13 Apps, Services, And Tech Brands You Might Not Realize Are Owned By Amazon

We may receive a commission on purchases made from links.

Amazon is one of the biggest companies in the world, with revenues in excess of $570 billion in 2023. And that's no surprise, really: with 3 billion monthly website visits and more than 300 million active users triggering 1.6 billion shipments daily, Amazon is undoubtedly one of the most dominant brands in e-commerce. But while most of us likely associate Amazon with its online storefront, the company has its fingers in many more pies than just retail.

You're probably aware that Amazon Web Services (AWS) is an Amazon product — it's in the name, after all. And you may also have heard of, or even bought, some of the private-label products Amazon sells. But are you old enough to remember Amazon acquiring IMDb in those heady pre-Y2K days? And then there are all the Amazon-owned, but independently operating retailers and services such as Audible, Zappos, and Woot, most of which don't carry obvious Amazon branding.

There's a lot more to Amazon's operations than just its storefronts and cloud services. So, whether you're just curious or want to try and seek out legitimate alternatives to Amazon, here's a list of 13 apps, services, and tech brands the e-commerce giant owns.

IMDb

IMDb has been under the Amazon banner for so long that we wouldn't blame you for not realizing that the American corporation owns it. Amazon made an initial approach in late 1997, mere months after it went public in May, before fully acquiring the site in April 1998.

We don't know how much Amazon spent on IMDb alone, but a press release from April 1998 revealed that it spent $55 million on IMDb and two other websites. These were U.K. and German online book retailers Bookpage and Telebuch, which became Amazon's U.K. and German online storefronts. Sure, $55 million was worth a lot more back in 1998, but that price seems like a bargain now considering how often people use IMDb.

After all, you've probably at least glanced at IMDb ratings when deciding on a show to watch — even if not everyone thinks that's a good idea. IMDb also powers Amazon Prime Video's X-Ray feature, which provides info on the movie or TV show you're watching. Even industry professionals benefit from IMDb, via the membership-only IMDbPro, which offers tools such as casting services, professional page management, and box office information.

Shopbop

Given how huge Amazon is, it might seem strange to remember that the company had a string of failures during the dot-com bubble of the late 1990s and very early 2000s. Investments in online retailers such as pets.com and living.com didn't necessarily pay off, at least not for its partners, with many eventually shutting down.

While Amazon undoubtedly got off mostly scot-free, the experience of having so many investments bite the dust probably triggered a change in approach by 2006, when it purchased online fashion retailer Shopbop outright. This was Amazon's first acquisition since the end of the dot-com bubble, but despite that landmark, neither Amazon nor Shopbop disclosed the terms of the purchase.

Shopbop was founded in 1999 as the online presence of a brick-and-mortar fashion shop, and it had something Amazon lacked: fashion cred. Shopbop's online store carried products from prominent brands such as Marc Jacobs, Juicy Couture, Diane Von Furstenberg, and Citizens of Humanity. In contrast, Amazon had collaborations with retailers like Macy's. Shopbop continues to be part of the Amazon family, although it operates independently, primarily relying on its parent company for order fulfillment and Prime shipping.

Audible

Amazon's purchase of Shopbop proved to be the start of a major expansion drive for the corporation in the mid-to-late 2000s — albeit, one with a decidedly more digital bent than Shopbop's fashion retail business. Amazon got in on the digital content market relatively early, launching a beta version of paid MP3 download service Amazon MP3 — a competitor to Apple's iTunes — in 2007.

But music wasn't the only digital content Amazon saw potential in: The company entered into an agreement to purchase audiobook provider Audible in January 2008, with the roughly $300 million purchase completed a few months later. At that point, Audible had U.K. and U.S. websites alongside presences in France and Germany, through which it sold more than 80,000 audiobooks from 520 providers.

The most significant development in Audible's business model post-Amazon was likely the Audiobook Creation Exchange (ACX) in 2011. ACX was — and is — a way to connect audiobook rights holders with producers, facilitating the creation of audiobooks. It proved a huge success, providing the platform with three times more audiobooks in 2012 than all other audiobook sources combined. Audible has continued to ride the audiobook wave ever since, with its app revenue hitting $17.5 million in May 2022 — although Spotify's push into audiobooks may eventually give it a bit more competition.

