The Best Alternatives To QuickBooks For Small Business Owners

The Internet provides all sorts of opportunities for creative individuals to explore new business options. Online information and website-building tools for small businesses empower users to turn visionary ideas into online ventures. One of the most useful digital tools for managing a business is accounting and invoicing software.

Distributed by Intuit, QuickBooks is the biggest name in accounting tools. Its comprehensive feature list makes it viable for businesses of all sizes, with lower-priced feature tiers for smaller projects. From managing payrolls to creating automatic invoices, QuickBooks has made the process of owning and running a business easier. It's popular across industries for its simple, straightforward interface and versatile analytical tools.

At the same time, QuickBooks locks many of its features behind pricy premium plans. For freelancers in particular, QuickBooks can make managing invoices quite expensive. Luckily, the market abounds with other accounting software. Here are four of the best alternatives to QuickBooks for small business owners and the self-employed. These products were chosen based on a few factors, which can be found in greater detail at the end of this article.

Zoho Books

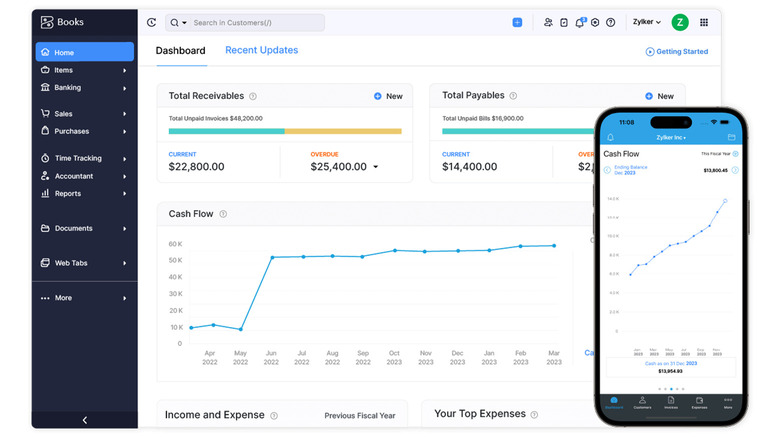

Many users will be familiar with Zoho Sheets, one of the most popular Microsoft Excel alternatives on the market. The same team also ships Zoho Books, an easy-to-use accounting software suite suitable for businesses of all scales. There are how-to videos for first-time users of the product available on YouTube and elsewhere, and Zoho Books remains one of the few invoicing software options to offer a wide range of features even on a basic plan.

Zoho Books offers most of the same tools as QuickBooks and allows users to import data like transaction history from previous accounting programs, including QuickBooks itself. A few downsides to be wary of are limited inventory tracking and a bare-bones user interface that can seem overwhelming for first-time users.

Unlike QuickBooks, Zoho Books offers a free tier for businesses earning less than $50,000 annually. Paid subscriptions with more features start at $16.22/month. Multiple membership levels with various sets of features are available, maxing out at $216.33/month for the Ultimate plan. The service works seamlessly with Zoho Sheets and the company's other productivity offerings, making managing other aspects of your business a breeze.

Xero

For people just starting their business venture, Xero is a great tool for paperless online accounting. We've already covered Xero's mobile accounting options for small businesses using iPads and other Apple devices, but the service has an equally robust Android implementation. Xero offers a simple, intuitive interface and a comprehensive feature set. Xero lets users pay bills, accept payments, and link bank accounts with ease. You can pay your employees directly using Xero through its integration with Gusto, which allows for international payments in over 120 countries. Xero also offers automated sales tax calculations that make managing your new business less of a headache.

Xero's design and features are built to serve self-employed professionals and small businesses. Larger companies operating on an international level might need to subscribe to Xero's premium plans to meet their needs. Xero provides its own mini-app store, allowing businesses to customize Xero to fit their needs and integrate popular extensions like PayPal, Stripe, and Timely.

Xero offers three pricing tiers: Early, Growing, and Established. Each offers an introductory price for the first three months: $3.75/month, $10.50/month, and $19.50/month respectively. The plans rise to $15/month, $42/month, and $78/month after that three-month introductory period. Early offers basic accounting and invoice options, while Established comes with advanced features like accounting analytics, international transactions, and project tracking. Growing, predictably, falls in the middle.

