10 Of The Best Investment Apps For Android Users (According To User Rating)

Investing is one of the best ways to make money on money you already have. It's also one of the key options people have to supplement their income later in life if they ever want to retire. With that said, the world of investing is tough to get into. There are tons of terms and numbers that aren't immediately understandable to folks outside of the circle, and keeping track of those investments is another world entirely from the world most people know.

Fortunately, there are a slew of apps out there that can help make the process easier. Such apps exist on both Android and iOS, and most of the time it's the same apps. Such apps can help you trade stocks without a broker, keep track of companies you've invested in, and even help you manage your finances to help you save more over the long term. It makes investing a lot easier to get into and much easier to manage than doing it on your own.

These apps, ranked based on their Google Play reviews, can help get your foot in the door and keep it there. However, as a word of caution, Google Play does have fake reviews just like you find on Amazon or other retailers, and should not be an end-all-be-all metric when determining the best investment apps.

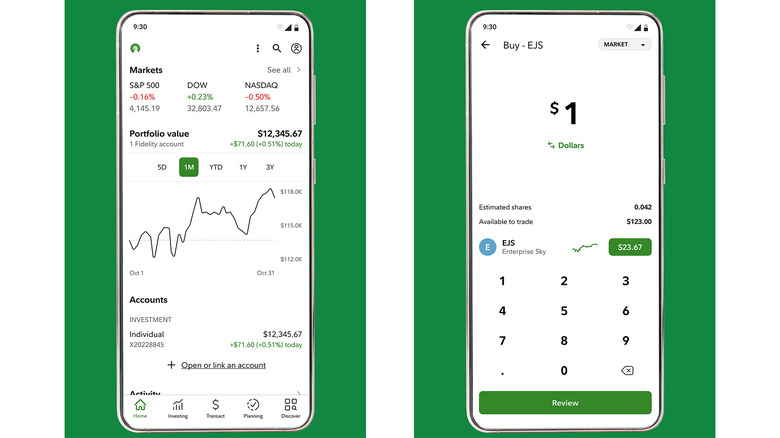

Your stockbroker app (varies)

In general, a great place to start for investing is your stockbroker app. There are many available, including Fidelity, Robinhood, Webull, AmeriTrade, E*Trade, Charles Shwab, Public, and many others. Choosing a brokerage account is like choosing a bank account. You should choose the one that works best for you and that includes the features that you want. For example, Robinhood is great for beginners as it has a very simplified interface, and it also supports some cryptocurrencies. Fidelity, on the other hand, is more intensive and comes with a variety of investment options along with the ability to open a checking account.

For the most part, a stockbroker app includes all kinds of information, including charts, news, and in-depth statistics about stocks on the market. You can check your investments to see how they're doing and get news and information about the companies you want to invest in. Since it's tied directly to your stock positions, you can immediately trade based on the information you learn. These apps tend to be a bit clunky when it comes to research compared to investment apps specifically designed for it, but otherwise, they're a good starting step.

When it comes to choosing a broker, you should research each one and figure out which one has the options and features that you want. For the most part, all of the big names are reliable, although none of them are free from the occasional controversy.

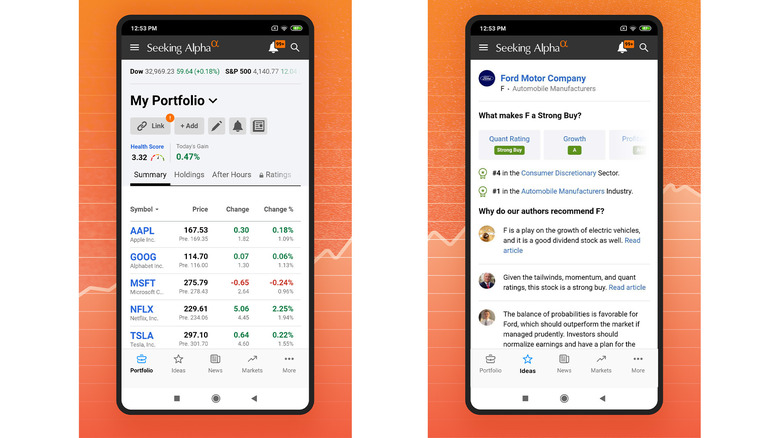

Seeking Alpha (4.3 out of 5)

