4 Of The Best AI Tools For Saving Money

If you're working toward a financially secure future, you can't put saving money on the back burner, but that's easier said than done. When you're dealing with increased expenses in nearly every area of your life, especially with rising inflation affecting various industries, saving for the future or big financial goals can seem like an uphill task.

That said, saving money isn't necessarily an unattainable financial goal. If you're struggling to analyze your spending patterns, budget your spending, and figure out where you can cut expenses, try using a personal finance app.

If you're looking to fast-track your way to a bigger savings account, there are four AI-powered tools that can help — which SlashGear has listed based on Play Store and App Store user reviews and first-hand experience. You'll also find a more detailed methodology that explains how these apps were evaluated and picked at the end of this article.

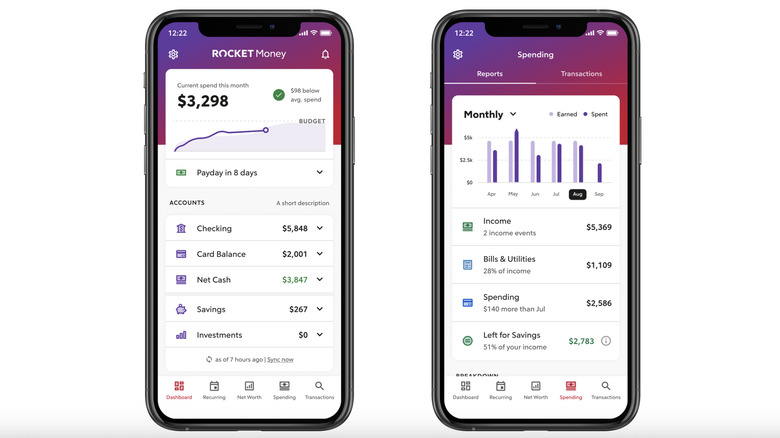

Rocket Money

Rocket Money (available on Android and iOS) is an AI-powered finance app that helps you take charge of your financial life with tools like credit reports and budget tracking. The data shared by Rocket Money can help you stay on top of your spending since you'll have access to a detailed breakdown of your spending. The app also notifies you of any potential events that you may need to account for, so you'll also never be caught off guard by a huge expense again.

What's more, you can use Rocket Money to make automatic savings contributions based on your expenses, develop a budget, and even cancel subscriptions that may be draining your savings account. The app is free to download, and users can choose between a free and paid version.

The free version of the app links to your checking and savings accounts, credit cards, and investment accounts. You can use it to manage your subscriptions, track expenses, and get timely alerts if you spend too much money or your checking account balance has dropped significantly.

The premium version offers all that and more, including a subscription service cancellation assistant and access to a Rocket Money expert for times when you may need some extra assistance. That said, you will need to shell out between $3 to $12 per month to access the more important features, based on what Rocket Money describes as a "pay what you think is fair" model.

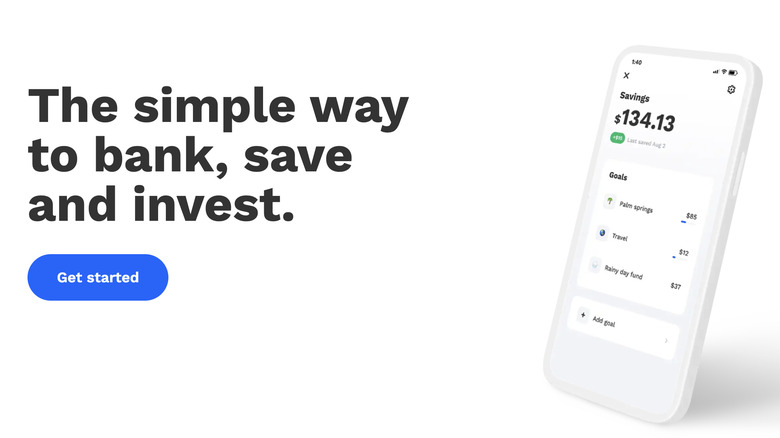

Albert

An all-in-one financial tool, Albert (available on Android and iOS) can help you save money, build a portfolio, and monitor your accounts for suspicious activity. It even offers eligible users a cash advance of up to $250.

The way this app helps you save is by analyzing your income and your expenses, and also accounts for bills. Based on this, it automatically sets aside a certain amount of money each week, helping you build your savings over time. You can also choose to set your own savings schedule. Either way, the app helps you save money that you may otherwise spend.

To use Albert's money-saving tool, you'll need to sign up for a subscription plan called Genius. Eligible members who opt for this plan may also earn cash bonuses based on their savings balance every month.