FreshBooks

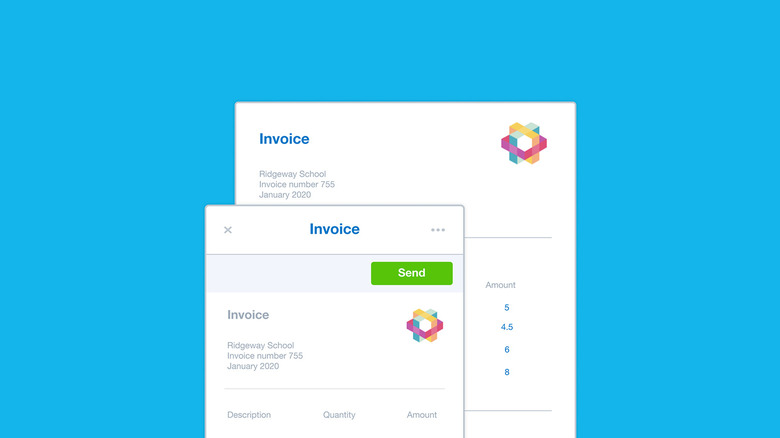

Another prominent name in the accounting space is FreshBooks. FreshBooks does its best to match the QuickBooks feature set, with a mobile app that carries over nearly all that functionality from the web version. FreshBooks' invoicing tool allows users to automate charges and accept ACH payments for quick transfers in the U.S. Users can personalize invoices with their own branding too.

FreshBooks' time-tracking functionality is powerful as well, with support for tracking hours for specific projects or clients. You can use the tool on any device with a single tap. Every member of your team can track how long they've worked on projects, which can be accessed by the administrator using the dashboard. You can invite staff and clients on a per-project basis and collaborate with them in real time.

You can start with the Lite plan which costs $7.60 per month and can accommodate unlimited invoices for up to 5 clients, with the ability to add extra team members and advanced payments for an additional cost. Higher-priced subscriptions unlock access to more features, including the ability to invite your accountant, track profitability for your projects, and run accounting reports.

Wave Accounting

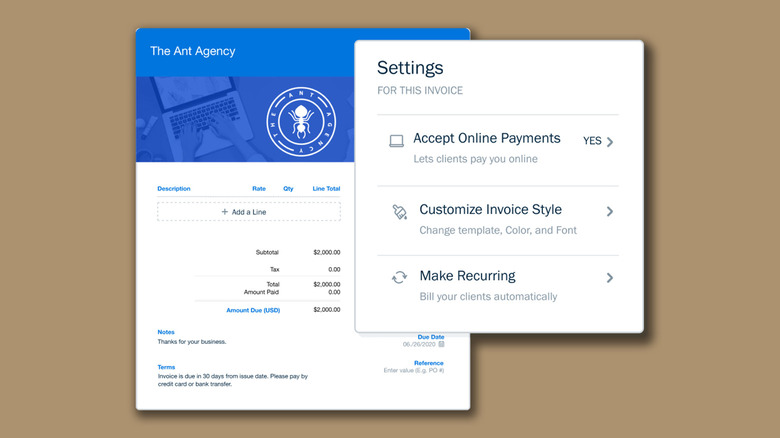

If you are an individual freelancer selling online services and simply don't wish to blow any money on subscription fees, give Wave Accounting a shot. Its free version lets you create and manage unlimited invoices, unlike most other accounting software. This functionality extends to the mobile app, which lets you receive online payments and micromanage your cash flow. While Wave's invoicing capabilities are adequate for individual business owners, the lack of inventory control and subpar customer management system might not suffice for businesses with multiple employees or those that sell physical products.

Wave's free Starter plan requires users to accept a fee of 2.9% + $0.60 per transaction to process payment through the service. The $15/month Pro Plan nixes the 60-cent fee. Both Starter and Pro plans allow you to add branding to your invoices and view detailed reports using the dashboard. Overall, for freelancers seeking a simple, straightforward accounting solution, Wave Accounting is a good place to start.

Why were these products chosen?

The products featured in this article were picked depending on a few factors. Other than being trustworthy and reliable, all of these digital accounting tools offer a similar fleet of features and come at various pricing tiers, making it easy to pick the plan that fits your needs the best. Obviously, being comparable and even a better value in comparison to Quickbooks was an important consideration when these services were chosen.

Another crucial aspect of sticking with an accounting software for your business or personal needs is online support. All of the mentioned products offer either live chat or email support, making it less painful to deal with when something goes astray. Picking the best alternative to Quickbooks is subjective, but every product on the list has its distinct advantages. If you care for it, the tight integration with Zoho's other apps is a solid reason to pick Zoho Books over the other recommendations on this list.

Both Xero and Freshbooks have useful features that make managing your business a bit easier. However, if you're just getting started and are unwilling to spend any extra, nothing comes close to Wave Accounting's free tier that doesn't restrict the number of invoices you can add.