Seeking Alpha is a well-known stock news and analysis platform with its own Android app. The app does many of the same things as its website equivalent. Users can check out financial news about companies that they follow, research and analyze stocks, and there is an option to include your portfolio so you can check how you're doing without always needing to open your brokerage account. There are also a host of newsletters available if you prefer to get your news that way.

All of the above is what you get with the free account. Subscriptions are available starting at $19.99 per month that unlock additional features, such as investment insights, additional access to tools, and access to more exclusive parts of the service where only other paying members can go. Whether or not it's worth it depends heavily on the person but Seeking Alpha does boast that its stock picks outperform the S&P, a pretty good track record when it comes to picking stocks.

The app itself features a clean user interface with buttons along the bottom of the app that help take you to the major hubs of information. It's nothing original or Earth-shattering but it gets the job done without being too cluttered or difficult to use. It maintains a 4.3 out of 5 rating on Google Play with most complaints being about app optimization issues that seemed to stem from recent updates.

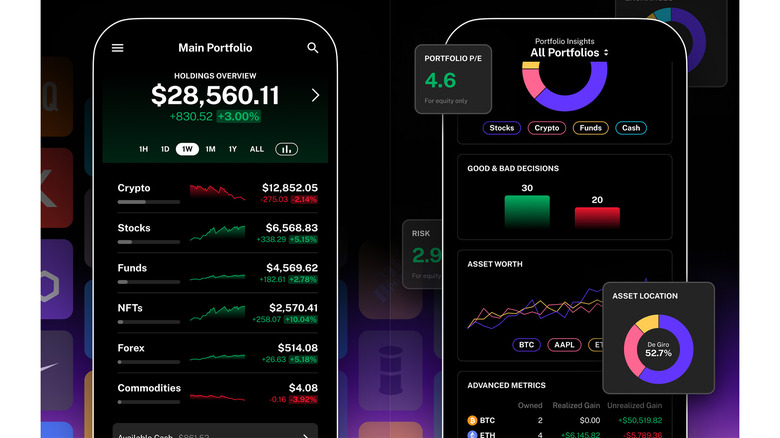

Delta Investment Tracker (4.4 out of 5)

Delta Investment Tracker is another news and analysis aggregator app that lets you track your various investments. Unlike Seeking Alpha and many of its competitors, Delta Investment Tracker gets its bones by following just about every type of investment you can think of, including cryptocurrency, NFTs, forex, and commodities. Its main claim to fame is that you can keep track of live prices for all of those things in one spot, which makes Delta popular in the Play Store. As of this writing, it boasts more than 1 million downloads.

In addition to the comprehensive price tracking, you also get the usual stuff like the ability to track your portfolio. That includes stocks, your crypto wallet, and other investment portfolios. There are also some other tools, like price alerts, to help you trade more quickly and effectively without having to check your phone every 30 seconds. Like most investment apps, there is a subscription-powered pro version as well that boasts more portfolio insight tools, advanced metrics, and more options to sync your various portfolios. Of note is the "Why is it moving?" feature that will drop news tidbits when stocks make big swings to tell you why it happened. Subscriptions start at $7.99 per month or $99.99 per year.

Delta leans less on the news than other such services but makes up for it by having more charts and graphs showing things like prices and other metrics. It's also less expensive in terms of subscription cost from the larger, more traditional stock market analysis companies. These things likely contribute to the app's 4.4 out of 5 rating on Google Play.

