Is Infiniti Going Out Of Business? Here's What You Need To Know

Reports suggest that Nissan might go out of business soon. The Japanese company is reportedly struggling with declining sales, both domestically and in the United States.

Competition from Chinese and other automakers, coupled with an 85% drop in third-quarter profits, has led to cuts in production and has already cost the company some 7,000 jobs. Concerns over the incoming U.S. administration have also fueled uncertainty, amid fears of major regulatory changes.

Naturally, these challenges extend to Infiniti, Nissan's luxury vehicle division. Infiniti — which produces its vehicles in Japan, Mexico, and the U.S. — maintained a significant presence in the premium automotive market worldwide for decades. Launched in the late 1980s, the Infiniti brand grew at a healthy pace, despite some setbacks, with U.S. annual sales reaching a peak of 235,788 units in 2012. In recent years, however, the brand has struggled and now appears to be facing an uncertain future. Here's what you need to know.

Infiniti sales figures: What the numbers say

While Infiniti does have a global presence, the U.S. remains its primary market, so it's best to focus on annual sales figures in the U.S. to evaluate the brand's performance. Here's what they look like.

In 1990, Infiniti sold 17,382 vehicles in the U.S. The numbers fluctuated between approximately 30,000 and 50,000 in that decade. In the 2000s, the company reached new heights. In 2005, for example, it sold 207,129 vehicles. This continued into the early 2010s, with 2012 being the best year on record, as stated above.

Things started going downhill later in the decade, and in 2020, annual sales figures dropped to 79,503, while 58,555 units were sold in 2021. The sales figures for 2022, when the Infiniti QX80 hit the market, are even worse — Infiniti sold 46,616 cars in the U.S. that year. Though there was an increase to 65,316 units sold in 2023, that is still nowhere near the 2012 peak.

Other major luxury car brands are performing much better than Infiniti. Lexus, for example, sold 320,249 vehicles in the U.S. in 2023. Tesla, meanwhile, recorded sales of approximately 650,100 units, making it the leading luxury brand in the country.

What was the plan for Infiniti?

Amid declining sales in 2020, Infiniti appointed Peyman Kargar as Global Chairman. Kargar publicly acknowledged that Infiniti was struggling, primarily because it had failed to "bring enough new products to our customers" (via Business Insider).

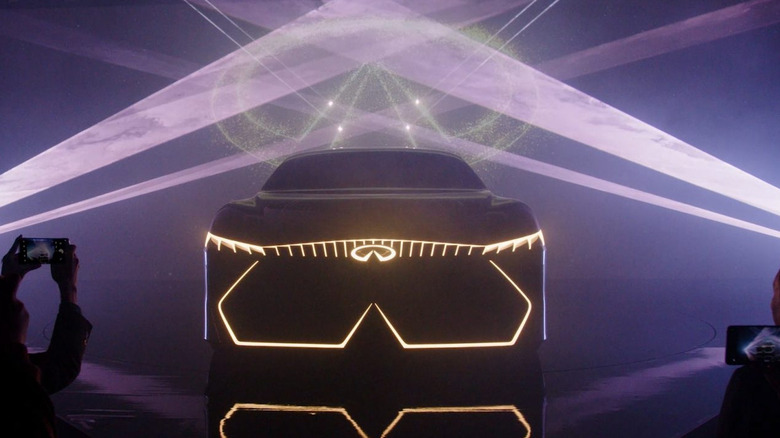

Kargar did not remain long in the position, and was replaced by Jose Roman in 2023. That same year, Infiniti unveiled its first electric vehicles, signalling that it may still have something to offer in a market dominated by modern, forward-thinking companies like Tesla.

These innovations are part of a broader effort by Nissan called Ambition 2030. Initially launched in 2021, Ambition 2030 is a project focused on electrification and sustainability. By 2030, Nissan aims to introduce 27 electrified cars. Of those 27, 19 will be fully electric vehicles. Despite its name, the plan doesn't seem terribly ambitious, but it was seen as a step in the right direction for the struggling Infiniti brand.

What's been happening recently with Infiniti?

News broke on December 5 that Infiniti is exploring the possibility of co-locating some of its dealerships with Nissan stores. In other words, Infiniti vehicles would be sold alongside Nissan models at certain locations, which could theoretically help both Infiniti and Nissan increase sales.

At present, the average Infiniti dealership sells only around 24 vehicles per month, with some dealers reporting losses ranging from $600,000 to $2 million. Given these figures, any sales boost, no matter how seemingly insignificant, could provide a lifeline.

On the flip side, this would be a rather unusual solution for a luxury brand — luxury car brands need to differentiate themselves from their mainstream counterparts, ensuring exclusivity and a premium customer experience. Additionally, even if the concept proved successful, it would not address the structural issues plaguing the brand and would likely serve only as a temporary fix.

That Infiniti is looking at short-term, unconventional solutions, such as co-locating dealerships with Nissan, signals that the company as a whole is under major pressure to boost sales as soon as possible. It would hardly be a surprise if it folded.