Why Some Of The Coolest Android Phones Aren't Sold In The U.S.

The most striking aspect of the U.S. smartphone market is the sheer lack of competition, which in turn hurts the consumer because, in lieu of alternatives, they have to pick from a paltry selection of options at their disposal. At the top end, the battle is fought between Apple and Samsung, while the daring few pick between the likes of Google, OnePlus, and Motorola.

But irrespective of the price bracket you look at, there is no denying the fact that shoppers are not getting the best value for their money; actually, far from it. From high-refresh screens and super fast charging to high-resolution cameras, there is a lot that smartphones sold on U.S. soil miss out on.

For years, industry pundits and supply chain analysts have spilled a lot of digital ink over the reasons why those outrageously value-centric China-made smartphones are not available in the U.S. From the lack of carrier deals to the dynamics of a trans-Atlantic trade not being conducive for a razor-thin profit formula followed by these brands; there are a whole bunch of valid reasons why these phones never hit the U.S. stores.

Unfortunately, the current state of geopolitical tussle between the U.S. and China makes it nigh impossible for the situation to improve. But no picture of the current situation can be painted without highlighting the precarious Huawei situation in bold strokes. What follows is a brief overview of all the factors that have historically kept Chinese smartphones from making their way to the U.S. market and why the situation doesn't appear to be improving in the near future.

Cost and conditions

Over the course of the past four quarters, culminating with Q3 2023, Apple's global smartphone share has dropped consistently from 23% to 16%, according to Counterpoint data. A rebound is supposed to happen in the ongoing quarter, but that doesn't take away from the fact that the U.S. market leader has lost ground worldwide. In the meanwhile, Chinese giants such as Xiaomi and Oppo have made sustained progress.

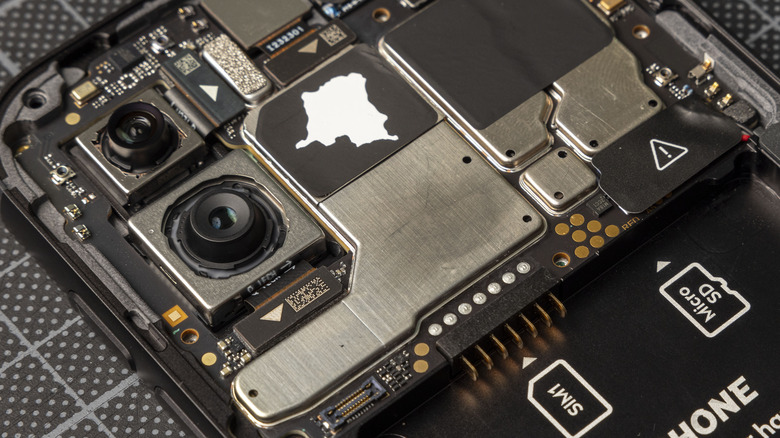

Of course, it's a testament that these brands are making interesting phones and selling them in fittingly high numbers. But it's not just the budget segment where they succeed. In fact, these two are far more adventurous at form factors and usually stay ahead of Apple and Samsung at most smartphone innovations. And yet, neither brand has sold a phone on U.S. soil in years.

In 2019, Alen Wu, who led the global sales department for Oppo, told the press that "very stringent and sophisticated requirements" put in place by the carriers — which control around 90% of the market — give the U.S. market an unsavory distinction as "the most difficult market in the world."

As far as Xiaomi goes, the decision to skip the U.S. market mostly has to do with the company's profit model. Notably, the company operates on a model that caps profits at 5% of the net value of a product. That model gives Xiaomi an edge over its competitors and has solidified its image as a phone maker with prices that cost nearly half as much as iPhones but still gives Apple a run for its money at looks and innovation.

Carrier conundrums

The most obvious reason that Chinese brands aren't eager to work with carriers is because that would mean an aggressive revenue-sharing (aka profit slashing or price hike) is right around the corner. But there's another aspect at play here that keeps U.S. cellular operators from joining hands with Chinese smartphone brands.

The geopolitical tussles between the U.S. and China are no secret. It was owing to these strained ties that dozens of Chinese brands were put on a trade blacklist. ZTE and Huawei landed themselves in hot waters over telecom gear that allegedly posed a security threat. Then, there are lingering concerns about the alleged deep ties of the Chinese government with behemoths such as Xiaomi and Huawei.

The situation around smartphones was supposed to change in 2018. AT&T inked a deal with Huawei to sell its Mate series flagship phone in the U.S. At that stage, Huawei was already selling unlocked units in the U.S., but the distribution was quite small. In a carrier-reliant market like the U.S., a deal with AT&T was a huge step forward for the brand.

