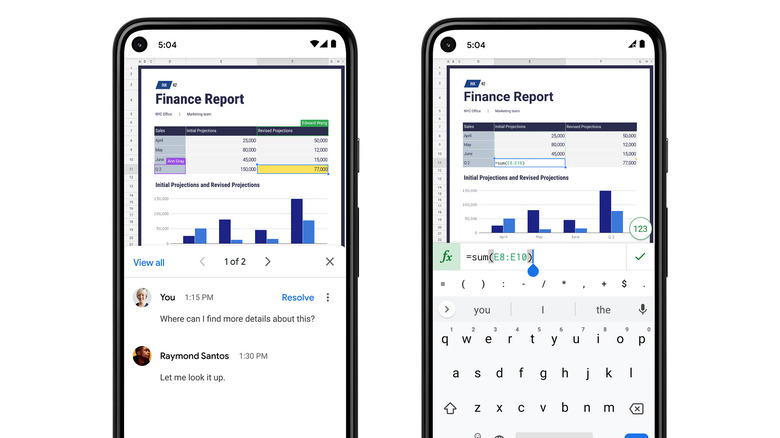

There is more than one way to skin a cat, as the saying goes. Before all of these fancy personal finance apps, a lot of people took to spreadsheets to create budgets and track their money. It's still a perfectly serviceable, low-cost option as long as you don't mind putting in the work. With a spreadsheet, you can balance your budget similarly to a checkbook, but it's all digital instead of physical. For this, Google Sheets is a good starting point. It's on Android and iOS, and it's free.

There are a several benefits to using a spreadsheet. As Mint demonstrated, personal finance apps may come and go, but spreadsheets have been around since 1979. They are going nowhere so you'll never have to worry about finding an alternative. Plus, there is a wealth of information on making spreadsheets do cool things, which helps lessen the learning curve. The downside is that it's not as functional and automatic or intuitive as a personal finance app. You'll have to do a lot more manual work to balance your budget.

Those looking for the more manual, lower-tech method can check out this tutorial from Experian as it's a great jumping off point for managing your finances. Google Sheets has a monthly budget template that helps make starting this method much easier. Plus, Google Drive gives you 15GB of storage for free, which translates to thousands of spreadsheets that are always backed up.

Greenlight

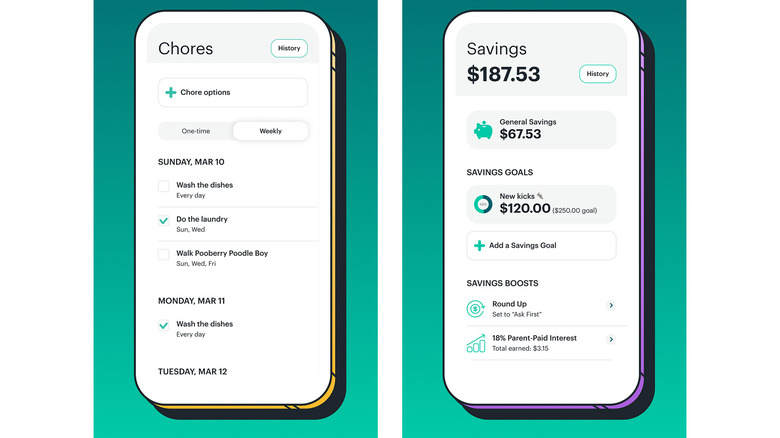

Greenlight is a personal finance app directed at parents and kids. The general idea is that it's supposed to help teach kids how to deal with their finances with the helpful and watchful eye of their parents to guide them along the way. It's technically an online banking app, so you'll have to set up accounts and all of that, but it's not too difficult to use once you get the parts moving. Per the norm, it's on the App Store and Google Play.

The benefit of this one is allowing parents and kids to manage a child's money together. Parents can set up direct transfers of money for things like chores or allowance, or add direct deposits for a teen's first job, all while being able to oversee things like transactions and expenditures to help guide them in spending their money wisely. Parents can also set spending limits, thus instituting a budget. They can also receive notifications when the kids spend money on their debit cards.

It's a neat concept and something a little bit different in the personal finance app space. The only part that may cause strain is that it is a banking app mixed with a personal finance app, and that means switching banks for most folks. Since many of these features can be recreated at other banks, it may be worth checking to see if your bank has dedicated children or teen accounts that have similar features.

Monarch

Monarch (Android, App Store) made a big push when Mint went down, and users seem to enjoy it. It works similarly to Mint and other personal finance apps. You log in with various accounts, and from there, you can import your transaction history, balances, and other financial data. You can also create a budget, watch your investments grow, and manage your finances to save money. It's fairly straightforward all around and it does a good job of not getting in its own way.

