10 EV Startups That Have Already Filed For Bankruptcy

It's not been an easy few years for EV startups. A combination of rising costs, climbing interest rates, and lower market demand has seen even market leaders like Tesla find themselves in a difficult spot, with the company being forced to cut prices to shift excess inventory. At the same time, most major automakers are now significantly ramping up their shift to electric, with new EV models from the biggest names debuting across almost every segment. That gives small startups an even bigger headache, as they have to tempt buyers away from an ever increasing lineup of rivals from familiar brands.

As a result, a string of those startups have already run out of funding, and many more appear poised for bankruptcy sooner rather than later. Going bankrupt isn't necessarily the end of the road for an automaker – just ask GM – but it seems unlikely that many of the current crop of startups will be able to relaunch. These failed startups are all at various stages of the bankruptcy process, with some gone for good and others emerging as shells of their former selves.

Fisker

The most high-profile EV maker bankruptcy in recent months has been Fisker, maker of the Ocean SUV. It filed for Chapter 11 bankruptcy in June 2024, after initial order levels for its debut production model fell short of internal expectations. Fisker had spent the previous months in talks with a major carmaker, widely reported to be Nissan, but the deal was called off at the end of March. It's not known exactly why the tie-up fell through, but the fact that the Ocean has been beset by various problems during its short production life certainly won't have helped matters.

A series of quality control issues led to four separate recalls being issued for the 2023 Ocean, including one particularly concerning defect where the vehicle could unexpectedly lose power while driving. The Ocean has also been subject to a significant amount of negative press coverage, including a review by prominent YouTuber Marques Brownlee that labeled it "the worst car [he'd] ever reviewed."

Fisker also faced the same major challenge that all EV startups face, namely, how to convince buyers to step away from major automakers and gamble on a new brand. Its direct sales model — selling straight to customers without a dealership network — proved to be the wrong move, and by the time Fisker realized its mistake and attempted to launch dealerships, it was too late. As of this writing, Fisker is in the process of selling off its remaining inventory at significant discounts.

Arrival

Another recent casualty of the EV startup bloodbath is Arrival, which filed for bankruptcy in Luxembourg in May 2024. Two of its UK-based subsidiaries had entered administration a few months prior, selling off their remaining assets, including those remaining from the company's former headquarters in Banbury, England. Arrival originally planned to build a range of electric commercial vehicles, including an electric bus, a cargo van, and a taxi, the latter in partnership with Uber.

However, a changing market and rapidly diminishing funds saw both the bus and taxi projects canceled, with only the cargo van remaining in development. Arrival also shuttered most of its UK facilities in 2022, shifting to a new base in the U.S. in a bid to take advantage of pro-EV legislation. Development continued, and a prototype version of the cargo van was subject to extensive testing throughout 2023.

The company's bankruptcy process is still ongoing as of this writing, but it seems unlikely that Arrival could make a return. In the years since the startup unveiled its first prototype, major automakers including Ford and Stellantis have launched all-electric versions of their popular cargo vans, leaving less room in the segment for upstart manufacturers like Arrival.

HiPhi

China is the world's largest EV market, and several of its biggest players have seen huge expansion in recent years beyond the country's borders. BYD is a prime example, becoming the world's largest EV manufacturer in the last quarter of 2023 and leaving Tesla relegated to second place in the sales charts. However, not every Chinese EV startup has been so successful.

HiPhi is one of the country's most recent failures, with its parent company Human Horizons announcing its bankruptcy in early August 2024. China's legal system makes it difficult for companies to file bankruptcy, and as a result, the situation is usually very dire for those that do end up going bankrupt. According to figures published by the Economist, 83% of companies that reach bankruptcy court in China have to be liquidated, while only 5% of bankrupt American companies suffer the same fate.

HiPhi was one of the more recent innovators in the EV space and promised to launch a range of three cars, called X, Y, and Z. As recently as 2023, it was still producing cars in China and was in the process of launching in Europe. However, it seems HiPhi's expansion plans were too ambitious, and a combination of slowing domestic sales and increasing costs saw it run out of funds. HiPhi's parent company has stated that it's aiming to emerge from bankruptcy through new investment or a joint venture, but it remains to be seen if it can pull through.