AbeBooks

Used-book retailer AbeBooks was the other big Amazon acquisition in 2008, alongside Audible. You could say that 2008 was a bit of a literary year for Amazon, especially considering what else Amazon got a piece of when it brought AbeBooks into its fold.

AbeBooks is almost as old as Amazon itself, founded in 1995 with an online presence beginning the following year. The Canadian retailer specializes in the sale of rare and hard-to-find used books, with some art and collectibles thrown in for good measure. At the time of Amazon's acquisition in 2008, AbeBooks had 110 million books for sale from some 13,500 sellers.

Buying AbeBooks also gave Amazon 40% ownership of LibraryThing, an online book catalog and tracking platform. Amazon already had a stake in rival social cataloging service Shelfari, and so gained quite a foothold in the market. It still didn't have its mitts on the rapidly growing Goodreads, but that turned out to only be a matter of time. Amazon eventually killed Shelfari, but AbeBooks continues to operate as its own entity. LibraryThing is also still an ongoing concern, although its 3 million members mean it's a good way behind the much more popular — and fully Amazon-owned — Goodreads.

Zappos

Initially launched as the much more dully-named ShoeSite.com in 1999, Zappos was a retail success in the early 2000s. Aided by several rounds of venture capital funding across its first decade of operation, the specialist shoe retailer broke past the $1 billion gross sales mark in 2008 and would eventually land at number 23 on Fortune's list of the 100 best companies to work for in 2009.

With that much money — and goodwill — rolling in, industry commentators at the time probably weren't all that surprised when Amazon announced that it had purchased the retailer in 2009 for 10 million Amazon shares, or around $888 million. Amazon also offered another $40 million in cash and restricted stock, bringing the total up to an impressive $928 million — likely one of the biggest purchases Amazon had made to date.

Amazon didn't rock the boat much at Zappos: it kept the management in place, including then-CEO Tony Hsieh, who pitched the deal as less of an acquisition and more of a change in shareholders and directors, with current Zappos investors becoming investors in Amazon instead. The company still operates independently of Amazon to this day, with the most recent estimates from 2015 putting revenue at $2 billion annually.

Woot

New decade, same old Amazon. The 2010s were only six months old when Amazon announced the purchase of another online e-commerce platform. This time, it was the limited-time one-deal-per-day platform Woot, for which Amazon allegedly paid $110 million in an all-cash deal.

Woot, which proudly calls itself the "original daily deals site," was the brainchild of electronics wholesaler Matt Rutledge, who founded it in 2004. Initially focusing on consumer electronics, the site's name and its off-the-cuff, edgy approach to marketing, communications, and sales — including a blind grab bag it called the Bag O' Crap — was, in many ways, a peak representation of the internet in the mid-2000s. The site did well for itself, too, landing on Time's list of the 50 coolest websites in 2005 and making around $165 million in revenue in 2008.

Amazon purchased Woot despite already having a last-minute deals function on its site, but commentators at the time suspected that Amazon's acquisition had more to do with the value of data, behavioral information, and mobile shopping than anything else. Woot continued to operate as it had after the acquisition, although founder Rutledge left soon after Amazon's purchase. He eventually launched Meh, a rival daily deals site.

Goodreads

The early 2010s saw Amazon with a decently solid foothold in the social book cataloging and discovery market via its part-ownership of LibraryThing — which it acquired by buying AbeBooks in 2008 — and Shelfari. But there was an issue: Goodreads. The rival service was well ahead of Amazon's part-owned offerings in the early 2010s, with its 11 million registered users and 395 million books in 2012 dwarfing LibraryThing's 1.6 million members and 77 million books.

While the acquisition may have shocked the industry and Goodreads users alike at the time, in hindsight it was probably one of the most obvious moves Amazon could have made — at least, as far as the book market was concerned. Despite all the dismay about the acquisition, Goodreads continued to grow at an impressive rate over the years and hit the 150 million user milestone by the end of 2023.