On top of the usual budget and transaction tracking, Monarch's big claim to fame is that it's an all-in-one solution. You can check your transaction history from every account, making it easier to track your purchases, subscriptions, and refunds. With that information, you can cancel old subscriptions and reduce your purchases to save money. The app has a direct interface that shows you information without a bunch of fluff. It can also keep track of things like loans, credit cards, and other debts to help you pay them down faster.

Monarch does have a subscription that costs $14.99 per month or $99.99 per year. New users get a week to try Monarch before being asked to pay for anything, but there is no free version of this app. It's not an unreasonable amount for a subscription, but other personal finance apps do have free versions for people who don't want to add another paid subscription.

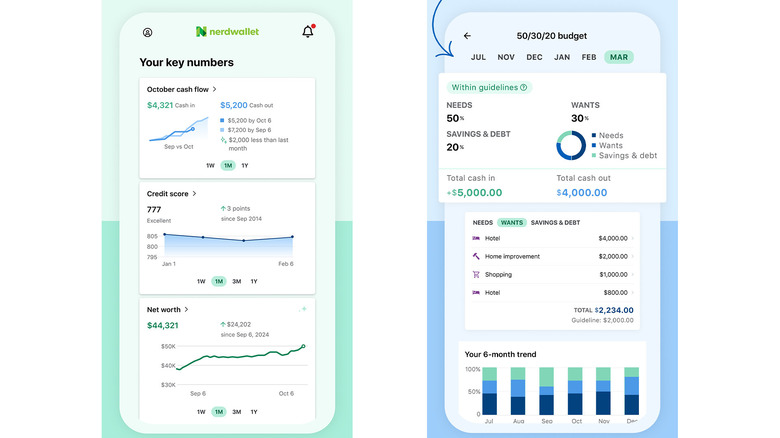

NerdWallet

NerdWallet is an excellent personal finance app on Android and iOS. It works by letting you log into your bank account and other accounts and then puts all of that information at your fingertips in a single app. NerdWallet's strongest feature is its user interface which is colorful and relatively easy to read. Once you get everything set up, it's just a matter of finding all of the information you need and using it to save you money. You can also log in with investment accounts to see your overall net worth in the form of investments, debts, and even your home value.

You get the same general features such as a budget builder tool. There is also the standard access to your transactions and debt history so you can make better financial decisions. However, NerdWallet adds in more features like credit score monitoring and various tips and tricks by NerdWallet's staff on how to save additional money or spend your cash more intelligently. Thus, it works best as a resource for information. And its data displays are particularly helpful.

There is a NerdWallet Plus subscription that costs $49.99 per year, which is less than most competitors. It adds some extra features like more advice and an insurance assistant tool, but most folks will be able to use the free version without issues. It also houses a lot of advertisements such as credit card offers that you'll probably want to ignore for the most part.

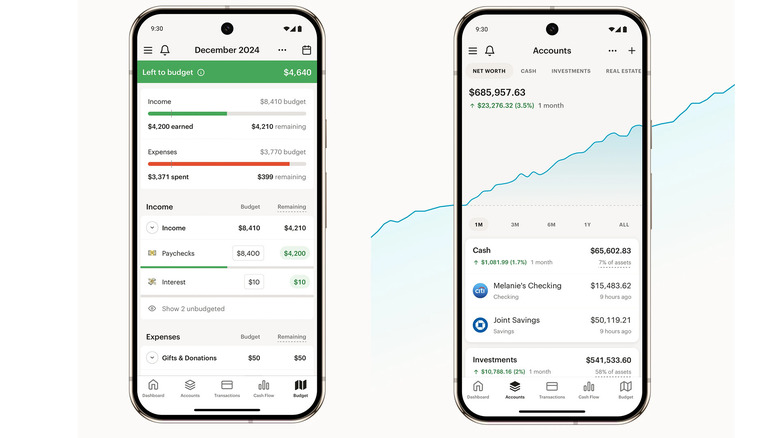

Quicken Simplifi

Quicken Simplifi is arguably the most logical choice for a Mint replacement. Quicken has been around since the 1980s and has been in the personal finance software game all this time. However, Quicken Simplifi came out in 2020 on Android and iOS, so it's the latest effort from the personal finance giant. It works as you would expect. You get the usual stuff like connecting with your various accounts and tracking your money down to each individual transaction if you so choose. You can also add credit cards, investment accounts, and other things to keep track of your overall net worth.

Since Quicken is a larger company, it also has integrations with other software. For example, you can use Zillow to track your home's value. Aside from that, you get the usual array of features like a budget builder, a savings goal tool, and even a retirement planner. These tools can be used in various ways, such as a vacation fund. There are a lot of tools, integrations, and information to work with allowing you to tackle your finances from a variety of angles.

