The Big Battery Gamble That's Make Or Break For Nissan's Electric Car Roadmap

Nissan is readying trial production of the batteries it has bet its future EV roadmap on. It is a high-stakes gamble on a new cell technology that could give electrified vehicles twice the range and lower price tags at the dealership. Known as ASSB, or All-Solid-State Batteries, the new chemistry aims to oust liquid from the cell structure and, in the process, make for safer, more energy-dense, and faster-charging packs that could help Nissan rapidly expand its EV footprint beyond just Leaf and Ariya in the U.S. today.

"We believe that ASSB is a game-changer, because it is high density and the cost is better," Makoto Uchida, CEO of Nissan, said at a roundtable at the Japan Mobility Show 2023, where the automaker hosted SlashGear. "I'm looking at the EV price level, further drastically coming down. Because speed of channel, and the cost of the goods of EV going down much faster than we expect because of the massive volume demonstrated in the channel ... We really have to change how we optimize the cost of the EV."

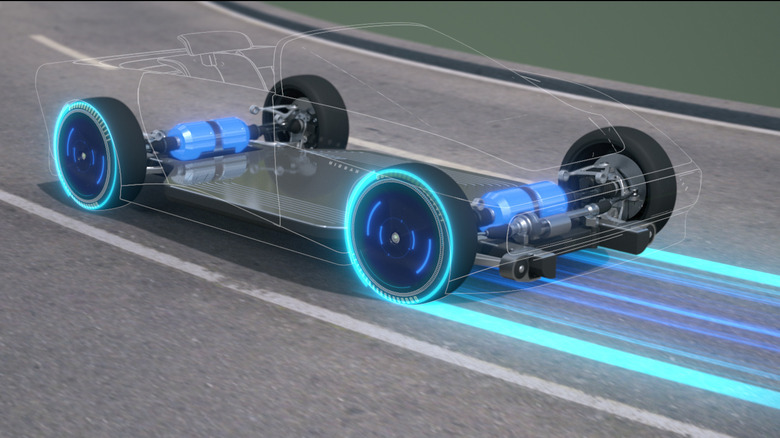

Battery technology plays an outsize role in that, certainly, but it's not the only part. Nissan is also looking at how simplifying its battery structures could also contribute to reducing cost and complexity.

Goodbye liquid electrolyte, hello greater energy density

ASSBs skip the liquid used in current lithium-ion batteries in favor of a solid electrolyte. Not only is that neither flammable nor volatile — bypassing the potential for inadvertent battery ignition notorious in EV fires — the solid electrolyte also has higher temperature limits, which means ASSB-equipped cars can support higher sustained fast-charging rates.

Cost advantages are unlocked by virtue of supporting a broader array of anode and cathode materials, as they're less likely to experience side reactions with the solid electrolyte versus a liquid one, not to mention anode materials that have higher energy density for more overall power storage. That means, Nissan predicts, the potential for twice the range in the same footprint as a Li-ion battery.

At least, that's the concept. Nissan isn't the only automaker working on ASSB, though it's one of only a handful that has announced a specific roadmap for not only production but commercialization of the technology. In 2024, Nissan plans to launch a pilot plant for ASSB production. By 2028, the company intends to launch its first electric vehicle using ASSB.

ASSB should be competitive from day one

While ASSB technology might be complex, actually explaining its benefits shouldn't be too tricky. "From customer's perspective, the energy density: twice more," Toshihiro Hirai, senior vice president of powertrain and EV engineering, told SlashGear in an interview. "Rechargeability, almost one-third. Cost reduction significantly. Those are still our target."

That's not to say ASSB's benefits will all be unlocked immediately, though the good news is that the more important aspects of the new tech — from a driver perspective — should be present on day one, Hirai insists. "First generation probably will have a two-step of cost reduction," the engineer explains. "First one is the chemistry still will use the nickel manganese cobalt type of material. That's why we cannot expect so significant cost reductions in the first step."

Even then, the result shouldn't see a "significant cost difference" from what's available now, Hirai says. From 2030 and beyond, though, Nissan is predicting significant cost reductions.

Not just for pure EVs, but hybrids too

Just because All-Solid-State Battery technology promises significant performance improvements over current cell types in use, that doesn't mean Nissan envisages it paving the way to a fleet of solely battery-electric vehicles. Not anytime soon, anyway. Even with twice the range, EVs simply aren't suitable for every driver's needs yet.

"If you look at market by market, some markets may not be ready for EV," CEO Uchida said. As a result, rather than moving Nissan as a monolith and pushing full electrification regardless, the automaker is taking a more piecemeal approach. "We are thinking how we can adapt to the change of the business environment in each respective market," the CEO explained.