While a tool like Albert is undoubtedly helpful, the subscription alone costs $14.99 per month. If you don't end up using all of the features of this plan, the cost may not justify the benefits.

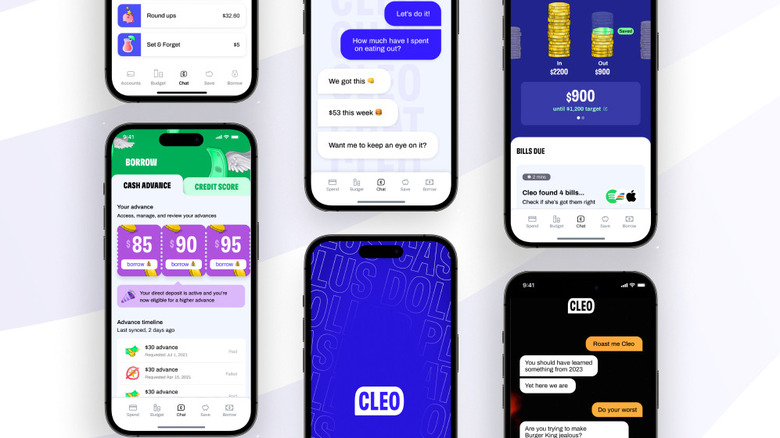

Cleo

Cleo (available on Android and iOS) isn't a traditional personal finance app. Instead, it's an AI assistant that provides financial advice and makes saving money a little less intimidating. The app lets you set personalized savings goals and allows access to tools like the "Swear Jar" that fines you for unnecessary spending.

The app also makes budgeting more fun with the free AI budget planner that lets you have a comprehensive view of all your accounts in one place. You can also enable monthly payment reminders and bill trackers.

Despite all the tools you may have at hand, consistently managing your money and staying on top of your finances can be hard. Cleo aims to make this a little easier (and fun) for you by way of its AI-powered assistant. Whether you have a money-related question or want some motivation to continue saving up, Cleo's AI chatbot will have something interesting to share. Keep in mind that the chatbot is likely to offer generic suggestions, so don't expect it to be extremely intuitive.

Cleo's free subscription is all you need to budget, save, and track your expenses. However, if you want features like access to your credit score, personalized savings goals, and the option to request a cash advance, you'll need to become a Cleo Plus member. While you're likely not too keen on signing up for yet another subscription, the Plus membership costs just $5.99 per month if it piques your interest.

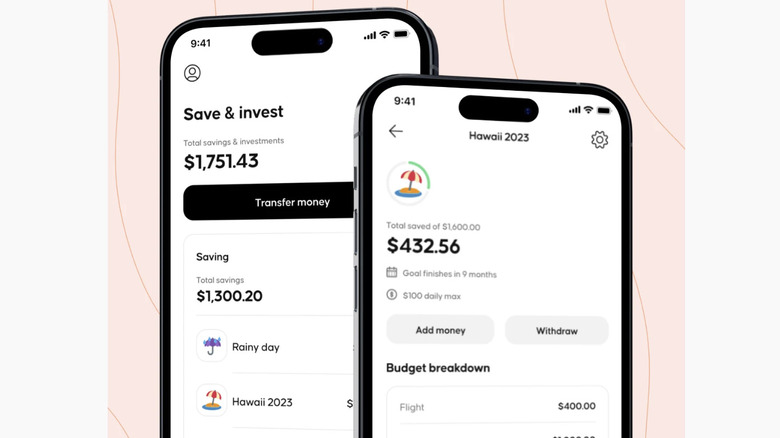

Oportun

If you're looking for a straightforward tool that does the grunt work of tracking your expenses and figuring out how and what you can save, try Oportun (available on Android and iOS). The app tries to tackle money savings a little differently with its "Set & Save" feature.

This tool essentially tracks your income and expenses, and saves what it thinks you can afford. You can use this feature regardless of whether you're a salaried employee or a gig worker. The best part is that it also accounts for things like tax refunds and bonuses.

If you borrowed a personal loan from Oportun, you get to use the Set & Save tool for an entire year, free of charge. If not, sign up for a free trial of the Oportun app for 30 days; if you like it, you can continue your subscription by paying just $5 per month.

The simplicity of this app is both an appeal and a slight drawback. While it's great for people who prefer something straightforward to help with their savings, it lacks more advanced features like a portfolio builder.

Why these apps made it to this list

The apps listed above were chosen primarily based on user reviews and ratings on the Google Play Store and Apple App Store. Each of these tools had an average rating of 4.0 or above and received thousands of reviews. What's more, the features offered by these apps make them ideal for a range of users.

After these apps were shortlisted, they were downloaded and tested by SlashGear to determine if they functioned as expected, and could back up the claims each company makes.