Who's Dominating The EV Battery Market And Why It's Important

The electric vehicle (EV) battery market is dominated by Chinese suppliers, with market research reports for 2023 and early 2024 showing that six out of the top 10 manufacturers are from China. More than two-thirds of the world's EV battery capacity in 2023 was supplied by Chinese manufacturers, and in the first four months of 2024, another report finds that already nearly two-thirds have been supplied by them. What's as interesting is that more than a third of that capacity is made by a single Chinese company — CATL, which cornered 35% and 37.7% of the market in the same two periods, respectively.

In fact, China's dominance in battery manufacturing is currently across all lithium-ion batteries (LiBs), and in 2023, EV batteries accounted for over 70%of total LiB shipments, as per a TrendForce report. Over 75 percent of LiBs shipped in 2023 were manufactured by Chinese companies. Counterpoint Research also notes that the growth of the EV battery market exceeded that of EV sales in 2023, at 44% year-on-year compared to 38% year-on-year for the previous year.

The six EV battery manufacturers from China in the top 10 (in descending order of market share) are CATL, BYD, CALB, Gotion High-Tech, EVE Energy, and Sunwoda. Despite Japan's and South Korea's early dominance in the field, today, there are only three South Korean manufacturers in the top 10 — LG Energy Solution, Samsung SDI, and SK on — with only one Japanese manufacturer, Panasonic.

The top 10 EV battery manufacturers

Looking at the first four months of 2024 (January to April), as per South Korean market research firm SNE Research, global EV battery capacity in this period was 216.2 GWh, which was up 21.8% year-on-year compared to the same period in 2023. CATL, the market leader, held a 37.7% market share in the period, growing 30% year-on-year. BYD, on the other hand, held a 15.4% share, growing 18.3% year-on-year. Next up, are the three South Korean battery manufacturers, starting with LG Energy Solution, with a 13% market share, growing 7.8%. Samsung SDI, which saw the biggest growth in the top 5 at 32.9%, had a 5.1 percent market share. SK On, on the other hand, had a 4.8% market share, down 2% year-on-year.

Panasonic saw a 29.5% drop year-on-year, with a 4.7% market share. SNE Research claims the biggest reasons for the downturn was due to a slowdown in sales of Tesla Model 3 in which Panasonic's battery is installed, adding it is expected to recover market share after the unveiling of its advanced 2170 and 4680 cells that are mostly Tesla-focussed. As for the remaining four Chinese manufacturers, CALB held a 4.2% market share with 23.9% growth; Gotion held a 2.2% share, with 15.8% growth; EVE had the same share, with 45% growth, and finally, Sunwoda had a 2% share, with 57.7% growth. Other manufacturers outside of the top 10 had an 8.7% share in the same period, growing 82.7% year-on-year.

Why it's important who's dominating the EV battery market

Apart from being the top manufacturer of batteries, China also has four of the top 10 electric vehicle makers in the world, namely BYD (also the second biggest EV battery maker), Geely, SAIC, and Changan. It is also the top market for EVs, with more than twice the EV deliveries (2.5 million) than its closest competitors — Europe (0.957 million) and North America (500,000). With both the global EV and EV battery markets growing in double digits for the past two years, and that growth expected to continue, companies and countries that have a stronghold on manufacturing will make all the difference.

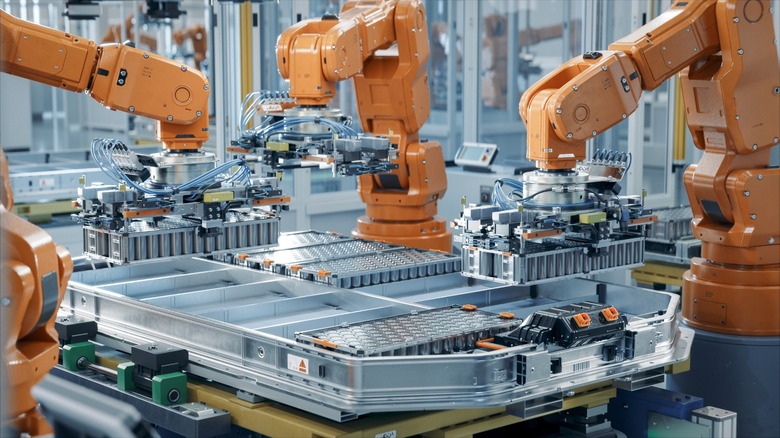

Currently, all of the top 10 battery manufacturers are headquartered in the Eastern hemisphere. Excluding differences in tariffs and duties, local manufacturing will help carmakers reduce costs (passing on the benefits to consumers) and enjoy better profit margins. This is part of the reason that Chinese EVs are so price competitive, even in other markets. The U.S. has, however, put tariffs on sales of Chinese EVs (though it offers tax credits as subsidies), in part to protect its own companies, and Europe is considering a similar move while subsidies have been discontinued in major European countries. This all makes EVs expensive for consumers in the two of the largest markets. Considering that the battery is the single most expensive component of an EV, it's imperative for countries to get local manufacturing in place in the long term to keep up with demand. US-based EV battery manufacturing has been gaining ground recently, and production in Canada may further alleviate the issue.

With all solid-state batteries, the future may look different

All this may change quite a bit over the course of the next decade, however. The industry is expected to shift to all solid-state battery (ASSB) tech, which is hoped to bring several benefits over to the current liquid-state battery tech used in lithium-ion batteries. These benefits include the solid-state batteries theoretically being less prone to combustion, offering better temperature adaptability, having a simpler manufacturing process as well as a significantly higher energy density limit — increasing both the power and range of an EV.

ASSB tech is expected to be commercialized as early as 2028, with companies like Toyota, Nissan, Volkswagen (VW's initial tests showed promise), and BMW likely to be frontrunners. The tech is being developed by multiple firms across the world — and it's a national development strategy in the U.S., the E.U., Japan, and South Korea, with some companies in the U.K. and even Canada. While China also has numerous firms working on ASSB tech, the country has some of the lowest number of patent applications on the tech, lagging far behind Japan, South Korea, and the U.S., according to TrendForce.

The market research firm adds that China's investment in ASSB tech is insufficient and that resources aren't being properly utilized. While there is a focus seen on semi-solid-state batteries, TrendForce believes the country is far behind others on ASSB tech. While nothing is yet set in stone, and some major developments could be made by China, it appears the future EV battery landscape may look quite different.