How To Avoid Fees When Sending Money Through PayPal

When people think of sending cash to someone quickly, PayPal often comes to mind. While banks have teamed up to create digital wallet alternatives, Paypal remains one of the most popular apps for sending money because it's easy to use: all you need is the email address of the person you want to send cash to get started. From there, it can get a bit tricky. While most would agree that the PayPal app and website are user-friendly, many have had the unfortunate experience of being charged unexpected fees when using the app to send money.

When we send money via PayPal, we want to hold onto as much of our hard-earned cash as possible. On the other hand, PayPal needs to turn a profit, and one of the ways it does that is by charging fees for the services it provides. How much PayPal charges you for sending money will depend on several factors, including who you're sending money to and your location. That's why it's important to categorize your transaction correctly to avoid paying any unnecessary fees.

Use the Friends and Family option

The easiest way to send money without paying any fees is through PayPal's Friends and Family option. As long as you use a linked bank account or your PayPal balance to send the money, there's no transaction fee. However, PayPal charges 2.90% plus a fixed fee of $.30 if you use a debit or credit card to send money using the Friends and Family option. If you use this option to send money internationally, on top of the domestic transaction fee, you'll pay a 5% transaction fee, with $.99 being the minimum and $4.99 the maximum international fee. PayPal also charges a currency conversion fee of 4% if your friend or family member receives the payment in a different currency from the one in which you send it.

Follow these steps to use Friends and Family to send money:

- Open the PayPal app on your phone.

- Tap Pay at the bottom of the screen.

- Enter the name, username, email, or phone number of the person you're sending money to.

- Enter the amount of money you'd like to send and tap Next.

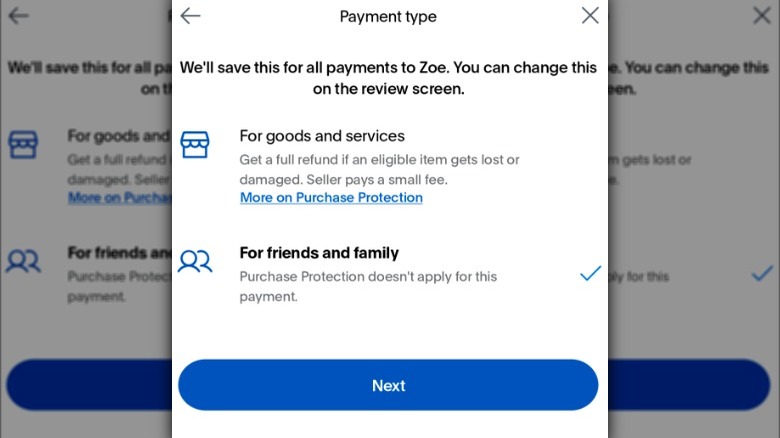

- Select the For friends and family option and tap Next.

- Choose your payment method and tap Send.

While it may be tempting to use the Friends and Family option to save a few dollars when buying goods, doing so can be risky. The PayPal Purchase Protection Plan doesn't cover the Friends and Family option, so if something goes wrong, you won't be able to file a dispute with PayPal and could lose your money. Scams abound on money-sharing apps like PayPal and Cash App, so it's better to be safe than sorry when sending money to recipients you don't know.

Avoid Instant Transfers

Leaving money sitting in your PayPal account is rarely a good idea. That's because balances on payment apps like Cash App and PayPal aren't FDIC-insured, so you should avoid using them like a bank account. When you receive money from someone on PayPal, you should transfer it to your linked bank account as soon as possible. However, if you want to avoid PayPal fees, be prepared to wait a few days from the time you send the money from PayPal until it arrives in your bank account.

When transferring money from PayPal to your bank account, the app will give you two options: Standard transfer or Instant transfer. The Standard transfer can take anywhere from one to three business days, and as its name suggests, money from an Instant transfer will show up in your bank account immediately. That Instant transfer also comes with a price tag of 1.75% of the total transfer amount, with a maximum fee of $25. Planning ahead so you're never in a position where you need to transfer your PayPal balance immediately can help you save a significant amount in transaction fees.