What Happened To The Bundil App From Shark Tank Season 10?

We may receive a commission on purchases made from links.

On October 21, 2018, the third episode of the 10th season of "Shark Tank" — actually shot second — premiered on ABC to approximately 3.9 million live and same-day viewers. The second of four pitches saw founder Dmitri Love soliciting investment in Bundil, a startup built around directing consumers' spare change into cryptocurrency. Though Love was nervous at first, stumbling in the early parts of his presentation, he eventually smoothed over his jitters and got his point across. Most of the Sharks had reservations for various reasons, but Kevin O'Leary liked the idea and had enough related companies that it made sense for him to make an offer, albeit one for a 50/50 partnership, which Love accepted.

However, as has become commonplace — Love would later say it happens to 88% of deals accepted on the air on "Shark Tank" — the deal fell through during due diligence. Bundil managed to stick around for several years and even secured funding away from the show, but Love felt like it wasn't enough, expressing concerns that being an entrepreneur of color was depriving him of opportunities. He shuttered Bundil in mid-2023, but that wasn't the end of his story. As of 2024, he has a new company, another one in the fintech space, and appears to be thriving.

Unlike many "Shark Tank" entrepreneurs whose investments weren't finalized after shooting the show, Love has been incredibly open about why the deal fell through. Read on to find out why that happened and how he rebounded.

What happened to Bundil on Shark Tank?

Dmitri Love entered the tank seeking a $100,000 investment for 10 percent of the startup he founded, Bundil. This app invests the spare change from cash purchases in cryptocurrency, making it an alternative to something like CoinOut, which was pitched to the sharks the previous season on a similar app minus the crypto element, or ChangED, which Mark Cuban invested in away from the show and directs the change towards student loan payments. Clearly nervous, Love got tongue-tied early in his pitch, but he soon got back on track.

At the time of the pitch, two months into the app's existence, Bundil supported three cryptocurrencies — Bitcoin, Ethereum, and Litecoin — and it charged users $3 per month or $24 per year. Kevin O'Leary explained that, from what he learned from fractional stock share ownership app Beanstox, more than 80% of apps in that space failed within three years because they couldn't get their customer acquisition cost below the lifetime customer value. Love responded to that by saying that customer acquisition costs had been roughly $2.70 per user based on the $1,000 invested in getting 360 subscribers.

Lori Greiner opted out because she was a crypto skeptic, while Cuban joined her because he considered ChangED a conflict of interest. Daymond John also passed because he felt the whole thing was too early. O'Leary offered $100,000 for a 50% share because he was going to need to invest a lot more money as time went on to help acquire customers. Guest shark Matt Higgins then opted out and encouraged Dmitri to take Kevin's offer, which he did.

What happened to Bundil after Shark Tank?

As often happens — e.g. the ReThink app from Season 8 or Spare from Season 10 — it doesn't look like Bundil's deal with Kevin O'Leary ever closed. Although it's not clear how up-to-date or otherwise complete the list is, Bundil is not listed among the "Shark Tank" investments on O'Leary's website. In addition, O'Leary stressed in the episode that Bundil needed "gasoline poured on it" to accelerate its growth, and there appears to have been no such effort to rapidly grow the company. And going by a search of O'Leary's Twitter/X account, the only time that he ever posted about Bundil was while the episode was premiering on the East Coast. By all appearances, this deal fell apart after the taping during due diligence.

Unlike a lot of other "Shark Tank" deals that fell apart after the taping, though, we know the story of why, as Dmitri Love gave his side on the "Outside the Tank" podcast/YouTube show in July 2021. "So actually, I turned it down," he explained. "50% is a lot, and we asked for some specific parameters, one of which being if we raise another fundraising round afterward, would he be willing to dilute? And additionally, if that isn't the case, would you provide more capital so that we have an actual runway and can actually survive this company? Those are two things he couldn't commit to, so we did not end up closing that deal. I'm sure you know by now, about 88 percent of the deals on 'Shark Tank' don't close, so it's kind of normal." Love added that he stayed in touch with O'Leary's team, though.

Is Bundil still in business?

Bundil kept going for several years, with Dmitri Love noting in a March 2019 interview for DallasInnovates.com that the startup was brought into the fold of the Capital Factory Accelerator. "Capital Factory mentors some of the greatest companies around the world, and we are proud to be among the few," he explained, later adding "We are securing our next round of funding and planning to add numerous cool features that our users will absolutely love."

Various posts on Love's LinkedIn blog also indicate that the company did secure non-"Shark Tank" funding, though one post, in particular, illustrates his frustration with competitors getting preferential treatment. Specifically, he felt the problem was something that's been discussed at times on "Shark Tank" — that Black entrepreneurs have a much harder time finding investors. "I've watched direct competitors raise millions in a pre-seed round, still not get as much traction as we have and then raise a few million more to keep going," he wrote. "I've watched similar concepts with no product-market fit, no team, no product in general, no revenue, etc., go on to raise tens of millions to explore their idea." After listing possible alternative explanations, he concluded "Or maybe, we are just black founded" before asking for feedback.

In late 2023, Love posted on LinkedIn that he hadn't been posting much all year, "mostly because my company failed," saying that Bundil "shut down early this year." He didn't get into much detail about what happened, past saying that he "should've been thinking of a pivot or new direction much earlier than I did."

What's next for Bundil's founder?

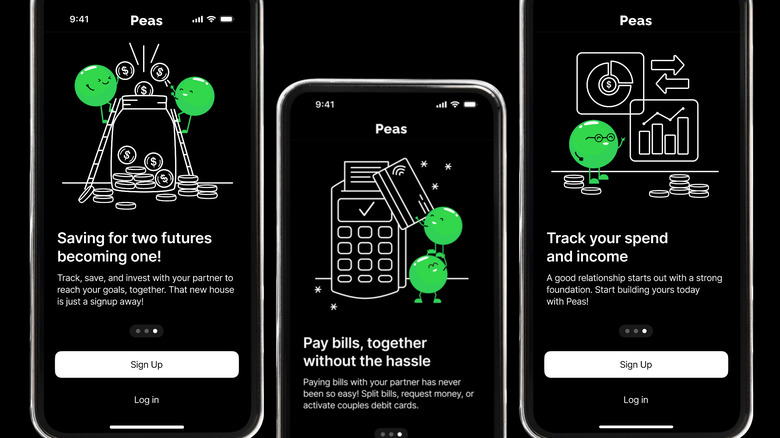

Dmitri Love's LinkedIn page says that he finished up at Bundil in June 2023, and it looks like one of the first things he did was flirt with YouTube content creation, as he posted a video about how to get on "Shark Tank" the following month. The month after that, he started a contractor job as a product advisor with investment company Seeds, which he juggled with an existing product advisor contract at medical AI startup Robin Healthcare from March to October 2023. The Seeds gig finished up in February 2024, at which point he announced a new startup where he would serve as CEO – Peas Technology.

"Good things come to those who wait," he wrote in a LinkedIn blog post. "I am thrilled to share our new venture Peas Technology is changing the way couples do finance. With Peas, you can split bills, save together, and manage your finances with the world[']s first group chat financial AI assistant. All without switching from your current bank." Love also shared a post from co-founder Max Stiling that put Peas into the context of reinventing joint accounts to lessen the damage in the event of a divorce. with Stiling saying that "joint money is completely solvable." According to its website, Peas is currently in private beta and accepting waitlist requests.

So while Bundil is gone, the future is still looking pretty bright for Dmitri Love, and it looks like he has a stable career in the fintech startup sector, regardless.

"Shark Tank" is available for purchase on Prime Video.