Of course, its biggest pro is also its biggest con. This is a large, bloated app and if you're not using all of the functions, you may be better served with something simpler. Quicken also has a subscription for Simplifi to the tune of $71.99 per year. That's not excessive but it's not the cheapest app either.

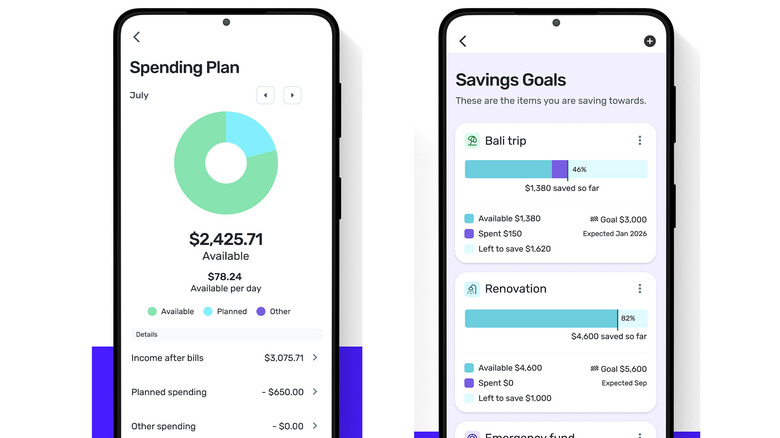

Rocket Money

Rocket Money is another big player in the personal finance space. The app is available on Google Play and the App Store, so you don't have to worry about what platform you own. Like most, you can import your financial data and get a bird's eye view of your finances and spending. You can then use that data to reduce your spending and save some money. In the grand scheme, it works like many other Mint alternatives, so it's not necessarily treading new ground.

With that said, Rocket Money does do some things better than others. A few examples includes its subscription tool that automatically identifies subscriptions so you can cancel ones you don't want anymore. There is another tool that can help you negotiate better rates on your existing debts, letting you pay them off more quickly with less interest. Those kinds of features can really help, especially if you're in a lot of debt or have a lot of subscriptions. Rocket Money also lets you view your entire net worth from assets to investments and debts.

Rocket Money has subscriptions that range from $6 to $12 per month depending on which tier you want. This subscription is required. All new users get a seven-day free trial to see if they like it, and then they'll have to pay to keep going. On the plus side, $6 per month is on the lower side of things but it's still an extra cost no matter how you shake it.

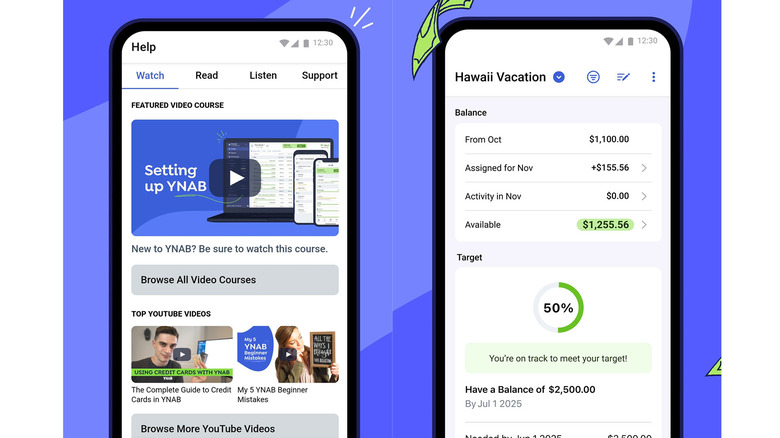

YNAB

YNAB, short for You Need A Budget, is an app that does what it says. It's available for both Android and iOS, which is good news because people seem to really like this one. This one does the basics as but manages to put all of the financial information you need in about as easy of a presentation as it gets. It shouldn't take too long to get everything set up and going. You also get the stuff you'd expect like a budget tool to help manage your finances more effectively.

Perhaps the biggest benefit of YNAB is that it's built for families or households. That means you and your partner, roommate, or whatever can work out of the same account. That makes it much easier to manage multiple accounts from multiple people. You can even include your kids. Add in stuff like the loan planner tool, and it's a potent mixture of simple and effective. It does this with the aforementioned tools and omitting things like third-party credit card pitches, which is nice to see.

All new accounts get a one-month free trial, which is much longer than the other subscription finance apps on the list. After that, you'll have to pay $14.99 per month or $109.00 per year to continue service. That's a little pricey but if you're in a multi-person household, YNAB quickly becomes one of the least expensive options per-person as each account only needs to be paid for once.