What Happened To The Honeyfund App From Shark Tank Season 6?

The sixth episode of the sixth season of "Shark Tank" premiered on ABC on October 24, 2014, to an audience of 6.9 million viewers, according to Nielsen ratings. The second of four pitches featured in the episode was for Honeyfund, a crowdfunding site that engaged couples can use to crowdfund their honeymoons in lieu of more traditional gifts. They had processed nine figures worth of transactions to date, but the company's actual revenue in transaction fees was much smaller, representing approximately 1.5 percent of funds sent to soon-to-be newlyweds via the platform. Regardless, Honeyfund had carved out enough market share that multiple sharks were interested, with the company's owners, married couple Josh and Sara Margulis, eventually settling on the least conventional offer that was extended to them.

Unlike most "Shark Tank" companies, Honeyfund has been referenced regularly on the show, so it's no surprise that the deal closed after due diligence and the company continued to be successful. However, the company has taken some turns since the last time viewers were formally updated about its status on the show in 2019. After relocating Honeyfund to Florida, the Margulsises got divorced, with one spouse buying out the other, and the company was, understandably, absolutely devastated by the restrictions of the COVID-19 pandemic. Honeyfund is still soldiering on, though, and it's having an impact beyond its owners, its users, and the wedding industry, serving as the plaintiff in an important First Amendment lawsuit.

What happened to Honeyfund on Shark Tank?

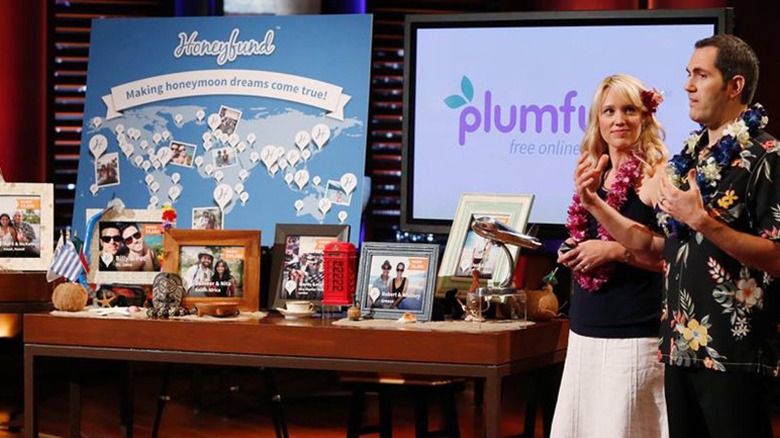

Married couple Josh and Sara Margulis entered the titular tank seeking $400,000 for 10 percent equity in their honeymoon expense crowdfunding company, Honeyfund. When they were engaged, they wanted to start a business together, and after their personal honeymoon-funding site generated over $5,000, they knew that scaling that concept into a crowdfunding platform was the business for them. As of filming, Honeyfund had, in roughly eight years, raised $200 million in gifts for "hundreds of thousands of couples," with $67 million in the prior calendar year. However, Honeyfund's revenue, a transaction fee of roughly 1.5 percent, was $987,000 of that $67 million, of which $217,000 was profit. They had managed to keep their customer acquisition costs low, though, at 88 cents for the average $9 customer.

Lori Greiner was the first shark to opt out, feeling it was too crowded, while Mark Cuban joined her because he wasn't impressed with the Margulises' plan to scale the business, introducing a Spanish-language version of Honeyfund and various spinoff websites for other gift-giving events. Robert Herjavec was the first to make an offer, $500,000 for 50 percent, feeling that he needed to be an equal partner with the couple, but when Barbara Corcoran offered $400,000 for 30 percent, he matched that deal. Kevin O'Leary, though, offered $400,000 for a third of their transaction revenue with no equity until he got three times his investment back, which the Magulises accepted when Robert wouldn't go down to 25 percent.

What happened to Honeyfund after Shark Tank?

Unlike most "Shark Tank" deals, Honeyfund is one where regular viewers of the show can deduce that the deal brokered on the show closed after real-life due diligence was completed. That's because, in the decade since the Honeyfund episode premiered, Kevin O'Leary has regularly referenced Honeyfund when businesses with any similarities to the crowdfunding website sought investments on the show. That there was an update segment the following season is just gravy. In that segment, O'Leary brought the founders of Honeyfund, Wicked Good Cupcakes, and Bottle Breacher together at the wedding of a friend of his in Nantucket to commemorate the launch of "Something Wonderful," a wedding gift and services platform.

"We're thrilled to be part of the Something Wonderful network!" said Sara Margulis in an O'Leary Ventures press release announcing the launch of the platform. "Along with new perks on Honeyfund and Plumfund accounts, our users now get exclusive discounts on Bottle Breachers, Wicked Good Cupcakes, and more products coming soon." It's not entirely clear if there was ever actually a platform launched, though: There's no Something Wonderful website, and Google isn't exactly helpful in finding information from beyond 2015, so it seems more likely that the network exists in its original form: discounts for the other businesses emailed to customers who patronize one of the member businesses. Honeyfund also got its own update segment in 2018, revealing they'd done $5.6 million in revenue in the three years since their episode aired.

Is Honeyfund still in business?

By all indications, Honeyfund is still an active, relatively successful business. As of this writing, Honeyfund.com's "How It All Works" page says that more than $844.6 million has been gifted using the platform to date, which would translate to roughly $12.7 million in transaction revenue if their cut of each transaction has stayed relatively static. That same page on Honeyfund's website also stresses that it has by far the lowest fees of any site/platform in its class.

Sara Margulis was interviewed by Authority Magazine in April 2022, where she outlined some of the difficulties she and the company had faced, at which point she revealed that she and Josh had gotten divorced and that she bought out his half of Honeyfund. "We moved the family and business across the country to Clearwater, FL to work with our cousin who was a successful entrepreneur and our business mentor," she explained. "A month later he unexpectedly passed away from a heart attack. Then in 2018, I separated from my co-founder and spouse after a failed attempt to sell the business. We decided to move the family back to Northern California in 2019, and I bought him out of the business with a lot of hope for the future. Then Covid-19 hit in 2020 and Honeyfund's revenues dropped 90% overnight."

To offset the cashflow issues caused by the pandemic lockdowns, Sara put shares of the company up for sale on StartEngine. Cumulatively, the campaign raised over $1.5 million.

What's next for Honeyfund and its founders?

Since divesting himself of his half of Honeyfund, Josh Margulis has returned to his previous job as a software engineer, a job he held for over a decade at Adobe before going out on his own. According to his LinkedIn page, he started as a software engineer for credit card processor Stripe in October 2023, following up on stints with Lark Health as well as fraud prevention company NS8. Between Lark and Stripe, he also had a short stint working for Silicon Publishing as an independent contractor in the role of senior product manager.

As for Sara Margulis and Honeyfund, their most significant impact may end up being something other than the financial windfall for the Margulises or how the site changed wedding gift-giving. In June 2022, alongside a few other companies, Honeyfund sued Florida Governor Ron DeSantis in federal court to block enforcement of the Stop WOKE Act, which barred businesses and schools alike from teaching anything that fell into the current conception of "wokeness" as defined by conservative politicians.

By August 2022, the defendants had already secured a preliminary injunction on free speech grounds. In March 2024, a three-judge appellate panel upheld the injunction. "This is not the first era in which Americans have held widely divergent views on important areas of morality, ethics, law and public policy," reads the appellate panel's opinion. "But now, as before, the First Amendment keeps the government from putting its thumb on the scale."