Despite the huge user base, Amazon hasn't been a great custodian of Goodreads (although Kindle app integration is undoubtedly a boon for some users). Insider sources told The Washington Post that Amazon's focus seems to have been gaining access to the site's user-generated data, without much concern for updating or maintaining the site or app, both of which users often complain about.

Twitch

If you were around on the internet in the mid-2000s, you may remember a little website called Justin.tv. Justin.tv was one of the earliest sites to jump on the internet video bandwagon after YouTube's success, launching to the public in 2007. The service gained popularity surprisingly quickly, mainly thanks to the burgeoning esports market. Esports eventually got so big that the company spun its entire gaming section off, launching TwitchTV in 2011.

It proved to be a smart move: Twitch hit 3.2 million monthly users within a year of launch and, by 2013, its 600,000 broadcasters pulled in 28 million unique viewers. Video game streaming was huge, and it wasn't a surprise when rumors started floating around of a big-money acquisition, initially by YouTube. As it turned out, the spoils went to Amazon, which bought the live-streaming platform for a cool $970 million in 2014.

It hasn't necessarily been the smoothest ride for Amazon or Twitch in the decade since, with the service still running at a loss and laying off one-third of its workforce early in 2024. Amazon Prime owners do get access to complementary Twitch channel subscriptions — one of the many perks of subscribing to Amazon Prime — but that's likely scant comfort for Twitch staff or Amazon's bean counters.

Blink

The story so far has been one of Amazon acquiring up-and-coming — or rival — websites, but the late 2010s and early 2020s saw the company make a flurry of prominent hardware acquisitions. One of the earliest was Blink, a startup building battery-powered smart cameras and doorbells, for which Amazon paid a reported $90 million in 2017.

Blink made a name for itself with a 2014 Kickstarter campaign for a wireless, battery-powered HD home security cam. The campaign eventually raised $1 million, and launched the product in 2016 to decent, if not necessarily glowing reviews. Amazon's purchase seemed an obvious move at the time, with Blink's already-present Alexa integration and smart-home capabilities complementing Amazon's Amazon Key program, which allowed home delivery while the owners were away.

However, it wasn't quite that simple: Contemporary reports claimed that Amazon's primary motivation for buying Blink wasn't the cameras. Instead, it wanted to get its hands on Blink's proprietary low-power chips, which Amazon allegedly planned to integrate into its hardware — such as Cloud Cam and Echo — to improve battery life. Whatever the reason for Amazon's purchase, Blink is still going strong as of 2024 with products like the Blink Outdoor 4 Camera.

Ring

What's better than owning one smart doorbell company? Why, owning two, of course — if you're Amazon, at least. Fresh from acquiring Blink in late 2017, Amazon further muscled its way into the IoT market by buying rival smart home company Ring. But where Blink was a relatively cheap acquisition, Ring was anything but: Amazon paid somewhere between $1.2 to $1.8 billion, and that was after having previously invested in Ring via its Alexa Fund.

Ring was Amazon's second-largest purchase at that point, although even the priciest contemporary estimates still put the buy way behind the $13.7 billion it spent on Whole Foods Market. The huge disparity in purchase price between Blink and Ring reflected the latter's popularity: contemporary estimates suggested that Ring dominated almost the entire U.S. market for video doorbells, with revenue also coming from new products focusing on the home security market — netting the company $415 million in 2017.

Despite the overlap between Ring and Blink's products, both companies are still making products. Amazon seems to have decided to market the two brands to different demographics, targeting Ring products such as the $229 Battery Doorbell Pro at more affluent homeowners.

Eero

Amazon's push into IoT technology continued apace when it purchased mesh router manufacturer Eero, paying an alleged $97 million for the company in 2019. Eero was something of a pioneer in the mesh Wi-Fi space, with its debut three-piece system from 2016 serving as the catalyst for a whole new market of whole-home mesh routers that handily overcame many of the issues with standard Wi-Fi setups.

