4 Alternatives To Apple Pay Later If You Can't Front The Bill Right Away

Listen, money gets tight sometimes, and we could all use any form of assistance to help us get by. That's where Apple Pay Later came into play. The service that, in late 2023, finally became widely available to iPhone and iPad users in the U.S. let you buy now and, well, pay later, splitting purchases into four payments with zero interest and fees all from the comfort of your iPhone. It was a great resource for anyone looking to make a sizable purchase or in need of a bit of financial assistance. Unfortunately, all good things must come to an end, and Apple Pay Later met an untimely and abrupt end.

Apple announced the end of Apple Pay Later in 2024, releasing a statement to 9to5Mac a little more than a year after the service's launch in the United States. Although Pay Later is no longer available, the company remains committed to offering "easy, secure, and private payment options with Apple Pay" to its users. Later in the year, Apple will release a new loan feature through credit and debit cards and other lenders to users worldwide. And while the new initiative brings loans via Apple Pay to more people, some may not be able to wait for it to drop. If that's the case, here are some good alternatives to Apple Pay Later you can use in the meantime.

Affirm

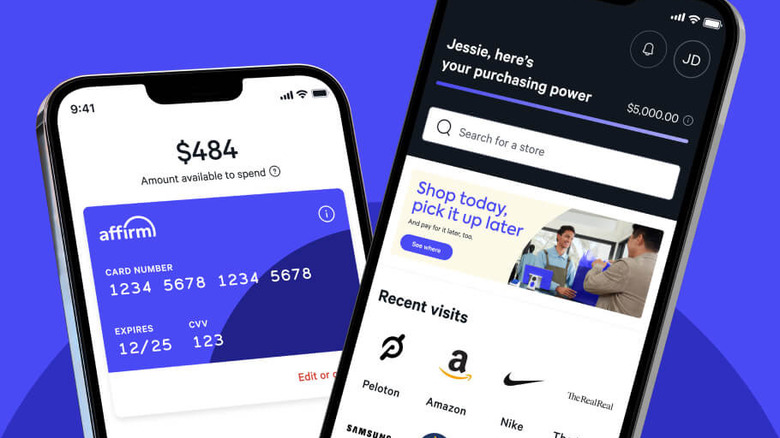

If you are looking for a replacement for Apple Pay Later, one of the most popular ones is Affirm. It's one of the original pay-over-time services, so in a way, Apple was attempting to make an Affirm-like service with Pay Later.

Much like Apple's now nonexistent service, Affirm offers users an option to buy now and pay later. With them, you have two options: Affirm Pay in four or monthly payments. The first, as the name suggests, splits your purchases up into four payments charged every two weeks. There are zero fees and interest on these, and they don't affect your credit score. The second option, again, speaks for itself, allowing users to choose how much they pay and how many months they want to take to pay it off, with the longest payback timeframe being 48 months. Both can be set up as automatic payments, and the service assures customers that it will never tack on extra fees.

Affirm is available through your smartphone with the Affirm app or a physical Affirm card, and you can essentially use either anywhere. Some of the company's biggest partners include Walmart, Apple, and even Amazon offers Affirm installment payment options. Once you make a purchase using Affirm, you can then pick which payment option, with both available online and in-store.

Afterpay

If you want a service that mimics Apple Pay Later's digital only function, look no further than Afterpay. The smartphone app expands your virtual wallet with a digital, buy-now-pay-later card. Like the others, they have a Pay-in-4 service that allows you to pay for any purchases in four interest-free installments. The system schedules four payments over the course of six weeks, and the service is always interest free.

Unlike those previously mentioned, Afterpay does add fees for late payments. They are either $8 or 25% of the transaction, whichever is less. However, if you pay on time, you don't have to worry about any extra fees. They also offer monthly payments for larger purchases over $400. Users can choose between a six or 12 month payment plan, but Afterpay will tack on interest for both options.

Once downloaded, you can add the virtual Afterpay card to your Google or Apple Wallet, making it function just as Apple Pay does. You can use the service both online and in-store, wherever tap to pay is available. Online, the app has exclusive deals with brands like Nike, Macy's, and Target, and it even has an explore page that gives you personalized recommendations.

Klarna

Klarna sets itself apart from the others on this list by offering a hub for some of the best deals on the internet. Whether you're looking for clothes, gaming consoles, lawn care tools, or anything in between, Klarna will link to sellers all over the internet, so you can find the best deal and sign up for one of the payment plans to pay it off.

The company's "Pay in 4" option splits purchases into four interest-free payments every two weeks. They also have a "Pay in 30 days" plan which, you guessed it, allows you to buy something and take up to a month to pay it off. This option doesn't include an upfront payment or interest, as long as you pay it off before the 30 days are up. And if you have a larger purchase, you can sign up for monthly payments through Klarna (up to 24 months), but these will have interest on them. Naturally, they also have an option to pay for purchases immediately, but that's not what we're here for. Klarna's late fees are up to $7 or 25% of the installment amount, whichever is lower.

Klarna comes with you wherever, letting users make purchases in their smartphone app, browser, browser extension, or in-store with the Klarna Card, though you will have to join a waitlist to get the physical card. Some of Klarna's partnered brands include Nike, Instacart, GOAT, Yeti, and Prada.

PayPal

That's right, last but certainly not least, we have PayPal. The iconic online financial transaction website has been upgrading the services it offers over the last few years. PayPal now has its own stablecoin, and PayPal Pay in 4 is the latest alternative to Apple Pay Later.

PayPal Pay in 4 is only one service in the company's larger Pay Later initiative. Keeping with the theme of this list, it gives users the option to split purchases into four interest-free payments. You can use it for any purchases between $30 and $1,500, paying for them every two weeks with no late fees. For larger purchases, Pay Later also offers a monthly payment plan. Users can choose between six, 12, or 24 month options, with zero down payments, no sign-up fees, or late fees on purchases of $199 or more. However, PayPal Pay Monthly does have interest (between 9.99% and 35.99%).

There are absolutely zero fees associated with PayPal's Pay Later options. However, it is worth noting that late or missed payments could negatively impact your credit score. They do have Autopay options to ensure your payments are on time, and you can track them online or through the app.