What Happened To The CoinOut App From Shark Tank Season 9?

We may receive a commission on purchases made from links.

Outside of short segments aired during the show, many businesses often fly under the radar after they appear on "Shark Tank." With many new businesses that receive deals every season, not every company can be Scrub Daddy or Bunch Bikes, and even successful companies fade into the background after their appearance. However, even if a company doesn't stay in the limelight for a long time, it doesn't mean they are automatically failures.

CoinOut is an example of a "Shark Tank" success, as the contestant and founder of the company, Jeff Witten, was not only able to secure a deal but would go on to run a successful company with over two million users.

That said, the success was certainly not a straight path, and the company was forced to evolve shortly after its appearance on the show. In one of the more inspiring "Shark Tank" stories, the CoinOut episode in Season 9 is a great anecdote that proves that sometimes, taking hard advice and rethinking the core of your business is the best thing for everyone involved.

What happened to CoinOut on Shark Tank?

Jeff Witten, founder of CoinOut, debuted on "Shark Tank" on Season 9 Episode 23 in 2017. He entered the show asking for $250,000 for 7.5% equity of the company, setting the CoinOut valuation to around $3.3 million. Witten aimed to do away with physical coins with his new product, which would include a plastic card (much like a debit or credit card) that members could use to store change after paying with cash at participating vendors. He'd go on to explain that integrating retail rewards programs would entice vendors to fork over the $20 per month subscription and 3% transaction fees that they would have to pay.

Initially, the Sharks challenged Witten's business model, questioning why retailers would need to pay him for the service and questioning the difference between his product and other offerings from major financial institutions. Witten remained steadfast in his belief in his company, unwilling to concede, and conveyed the company's value propositions, like the ability to leverage user purchasing data to sell to advertisers.

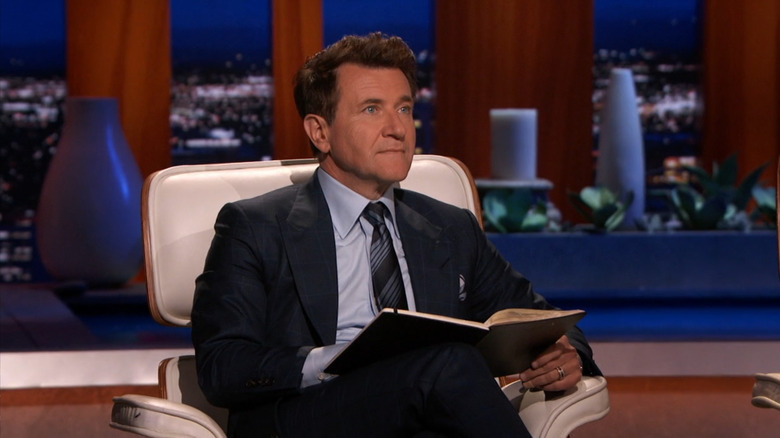

Eventually, Witten's dogged determination would see him receive a contentious offer from Barbara Corcoran. She proposed a $250,000 investment for 15%, but with the contingency that CoinOut could secure 700 new retail locations in the next six months. Feeling pressured, Wittens rejected the offer, eventually settling with Robert Herjavec on $250,000 for 15% equity with no contingency, though it significantly reduced the company's overall valuation to $1.66 million.

Robert Herjavec's deal with CoinOut fell through after Shark Tank

As it turns out, even though the deal seemed sealed and settled on "Shark Tank," the CoinOut agreement with Robert Herjavec never actually went through. Surprisingly, however, this turn of events is something that Herjavec probably regrets in retrospect. In May of 2021, CoinOut was acquired by Informed Resources Inc. (IRI), a market data and analytics firm founded in 1979 and a company that partners with major retailers like 7Eleven, CVS, Speedway, Kroger, and more.

According to a Columbia Magazine interview in 2022, Wittens would go on to discuss the deal falling through, admitting, "lucky for us, in retrospect, since it would have been terrible from a valuation perspective."

That said, it wasn't the original idea of a coin-based plastic card scanned across New York City cafes that would earn the sale for the young entrepreneur. By the time the episode actually aired on Shark Tank in 2018, CoinOut was already a different business, having re-thought the very core of its model after the time on the show.

CoinOut is now a cash-back app for receipts

CoinOut shifted its business model shortly after filming the "Shark Tank" episode. During the show, there was a memorable moment when Mark Cuban explained that the user profiles stored on the cloud as part of the CoinOut registration process was actually a brilliant idea but that Witten's insistence on pushing physical cards with POS integration was a nonsensical waste of time and concentration.

As it turns out, it seems like Wittens would take this to heart, as CoinOut re-engineered the app shortly after the show to cater mostly to those looking for cash-back rewards by scanning receipts with their phones. This would lead the company to start selling consumer behavior data based on these scans to major businesses when it unveiled its data platform in 2020, and it would segue into the outright purchase of the company by IRI a year later.

Today, CoinOut is still owned by IRI and can be found on the Google Play and App Store.

Jeffery Witten stepped away from CoinOut in 2022

Ironically enough, though Witten fought for his product when it made its appearance on Shark Tank, he ended up cashing or "coining out" in the end and has now moved on to other ventures. In April of 2022, Jeffery Witten would officially step back from his role as the CEO of CoinOut.

He'd go on to become an advisor for various companies and startups, including Fiat Growth. Witten has also served as the Chairman of the Executive Advisory Board for the Richard Paul Richman Center for Business, Law, and Public Policy since 2019.

As a graduate of Columbia University, Witten also sits as an Advisory Council Member for Columbia Entrepreneurship, Innovation, and Design, the same educational institution where he spawned the idea for CoinOut in the first place. Rather than sitting across from the Sharks, he's become a Shark himself.

What's next for CoinOut's founder?

According to Jeff Witten's LinkedIn page, he cashed out of CoinOut in April 2022, so to speak, and left the company. Though he also serves in various advisory positions with other startups, his main priority now is his role as co-founder of Sheer Health. That company is based around an app that, according to the frequently asked questions page on its website, "empowers our members to navigate their benefits and health related finances with confidence and ease." The same way that finance apps like Rocket Money interface with your bank accounts to help spot anomalies and stick to your budget, Sheer Health syncs up with your health insurance account(s) to do the same with your benefits. You can look over your claims, and point out opportunities to save money.

Sheer Health offers a free tier where no credit card is required to sign up, but, if the app "put[s] money back in your pocket," the company takes a 10% cut of that. If you subscribe to the $40 tier, though, then "any money we save or get reimbursed for you goes straight back into your pocket." The features are the same across both tiers; the paid one is just promoted as better for those with large medical bills or who see many of out-of-network providers. In its own way, you can see the DNA of CoinOut in Sheer Health, though it remains to be seen if Witten's newer company will see his old company's success.

"Shark Tank" is available for purchase on Prime Video.