Which Auto Manufacturer Will Win The Next Decade? An Expert Shares One Signal To Watch

The automotive industry has seen major changes since the turn of the century. Domestic production was once dominated by the Big Three — General Motors, Stellantis (formerly Chrysler), and the Ford Motor Company — but tech startups like Tesla and Rivian, which now supply thousands of drivers with vehicles, have changed the landscape. With technology changing the way we power our cars and even the way we drive, the automotive industry is evolving at a rapid pace, which begs the question: is it possible to predict which auto manufacturer will dominate the industry in the next decade? Will it be a more traditional corporation like Ford or Toyota that can use its size and influence to adapt to the changing market, or a newer company like Tesla that will move fast and break things and force the rest of the industry to follow its lead?

According to Dr. Laine Mears, Automotive Manufacturing Chair at Clemson University, this question "is too tricky to answer directly. Original equipment manufacturers (OEMs) are putting their money down on new technologies and seeing which way the fickle market will turn as time goes on. Let's see what happens."

However, Dr. Mears does note one signal that can predict which automaker may thrive in the coming years, and it has to do with the supply chain. "One group to watch, however, is the Tier 1 supplier base. What are the big design-responsible suppliers working on to introduce to OEMs in the near future? These folks run at much lower margins, [and] have to make decisions that could put the company on the next level of success or out of business; they therefore may be a good gauge of technologies that will be successful in the near future."

What is a Tier 1 supplier?

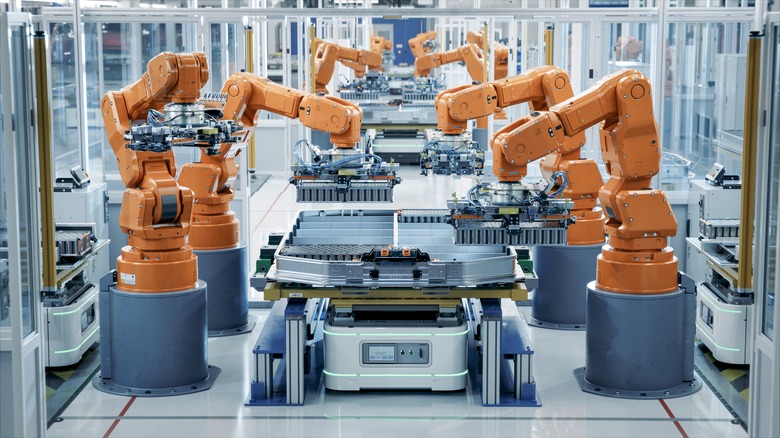

While it may be impossible to predict the future and say which auto manufacturer will win the next decade, the relationship automakers like Ford, Volkswagen, and Toyota have with their Tier 1 suppliers may provide clues to who will succeed in the evolving automotive marketplace. These companies are known as original equipment manufacturers (OEMs) because they make the products they sell — in this case, cars, trucks, and other vehicles — as well as many of their components. However, most OEMs rely on other companies to supply many of its parts, rather than make every component, such as brakes, tires, and — increasingly — computers, in-house.

Tier 1 suppliers are companies that manufacture final products to supply directly to OEMs. For example, an OEM like General Motors may use car seats or infotainment systems built by a Tier 1 supplier. Similarly, Tier 1 suppliers often rely on separate companies to provide components for the products they make for OEMs — these are known as Tier 2 suppliers. If a Tier 1 supplier is making an infotainment system for an OEM, a Tier 2 supplier may produce and provide the touchscreens used in that infotainment system. A Tier 3 supplier, meanwhile, will provide the components the Tier 2 supplier needs to manufacture a touchscreen. This supply chain can continue in this fashion all the way down to the raw materials.

Tier 1 suppliers are held in high regard within the automotive industry, as their competence and reliability is crucial for OEMs to manufacture their final products on time and with high quality. This also puts a lot of pressure on Tier 1 suppliers, as Dr. Mears notes, and why the products they decide to make and when can influence the industry as a whole.

Tier 1 suppliers can help steer the direction of the automotive industry

Two technologies that are currently influencing the automotive industry are electric-powered motors and autonomous driving systems. It's likely that this influence will only grow in the near future, though it's not a given that they'll dictate the course of the industry forever — as Dr. Mears notes, the market is "fickle." If, for whatever reason, EVs turn out to be a dead end for the industry, Tier 1 suppliers that have invested heavily in building batteries, chargers, and components for electric cars may fall on the sword of this decision. Likewise, OEMs that rely heavily on these Tier 1 suppliers will also likely suffer from this outcome. However, if EVs end up overtaking cars powered by gasoline and internal combustion engines in sales, both the suppliers and OEMs that backed this technology will thrive.

The same can be said for any technology that a company takes a gamble on, such as autonomous driving systems. The technology may be more nuanced as well. Rather than the concept of EVs as a whole, the choice of which battery technology to use or which materials to use within those batteries, for example, may prove incredibly influential.

With the industry currently at a technological crossroads, there may be more sink-or-swim technologies to support or ignore than ever before, which means the stakes are high for the decision makers at the tops of these companies. Since Tier 1 suppliers will have to design and manufacture components before OEMs can use them, choosing the right ones is an important decision for any automaker. The automakers that choose their suppliers wisely — at least according to Dr. Mears — may have the best shot at winning the next decade when it comes to influence and sales.