The acquisition wasn't without its concerns, namely from users who worried about the potential of Amazon snooping on and monitoring their internet usage habits. However, company bigwigs told Wired that this was a broadly unfounded concern and that Eero only gathered data on the devices connected to the system — and not what they were doing. Somewhat ominously, though, Amazon's Dave Limp did say that Amazon didn't need Eero to gather data, implying that the corporation already had more than enough data about its customers.

Like Blink and Ring, Eero continued to operate independently of Amazon after the acquisition. However, the new ownership brought with it some obvious changes, such as an Alexa-capable mesh router that launched mere months after the acquisition. Eero's products have continued to impress, with its routers sitting near the top of our list of the best Wi-Fi mesh routers.

Zoox

Discourse around self-driving cars has been almost constant for the better part of the last decade, ever since Waymo's autonomous cars debuted in 2017. One of the bigger, or at least better-funded names in the self-driving rush of the 2010s was Zoox, which managed to raise just under $1 billion in funding between 2014 and 2019, all in its efforts to develop a fully autonomous ride-hailing service.

In mid-2020, Amazon announced it would buy Zoox. Neither company disclosed the terms directly, but contemporary reports put the figure at around $1 billion. This wasn't Amazon's first foray into autonomous cars, either, with the company having participated in self-driving startup Aurora's 2019 funding drive. Amazon's push into self-driving vehicles made a lot of sense, with obvious potential benefits for the company's all-important delivery and logistics services. The chance to make a lot of money from a robotaxi-dominated future helped, too, most likely.

As with many of its hardware acquisitions, Amazon kept Zoox as a standalone operation, with company CEO Aicha Evans and CTO — and co-founder — Jesse Levinson staying with the company. Zoox's robotaxis finally made it to U.S. streets in early 2023, starting in California and quickly expanding to Las Vegas. Things haven't gone entirely smoothly since then, though: Not only has the autonomous car boom hit something of a plateau, but Zoox also became the subject of a mid-2024 NHTSA investigation.

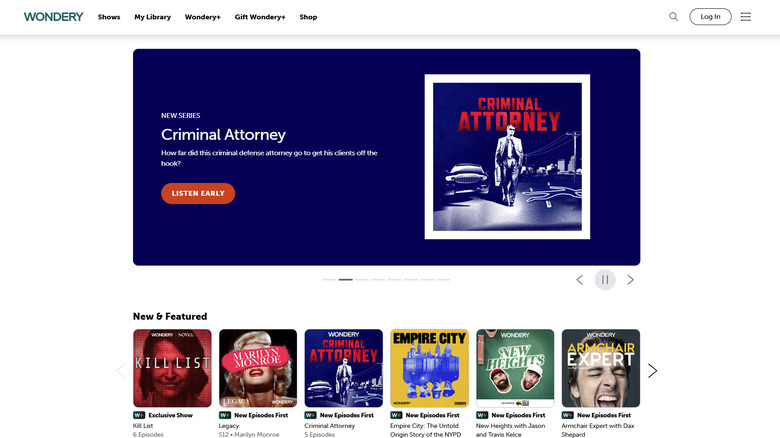

Wondery

There's no denying it: Podcasts are huge. They've been around since the early 2000s, but the COVID-19 pandemic pushed the format into the limelight, turning a low-revenue pursuit in 2019 into a juggernaut by 2021 that boasted $1.4 billion in advertising revenue.

One of the more prominent podcast networks involved in the meteoric rise of the format was Wondery, which former Fox International Channels CEO Hernán López founded in 2016. In just a couple of years, Wondery went from being the new kid on the block to one of the top five podcast publishers operating, accruing around seven million unique streams and 40 million downloads in December 2018 alone.

By 2020, Wondery was one of the few major podcast networks that was still independent, after companies like Spotify scooped up producers such as Gimlet Media and Parcast in 2019. But that wouldn't be the case for much longer, as Amazon announced its purchase of Wondery in December 2020, reportedly for more than $300 million. The announcement came mere months after Amazon introduced podcasts to Amazon Music, and Wondery became the service's crown podcast jewel once they completed the deal in early 2021. Wondery has continued to grow since then, notably striking exclusivity deals with high-profile podcasts "Smartless" and NPR's "How I Built This."