Everything You Need To Know About Tesla Insurance (And How It Compares To Other Providers)

More than just a car manufacturer, Tesla has also been in business as an independent insurance provider since 2021. Tesla broke into the insurance sector when it realized the prospect of high insurance premiums for Tesla vehicles was discouraging prospective buyers. The company stepped up to provide insurance itself, hoping to encourage more car sales by reducing the overall cost of owning a Tesla.

Tesla had dabbled in insurance before. In 2017, it launched InsureMyTesla in partnership with Liberty Mutual, before it was scrapped just two years later to focus on developing its own model, partnering with Markel Group's State National Insurance Company to provide insurance in California. The big difference between the previous attempt and its current offering is that it's no longer partnering with other insurance brokers — it's underwriting Tesla car insurance in-house.

As of this writing, Tesla insurance is only available in 12 states. Tesla's insurance uses telematics to monitor real-time driver behavior, except in California, where using tech to monitor a vehicle's location is prohibited by law. You can still get Tesla insurance in California, but your Smart Scores are provided for "educational purposes" only, and won't affect your premiums.

Using telematics to determine premium costs is known as usage-based insurance (UBI). Many of the biggest insurers use it, but Tesla has taken it to new and impressive levels made possible by its cars' technology. While other insurers may offer UBI as an optional alternative to traditional car insurance, with Tesla Insurance (unless you live in California) it's the only option.

Elon Musk wants to "turn a nightmare into a dream with Tesla Insurance." How does Tesla car insurance really compare to other car insurance options?

Tesla uses more metrics than other insurers

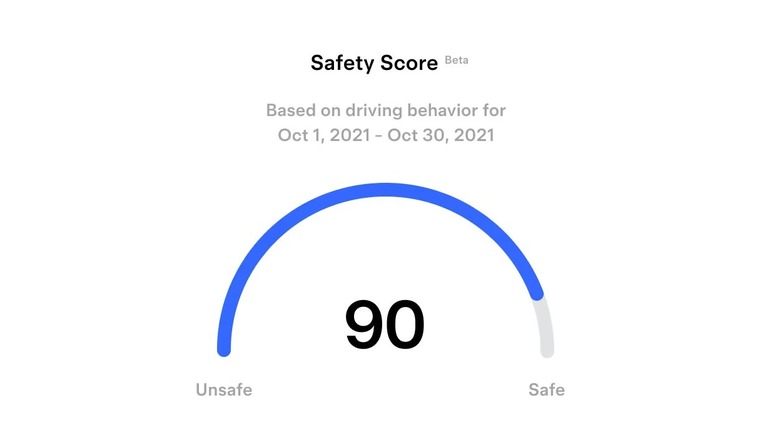

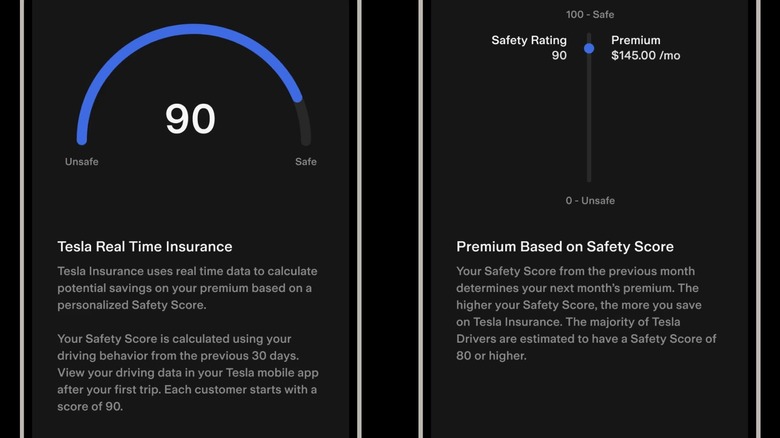

If you have a Tesla vehicle — or are waiting for one to be delivered — you can purchase the in-house insurance option through your Tesla account. Tesla then uses data collected directly from your vehicle to calculate your premium. Your driving habits data produces your monthly Safety Score, which is still in beta, according to Tesla. Unlike other insurance providers that offer similar schemes, there's no need to install an external tracking device in your vehicle.

Tesla calculates your Safety Score using eight factors: Late-night driving between 11 p.m. and 4 a.m., forward collision warnings, hard braking, aggressive turning, unsafe following, excessive speeding, forced autopilot disengagement, and unbuckled driving.

This is a lot more data than that used by other UBI providers to calculate a safe driving score. This is because other insurance companies don't already have their software installed in your car like Tesla does. If you sign up for Progressive's Snapshot or Allstate's Drivewise programs, you will likely be using your smartphone to monitor your driving. A phone app can sense how fast you're driving, record sudden stops, and track the time of day you're driving. However, unlike Tesla's tech, it won't know how close you are to the car in front, or whether you've buckled your seatbelt.

Tesla applies premium price changes more quickly

The data that Tesla collects determines your safety score, and this then determines your next month's premium. Your driving behavior from October 1-31 will be immediately reflected in your November bill. Everybody starts with a score of 90, and adjustments are made based on driving behavior. The maximum score is 100, and decent drivers are expected to maintain a score of 80 or higher, utilizing the metric known as the Predicted Collision Frequency formula.