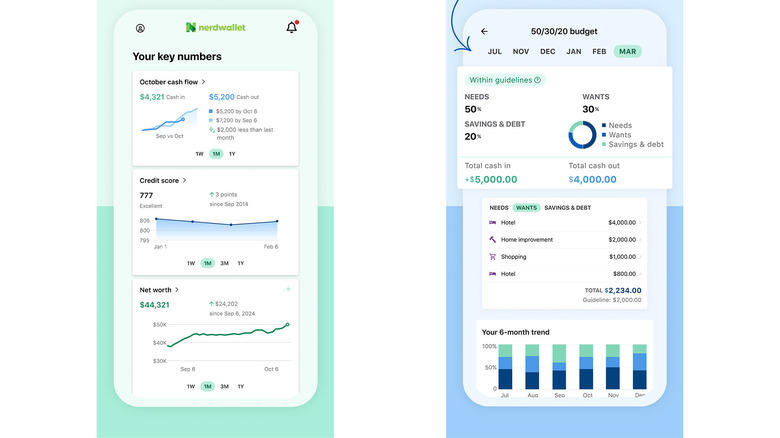

Nerd Wallet (4.5 out of 5)

Instead of delivering news and insights about your stocks, NerdWallet helps you manage your personal finances. This comes in the form of syncing your checking and savings accounts, your spending, and your budget so you can keep track of where your money goes. It'll even display things like your credit score so you can see if all those payments are actually helping you. As such, it's not the place you want to go if you want price alerts or to see how the stock market is doing today.

On the other hand, it does help you keep track of your net worth, which includes your various investments. You can add things like your stock market portfolio along with things that people don't typically think about when it comes to investments, like your home's value and equity. By managing your budget, you can reduce spending and add more money to your investments to help your money grow faster. The various tools and features help you invest more money and keep track of the things that build value, like your home.

In terms of usability, the app is clean and concise. It may take a day or two to input all of your various credentials to keep track of everything but after that, it's fairly smooth sailing as long as you stay on top of it. That's likely why it's garnered a 4.5 out of 5 rating on Google Play.

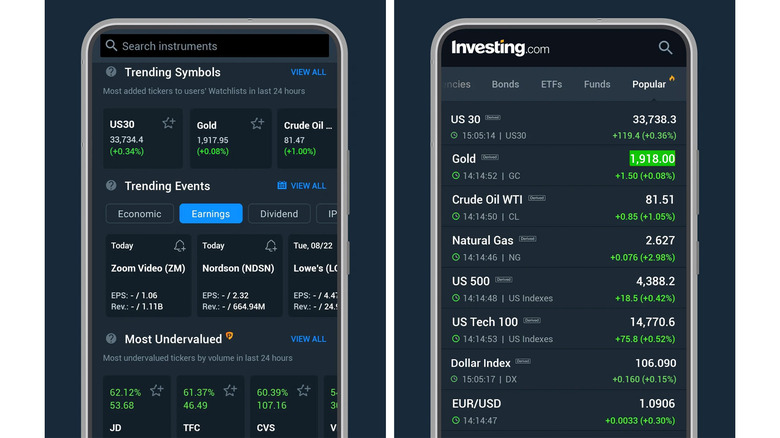

Investing.com (4.5 out of 5)

Investing.com is one of the oldest and most popular investing apps on Android with over 50 million downloads to date. It does the classic aggregate function where you can find news and analysis of various stocks while also keeping track of your portfolio to see how much you gained and lost. The app also has data about commodities, bond rates, and global indexes for those who want to trade internationally. There is a lot of information in this app, which is why it's so popular.

In addition to the information, there are a variety of tools, charts, analysis, and even a built-in currency converter to help you invest better. Investing integrates a social element as well so you can talk to other traders about stocks. The sheer amount of information makes it good as a one-stop shop for investing and with a little personalization, you can keep track of virtually anything you want when it comes to the stock market or commodities trading.

The free version of the app is supported by ads and grants you most of the features. Much like Seeking Alpha, a pro subscription plan unlocks preferred stock choices and more in-depth information. Investing has two plans. One is $15.99 per month and the other is $39.99 per month, although you can usually find deals around the holidays and other sales events. With the full Pro+ subscription, users get access to 1,200 metrics, the aforementioned stock picks, and additional widgets, among other things.