ASSB's relevance will remain regardless of whether it's installed in a hybrid or a fully electric vehicle, Nissan says. For the former, a smaller ASSB pack's more efficient input and output of power and its greater power density could make for a more responsive hybrid without the usual compromises around weight. For a full EV, meanwhile, being able to theoretically deliver twice the range from a battery pack the same size as a Li-ion-based electric vehicle is an obvious selling point.

Do you really need 600+ miles of electric range?

That's not to say Nissan necessarily wants to chase adding hundreds and hundreds of miles of range for its own sake, even if that might be a benefit in certain markets like the U.S., where customer expectations are significant. "U.S. requirements are the most severe customers' requirements," powertrain SVP Hirai suggested.

"Technically, theoretically, we can accommodate the twice bigger batteries than today," Hirai said. "In vehicles, for example, C or D [Class SUVs], usually, for example, 100 kilowatt hours. Why not 200 kilowatt hours in ASSB? This can realize more than 600 miles. Oh, great. But is it realistic?"

Potential EV buyers — and North American customers in particular — are notorious for overestimating just how much range they require on a single charge. In reality, the average U.S. driver uses their vehicle for under 40 miles each day, according to the U.S. Department of Transportation's Federal Highway Administration. Weening them off that misconception may take leveraging some of ASSB's other talents, like much faster charging.

Regulations evolving as fast as the technology is

"EV tends to charge overnight: this is different from petrol or gasoline," Hirai points out. "So day by day, every day, you can charge in the house. That's why rarely you need a bigger battery in the cars. It's more the new lifestyle of the EV practical question. But anyway, engineering perspective, we'll prepare ... bigger batteries for parts of the U.S. market. But the ASSB may change completely these kind of deductions."

Looming over all of that is the relative expense of electric vehicles. While automakers have been developing technologies like All-Solid-State Batteries, regulations in different markets have been evolving, too. Perhaps most conspicuous is the shift in the U.S. to tie EV incentives and rebates to American-made products. If automakers want their electric cars to qualify for the most tax breaks for buyers, then they need to be assembling components like batteries within the U.S.

"We still have a lot of challenges to mass produce ASSB," CEO Uchida conceded. And, while the 2024 production pilot will begin in Nissan's home country, beyond that, nothing has been decided for market-by-market manufacturing. "There could be a lot of opportunity," Uchida adds, "first we start with Japan as a pilot, but looking forward [we could localize elsewhere]."

EVs need to be cheaper - even if we're spending more

If range and price are the two lingering pain points to EV adoption, then ASSB could — albeit in a staggered way — address them both. That is, assuming Nissan's appetites still run to affordable models in the spirit of the Leaf.

On the one hand, there's a tacit recognition that the electric transition will only be effective if drivers can afford to get out of traditional internal combustion cars and into electrified models. "If you cannot make the cost competitive," CEO Uchida argued, "how can we — as OEM — make it sustainable?"

Nonetheless, at the same time, Uchida pointed out that new car buyers aren't averse to the idea of spending more. "If you look at household income today, how it's shifting, it's become much higher. And I think the car value, what people are willing to pay for, is rising."

ASSB still faces questions - and hurdles

Just how much the first ASSB vehicles will cost — and what sort of EV they'll be — remains to be seen. Nissan hasn't given any hints about form factor beyond saying in April 2022 that it sees potential for the technology "in a wide range of vehicle segments, including pickup trucks." While it has committed to an EV, that could still mean ASSB as the battery in an e-POWER hybrid, too. That would allow for a much smaller battery pack to be rolled out initially.

Down the line, though, Nissan has been aggressive about its cost predictions. Even in late 2021, when the automaker rolled out its Ambition 2030 roadmap, it was estimated that ASSB could bring the cost of battery packs to $75 per kWh by its fiscal year 2028. In 2023, the average cost for Li-ion batteries has been $152 per kWh, according to Statista research. At $65 per kWh, ASSB would achieve EV and gasoline vehicle cost parity, Nissan said.

Higher density and cheaper batteries certainly would address some of the key hurdles still facing electric vehicle adoption. That's not to say it's all of them: access to charging facilities remains a big issue and one that Nissan execs maintain that, while they'll embrace charging evolutions like the NACS connector in North America, they've still no intention of developing charger infrastructure of their own. If ASSB hits the goals Nissan has for it, it could represent as big a game-changer as the transition from NiMH to Li-Ion. First, though, it has to prove feasible to take from promising future technology to mass production-ready practicality.