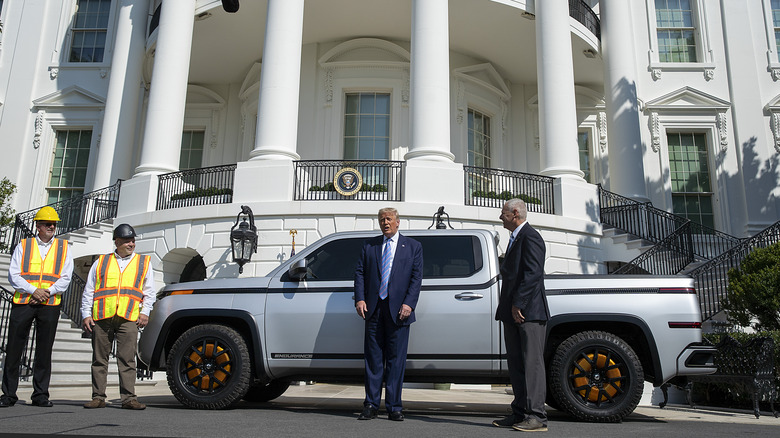

Lordstown Motors

From its founding in 2018 to its bankruptcy in 2023, Lordstown Motors had a messy existence. It was originally launched by a former executive at Workhorse, another electric truck startup, and was backed by a consortium of investors including GM. It planned to produce an electric truck at a former GM facility in Lordstown, Ohio, and the company reported significant interest in the model, claiming that 100,000 non-binding orders had been taken. It would later turn out that those claims were exaggerated, leading the SEC to eventually press charges against the company's former executives.

The company first admitted it had less orders than it originally claimed in 2021, with its founder resigning shortly after. Over the following two years, Lordstown entered talks with electronics giant Foxconn, and in 2022, Foxconn purchased the startup's Ohio plant. However, the two couldn't reach agreement over further investment, leading to the startup's eventual bankruptcy filing. In February 2023, just a few months before the filing, Lordstown disclosed that it had only managed to sell six vehicles, with around 40 remaining in the factory under construction.

Lordstown saw its restructuring plan approved in March 2024, with the company relaunched after almost all of its assets had been sold off. It now operates under the name "Nu Ride," and is essentially a vessel for investors to continue litigation against Foxconn. Lordstown's truck assets were sold to the company's original founder, who is attempting to relaunch production under the "LandX" name.

ELMS

EV startups inevitably burn through huge amounts of cash in their early years, and therefore are keen to attract as many investors as possible. One popular way to do this in recent years has been for the startup to merge with a SPAC, which is a publicly-listed company created solely for that purpose. Investors can buy shares in the SPAC, which can be listed on an exchange more quickly and easily than the startup itself, and then the SPAC merges with the startup, giving investors equity in the startup.

ELMS, or Electric Last Mile Solutions, was one such startup. It went public in June 2021 through a SPAC merger, but by June 2022, it had already declared bankruptcy. ELMS aimed to manufacture small electric cargo vans at its factory in Indiana. However, two of the company's most senior executives resigned in February 2022 after an investigation into their financial dealings. The news spooked institutional investors, and without further funding, the company quickly ran out of cash.

ELMS' assets were sold to a rival U.S.-based startup, Mullen Automotive, for $105 million in October 2022. Mullen itself is now reportedly in deep financial trouble, with its latest quarterly earnings showing revenues of just $65,000. As of this writing, Mullen remains operational, but it seems it might not stay that way for long.

WM Motor

Despite having financial backing from some of the country's biggest tech giants, China's WM Motor couldn't carve out a big enough slice of its home market and filed for bankruptcy in October 2023. By the time it ran out of cash, the company's lineup had expanded to five models manufactured across two facilities. It had reportedly sold just under 30,000 vehicles in 2022, which represented just 12% of its annual production capacity. The company claimed a variety of factors were to blame, including the oversaturation of the Chinese domestic market and rising raw material costs.