Yahoo Finance (4.5 out of 5)

Yahoo Finance is a popular option for stock traders with over 10 million downloads. The app is the gold standard for stock news and tracking. You can log into your various accounts and see your positions right from the app with information directly from your broker. From there, you can create watchlists, view news about each company, and view metrics about each stock. It's a good middle ground for folks who want to keep up but don't need 1,200 metrics to compare.

That isn't to say that Yahoo doesn't have a lot of information, because it does. The above features are available to free accounts along with information about European and Asian markets, trending equities, and even cryptocurrency prices. Yahoo also has a trio of subscription plans that include extra information. The base subscription includes portfolio performance analysis and a subscriber-only newsletter. Going another tier up adds access to thousands of research reports and additional news from Newsfeed, The Financial Times, and The Information. The top tier adds decades of historical data, more chart patterns, and more. All three plans also remove ads from the app and website.

In terms of usability, Yahoo is in the middle of the pack. It's easy enough to move around but can be a tad cluttered at times, especially if you access all of the information provided by the pro plans. There's enough there to spend years pouring through data but the free version is enough for beginner traders.

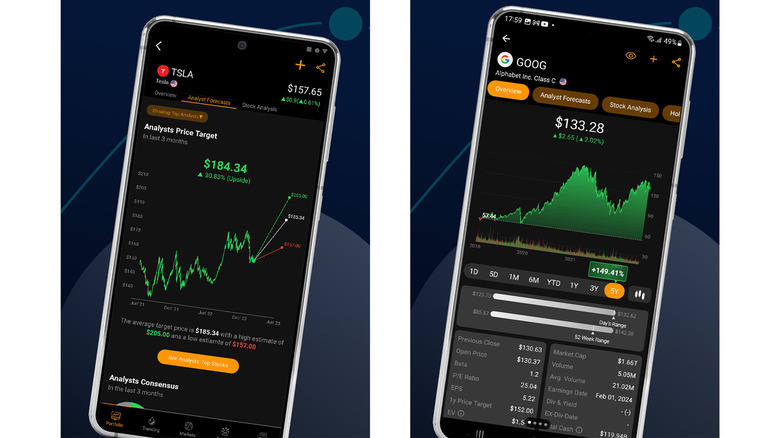

TipRanks (4.6 out of 5)

TipRanks is a stock market analysis app that is similar to Delta. It has news but it's not at the forefront of the app's features. In general, the app gives you tons of tools, charts, graphs, and data to pour over to help you make the best decisions while investing. That includes basic stuff like real-time quotes and advanced stuff like aggregate scores for which stocks are performing well or poorly. It also tracks the prices of the top 100 cryptocurrencies.

There is also an optional pro subscription that starts at $29.95 per month. You can get a discount if you pay for three years up front at an average of $19.95 per month. Going premium nets you extra features such as more advanced stock metrics, various algorithms to help you pick stocks, and a trending stock section based on trading experts. What's nice about TipRanks is that most of the features are free. The pro version mostly just helps you decide which stocks to buy based on the analysis of both computers and people.

The mixture of free features and reasonably easy user interface have made TipRanks a growing favorite among Android-toting investors. It only has 100,000 downloads but maintains a 4.7 out of 5 star rank on Google Play. Most complaints are centered around a recent redesign that will likely get optimization in future updates. In terms of usability and functionality, there are few real complaints about how TipRanks is set up.

Reddit (4.6 out of 5)

Reddit is not a typical investment app and some will turn their nose up at a glorified online forum being a place for investors. However, if you were in the Wall Street Bets subreddit during the GameStop craze, you might have made serious money. Those types of tips aren't commonplace on Reddit, but ignoring such a large segment of the retail trader base isn't smart. You can find some useful information there.