But the carrier pulled out of the deal at the last minute, reportedly due to pressure originating in the top policy-making halls. Later in the same month, Verizon also canceled plans to sell the Huawei flagship phone under pressure from the U.S. government, according to Bloomberg. Xiaomi, which overtook Apple in the global smartphone market back in 2021, is in a similar quandary.

Blacklists and and branding

In 2016, U.S. Mobile put up a handful of Xiaomi smartphones for sale, but the company soon clarified that the carrier was not an authorized seller of its phones in the U.S. market. Xiaomi has stressed in the past that it aims to go through the rigorous certification protocols put in place by carriers while duly following the patent laws, too.

In 2021, the U.S. government put Xiaomi on a military blacklist, which the company protested with a lawsuit of its own. The blacklisting mandate was lifted soon, but so far, no carrier has expressed interest in selling Xiaomi phones. Notably, the situation has not improved over the years. If the AI revolution of 2023 and the adjacent race for dominance in the segment goes, there is little hope of Chinese brands making their way to the U.S. seem even slimmer.

The best example would be the global semiconductor crunch that peaked during the pandemic era. From electronics giants and carmakers to defense industry players, everyone came to a realization that they desperately needed chips and that their precious machines and operations would come to a screeching halt without those silicon wafers. The AI boom stirred another mad race for securing graphics engines, so much so that Nvidia became a trillion-dollar company owing to the demand.

The rapid rise of AI deployment posed another threat. In 2020, the U.S. government further tightened the rules around doing business with blacklisted companies, targeting Huawei, which was already on the dreaded "Entity List" back in 2019. Over the subsequent years, those restrictions were further intensified under the Biden administration.

Patents and preferences

Carrier certifications, an unviable revenue-sharing model with carriers, and the market stigma of using a China-made phone in the U.S. are some of the reasons why a lot of smartphone enthusiasts, as well as market players, haven't really been fighting to get these phones from the East to hit the official sales channels. But another crucial aspect that dictates a brand's eagerness to enter a new market is patents.

When Lenovo acquired Motorola (which sold phones in the U.S.) back in 2019, it got a hold of over 2,000 patent assets, even though Google still retained a vast majority of Motorola Mobility patents as part of the deal valued at $2.91 billion. Lenovo CEO Yang Yuanqing reportedly noted that the most crucial aspect of the Motorola phone business acquisition was not getting an official entry into the lucrative U.S. market but getting access to a large trove of patents.

Holding patents is not just a surefire way for milking royalties. Instead, it allows two competing brands to settle their patent-related disagreements out of a court using a cross-licensing deal instead of landing in expensive legal hot waters. Patent disputes, especially those involving multinational brands, are usually an expensive affair and could stretch for years depending on the local laws and copyright rules.

Ever since the U.S. tightened its sanctions, especially those around semiconductors and AI development, the Chinese government has been pumping billions of dollars into companies like Huawei so that they can develop native technologies and capabilities to reduce their dependence on foreign brands. As part of the push, the country has also asked consumers to prefer local brands, which also explains the eagerness with which the Huawei Mate 60 Pro powered by an indigenous chip quickly went out of stock.

The Huawei factor

Now that we are talking about Huawei and its milestone development of a relatively competitive seven-nanometer chip, it is worth noting that the company may have skirted around some of the sanctions imposed by the U.S. government. According to Bloomberg, the Washington-based Semiconductor Industry Association claims that Huawei has established multiple secretive chip-building plants in the country under different names to avoid the sanction rules.

The concerns come in the wake of sanctions that cut off Huawei's access to 5G chips, Google software on phones, and most importantly, any adjacent tech with the semiconductor tech, mostly sourced from U.S.-based companies. Late last year, the Biden administration also moved to block the sale of AI chips from leading players such as Nvidia that could assist China with AI and supercomputer development.

In fact, the U.S. government is officially looking into how exactly Huawei landed an indigenous semiconductor with SMIC, which itself is on the blacklist. China, on the other hand, is moving with its own set of restrictive measures. It has banned employees at state-backed firms and government officials from using foreign devices, including iPhones sold by Apple, while simultaneously pushing the adoption of domestic-exclusive brands. Huawei is a core beneficiary of that shift.

With such high stakes regarding national security, geopolitical rifts, and a race to lead cutting-edge AI, it is highly implausible that more Chinese brand phones will make it to the U.S. market anytime soon. Moreover, the precedent set by Huawei and the nationalist fervor associated with it will also serve as a deterrent for any U.S. company, carrier, or seller to partner with more Chinese smartphone makers in the immediate future.