What The UAW Strike Could Mean For EVs And Car Buying

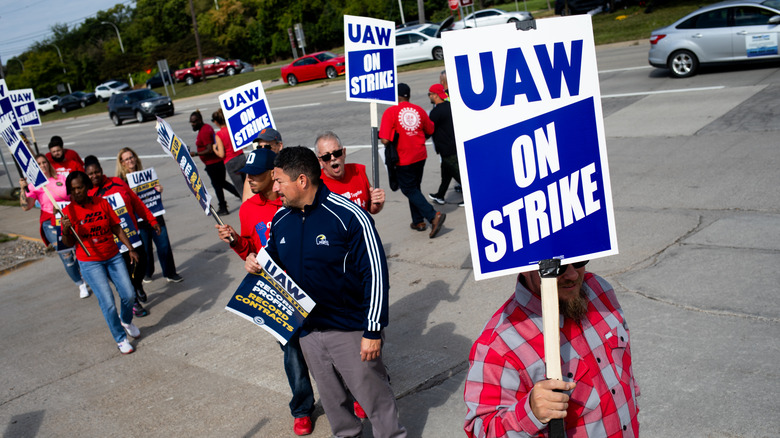

For the first time in its history, members of the United Auto Workers have simultaneously gone on a strike against the Detroit Three: a trio consisting of Ford, General Motors, and Stellantis. Nearly 13,000 members who work at plants assembling popular cars like the Ford Bronco, Chevrolet Colorado, and Jeep Wrangler decided to walk out after the UAW failed to reach an agreement with the carmakers.

The union — which has received support from multiple senators including Debbie Stabenow, Elizabeth Warren, and Congresswoman Rashida Tlaib — is demanding higher pay and better working conditions as their employers rake in record profits without sharing a piece of the pie with their workers. For now, the strikes are protracted strategically, but UAW has made it clear that it's ready for the long game. The affected automobile brands, on the other hand, claim that the offers they made were "generous" and "unprecedented."

Stand Up Strike Day 1 in Wentzville, MO.

Holding the line 24/7#StandUpUAW pic.twitter.com/BXHtGznxGN— UAW (@UAW) September 15, 2023

With uncertainty looming over assembly work at America's biggest automobile brands, the strike could very well land a hit on the wallet of buyers, and could stretch the wait times for buying new cars. The impact won't be evident immediately, but if the protests go on past a couple of months, serious supply chain trouble could be brewing, one that could hamper the prospects of getting repair and servicing facilities, too.

Unpredictable supply and service prospects

According to data cited by The Wall Street Journal, the Detroit Three currently have an unsold inventory that could last them around two months on average. While it is unlikely that these carmakers will raise the price of their cars in the immediate aftermath, dealers could very well hike up the sticker price upon sensing an unpredictable supply situation in the months ahead. However, that price bump won't likely be limited to new cars, as the used car market could see a similar pattern where models affected by the UAW strikers could quickly get more expensive.

Assuming the UAW strike lasts longer than the inventory estimates of GM, Ford, and Stellantis, it won't exactly be a rosy situation for shoppers considering other overseas brands such as Honda or Toyota. That's primarily because each maintains a significantly smaller inventory compared to its stateside counterparts. In a situation where buyers actually start picking up these vehicles, it won't be long before the demand drives up the cost.

As workers go on strike with the intention of ramping up their efforts, the affected carmakers will also feel the pinch of supplying repair and specialty replacement parts. For an average car owner, that would mean the wait times for service and repair appointments could get longer. Moreover, depending on the repair outlets' own inventories, their services could get more expensive as they prepare for an unpredictable future.

The EV factor

While the direct impact of long strikes at automobiles is somewhat predictable based on supply-demand patterns, there's an EV factor to be considered. As per The Wall Street Journal, the assemblies hit by the strike "build some of the companies' highly profitable and sought-after pickup trucks and SUVs." If the trio of Ford, GM, and Stellantis see profits dwindle due to supply issues, each will look at other avenues to balance the pinch and restructure plans. That avenue presumably would be electric cars.

The Detroit Three are in the middle of ambitious electrification efforts, and have poured billions of dollars into churning out EVs. It is plausible that each passes on the costs of reduced profits and a drying revenue from its ICE portfolio to the customers of electric cars, which are assembled at plants unaffected by the UAW strikes. In a scenario where the carmakers agree to the demands of the union, it is unlikely these companies will absorb the increased expenses.

Once again, car buyers would likely pay a higher price so that the companies can balance revenue figures. The turmoil at Ford, GM, and Stellantis could very well play in favor of the big, bad EV wolf — Tesla. The Elon Musk-led company has been setting shipment records in the past few quarters, riding on the back of a massive ramp-up in its production prowess. Plus, upcoming rides like the Model 3 refresh and Cybertruck have garnered the interest of consumers.