Demand for EVs in China had remained strong across 2022, but there were simply too many manufacturers and an excess of capacity that the domestic market alone couldn't fill. Many Chinese companies, including WM Motor, turned to overseas expansion to increase sales volumes, but despite launching in various Asian markets and in Europe, the startup still couldn't fill its order books. As of this writing, the company's future remains unclear.

Proterra

As well as making its own electric buses, Proterra also acted as a supplier of both charging equipment and battery packs for other EV manufacturers. It filed for Chapter 11 bankruptcy in August 2023. The company had previously merged with a SPAC in 2021, with investors valuing it at $1.6 billion at its peak. Like many other startups in a similar position, it was impacted by a combination of rising raw material costs and a slump in demand.

Proterra's journey through bankruptcy was a relatively brief one, with a significantly slimmed-down version of the company emerging in March 2024. Its bus manufacturing business was sold to Phoenix Motorcars, a rival bus manufacturer, for a reported $10 million, while Volvo Group snapped up its battery manufacturing division for $210 million. The latter deal included Proterra's nearly-new battery production facility in South Carolina, which only completed construction in January 2023. Post-bankruptcy Proterra retained its charging equipment division, and continues to operate in its new, much reduced form.

Byton

Byton was once tipped as a future big player in the Chinese auto industry, being founded in 2017 and unveiling its first supposedly production-ready car just two years later. However, that production never began, and by 2020, the company had already begun suspending staff in a bid to save money. A series of rescue talks with various investors throughout 2021 and 2022 failed, and by 2023, the company was forced to declare bankruptcy.

Originally, Byton's plan was to launch in China in 2020, then expand overseas over the following years. It received a dealer license in California in late 2019 and intended to open its order books to American customers in 2021, but it seems the company's expansion plans were too ambitious. The uncertainty and supply chain issues caused by the pandemic quickly put the brakes on the brand's plans, and it was never able to recover its initial momentum.

Uniti

City cars have always been natural candidates for electrification, as a long range isn't as important for cars set to spend most of their time stuck in urban traffic. Many cities, particularly across Europe, are also launching ever-more-stringent emissions zones in a bid to bring down pollution levels. In that context, the Uniti One city car made sense. It offered a range of up to 186 miles and featured a single 67 horsepower electric motor, with a starting price in the UK of £15,100 (around $19,300 at the time). Orders opened in the UK and Uniti's native Sweden in 2018, and more than 3,000 customers put down a deposit.

In the end, making the leap to production proved too much of a hurdle, with the company filing for bankruptcy in April 2022. Its existing investors had reportedly reached the limit of their funding capacity, and the company was unable to find suitable external investment. At the time of the filing, Uniti stated it was still accepting investment offers, but no further offers came forward. In a post on his personal website, Uniti's founder stated that, "Uniti will now rest for some years [as] I want to develop such a vehicle one day, but I want to do it with my own money, not investors'."

Zhidou

While a big wave of EV startups have gone bankrupt in the years since the pandemic began, some didn't make it that far. Zhidou was one of China's earliest EV startups, being founded in 2006, and at one point it looked like it was destined for success. It was among the first carmakers to bring an affordable EV to the Chinese market, and by 2017, had become China's second-largest EV manufacturer. However, a policy change in 2018 meant that EVs with short ranges no longer benefitted from the generous government subsidies that had driven Zhidou's early sales.

China's car market moves extremely quickly, and by the time Zhidou started feeling the effects of the subsidy cuts, it was too late. Rival manufacturers offered more capable cars at equally competitive prices, and Zhidou's market share dropped dramatically. It was enough to force the company into bankruptcy by 2019.

However, it would turn out that the story wasn't over for the brand. Half a decade after the initial bankruptcy filing, new investors resurrected the brand and launched a new microcar called the Rainbow. Orders opened in March 2024, with the car starting at the equivalent of less than $5,000. With its new backers including Geely, the automaker that owns Volvo and Lotus, it seems Zhidou is set to benefit from deeper investment reserves than before. Whether that translates to higher sales remains to be seen.