The best and most consistent example is stock news. Find yourself a good stock trading subreddit and folks will post interesting news about all sorts of things that may or may not affect the stock market. Plus, other subreddits are gold mines for beginner traders as people post questions and commentary all the time about it. Yes, stock trading subreddits have the same issues as every other subreddit in terms of nasty users and misinformation. However, if you can learn how to sift through that nonsense, it's a solid overall place to find out about new stocks and talk with other traders.

Reddit has a subscription but nothing about it is pertinent to investing. There is only one plan that runs for $5.99 per month or $49.99 per year. It removes ads from the site, grants you some personalization features, and grants access to a members-only subreddit. This is similar to the social spaces provided by investing apps like Yahoo or Investing, but more consistent because more people come to Reddit.

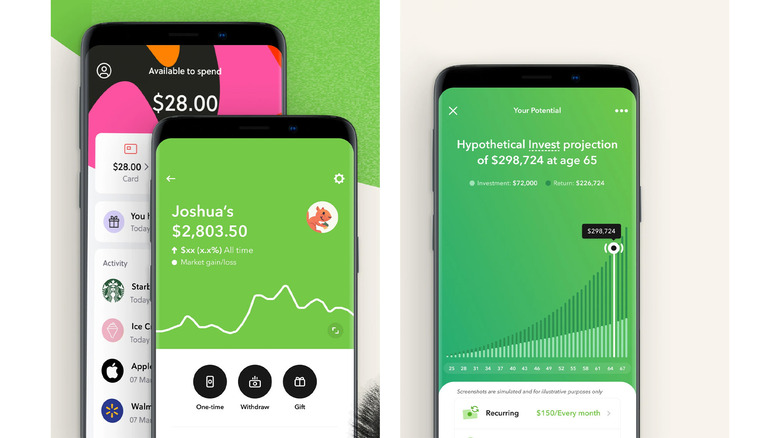

Acorns (4.7 out of 5)

Acorns is an app that actually lets you invest money, but it doesn't do so like you would with a stock brokerage app. The basic idea is that it takes your spare pocket change and invests it on your behalf. Over a long period of time, you'll grow a decently sized nest egg that can help you when you need it. In general, the idea is that you spend $3.50 on a coffee and then round up to $4.00. Acorns takes the extra $0.50 and invests it. Years later, you'll have some actual money in your account.

Other than the above, Acorns is pretty straight forward. You create and set up an account. From there, you simply deposit money when you have the time. Acorns matches investments by either 1% or 3% depending on which type of account you choose. That money sits around and grows in the background without you having to do anything. You'll lose money on some days and gain on others, but the investment should trend upwards as long as you keep investing.

Acorns is not the only app of its kind. Betterment and Wealthfront are also competitors in this space. Each offers the same "get rich slow" tactic where you invest where you can, and your money grows over time. Each app has its own pros and cons but the worst of them are rated 4.7 out of 5 on Google Play with Wealthfront being rated 4.9 out of 5.

TradingView (4.8 out of 5)

TradingView sits at a comfortable 4.8 out of 5 stars, which is very impressive for an app with 10 million downloads. The app accomplishes this by being user friendly enough for beginners while simultaneously being technical enough for more advanced traders. Similar to TipRanks and Delta, the app focuses more on metrics, charts, and data than it does on things like being a news aggregator. It also includes things like alerts about a host of investment items like stocks, currencies, bonds, futures, mutual funds, and commodities.

TradingView's claim to fame is its charts. It boasts some of the most comprehensive and customizable charts of any Android app on the Play Store, including some more complex ones like Renko and Kagi charts. Some desktop applications and websites don't even have those. Between the charts and the variety of metrics, it's difficult not to find what you're looking for. The only hard part is deciphering and analyzing all of it. There are over 50 exchanges to choose from, giving you plenty of things to research.

There are some limitations on the free version that unlock with the premium subscription. There are three tiers that range from $12.95 per month to $49.95 per month. Each successive tier allows you to view more charts at once with an increasing amount of data. All subscriptions also remove ads from the app and add one a host of additional features like multiple watchlists, charts based on user-definable formulas, and alerts that don't expire.