With other UBI products, you can expect to see a bigger lag between your updated driving score and a premium change. For example, Liberty Mutual's RightTrack applies your score to your policy at renewal or the end of the program. You don't see your premium change on a monthly basis like with Tesla. All insurance providers, including Tesla, are required to notify you of premium changes in advance. Tesla's app allows you to monitor your score, driving log, and premium payments, which could be seen as a positive for drivers who want more immediate transparency from their insurance premiums.

Other premium changes will be applied when applicable, such as the age of your car or if you move to a different location. Like all other insurers, the premium for Tesla insurance also takes into account the number of miles you drive, vehicle type, and your location, and also depends on what kind of coverage you've selected.

Tesla Insurance can still be more expensive than other insurers

The good news about this type of insurance is that, if you're a safe and responsible driver, you should see your impeccable driving habits rewarded with reduced premiums. However, this study by Market Watch found that Tesla insurance still works out as more costly than insuring a Tesla vehicle with a third-party insurer, like Travelers and Auto-Owners Insurance. That's based on an initial insurance estimate, as well as with a real-time score of 90.

Many users have found that after the first month of using Tesla Insurance, their premiums rapidly increased. Using Tesla's autopilot feature can potentially raise premiums, for example. Tesla insurance also doesn't offer discounts other than a discount for insuring multiple vehicles. Other insurers offer a discount for subscribing to a UBI scheme: Progressive provides an average of $94 in sign-up discounts, and Liberty Mutual offers a 10% discount for enrolling in its RightTrack UBI scheme.

The state you live in also makes a massive difference to the cost of your insurance and how Tesla compares to other companies. Value Penguin found that for Tesla owners in Texas, the in-house insurance was still the best bet. Insurance prices will always vary a lot depending on a range of factors, like the amount of coverage you want, whether you want extras such as roadside assistance, your deductible, and the model and age of your Tesla. It's always best to shop around and compare quotes to find which insurance company can give you the best deal.

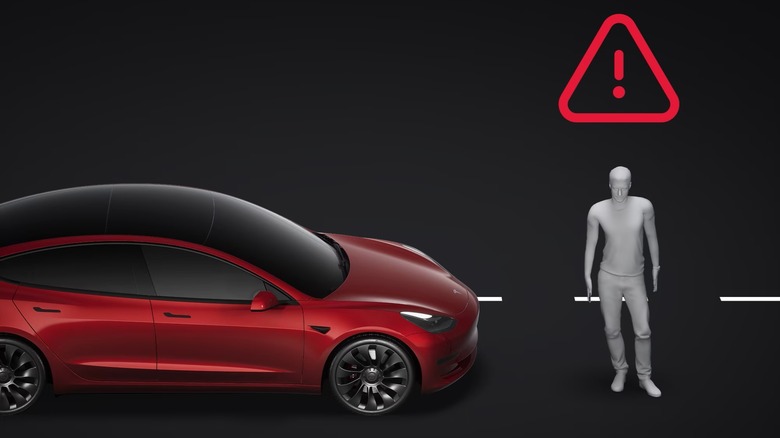

Tesla might be reporting more 'false positives' than other UBIs

Because Tesla's Safety Score is a fully automated system, if your car erroneously records an infraction, there's not much you can do to stop it from bumping up the cost of next month's premium. This wouldn't be a problem if the software always works as it is supposed to, but many users have reported being "dinged" for poor driving behavior, which hasn't occurred. A user on the Cybertruck Owners Club online forum shared a video where they were given a Forward Collision Warning (FCW) due to oncoming traffic in the opposite lane on a bendy road.

Tesla is currently facing a class-action lawsuit for the same issue, where the plaintiff — an Illinois resident representing Tesla owners across numerous states — alleges that Safety Scores are unjustly inflated due to incorrect FCWs. This includes incidents where cars reported warnings even though there were no other cars in sight, as well as instances where FCWs appeared in scores even though their vehicle hadn't reported them at the time.

Tesla Insurance customers are not happy with the customer service or claims process

All insurance companies face complaints when their customers aren't happy with the service they've received, especially after an accident or other claim. However, in the few years that Tesla Insurance has been operating, it seems to have racked up more than its fair share of disgruntled customers.

Filing claims should be simple. You just open your app and tap "Claims." Similarly, roadside assistance is promised at the tap of a screen. However, online forums and review sites are full of examples of people having problems. One user on the Tesla Motors Club forum shared their frustration at not being able to get hold of an adjuster for six weeks despite emailing and phoning multiple times. When they did get through on the phone after holding for two hours, the call was immediately disconnected. Responses on the thread also reported similar issues. Numerous customers have reported Tesla's poor claims handling to their state's Department of Insurance.

The Better Business Bureau awarded Tesla Insurance a very poor rating of F based on its score of 1 out of 5. Over 30 complaints have been made against Tesla Insurance on the BBB, citing long wait times for responses and difficulties getting through to a human employee. This doesn't compare well to Musk's aspirational plans in 2022, when he said that "it would be like same-day repair for a collision," and that the "night and day difference" in quality of care may not manifest for current members.