4 Of The Best Credit Building Apps On Android And iPhone

A good credit score can open many doors, qualifying you for a mortgage, car loan, or student loan. On the other hand, having bad credit can slam the door shut on many of these opportunities and even affect your ability to get a job, especially if you're applying for a position that requires handling sensitive information or managing finances. A good credit score lets lenders and employers know you have a history of paying off your debts and are likely to continue. Based on this information, they may conclude you're responsible and trustworthy.

However, don't throw in the towel; a bad credit score isn't the end of the world. If you've gotten off track with your finances, credit-building apps can help you get your credit history back in shape. These handy apps keep track of your credit score, help you build a strong credit history, and provide the insights you need to become a credit superstar. If you're ready to start building credit or get your credit history back on track, here are four apps to help you.

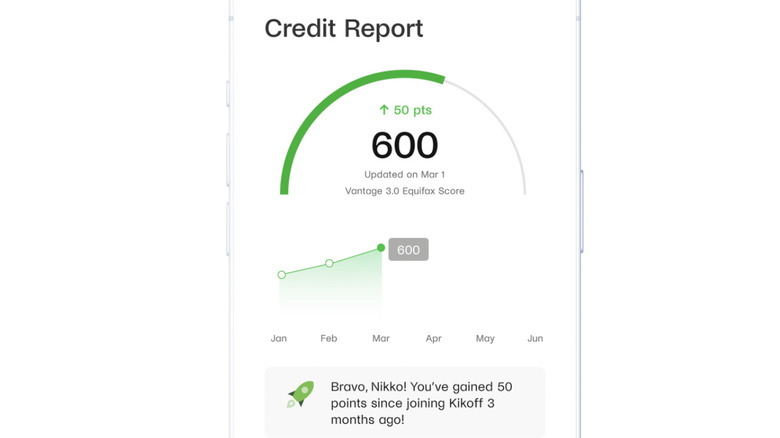

Kikoff

We're constantly reminded of the importance of building credit, yet without a credit history, securing loans becomes a challenge, creating a catch-22 situation. That's where Kikoff can help. Kikoff is an online lender that offers a unique product called the Kikoff Credit Account. The app, available on Android and iOS, is designed to help you build your credit from scratch, making it more likely that you'll qualify for loans in the future.

It helps you do this with a $750 revolving line of credit, which, unlike traditional credit cards, doesn't carry any interest. However, you'll have to pay a small monthly fee to use it. You can use this credit to purchase goods and services in the Kikooff online store. Since Kikoff aims to help users build a positive credit history, they report payments to two major credit bureaus, Equifax and Experian. Making payments on time and maintaining a low credit utilization rate, i.e., you're not maxing out your credit cards, can positively impact your credit scores.

When you sign up for Kikoff, you'll get access to VantageScore credit scores to track your progress. The company also provides educational materials to guide users in understanding and mastering credit-building strategies.

Self

Self, available on Android and iOS, takes a unique approach to helping individuals with a low FICO score build their credit by combining the discipline of saving with the benefits of a traditional loan. However, Self does things a little differently. Instead of receiving your funds upfront like traditional loans, Self holds your money in an FDIC-insured certificate of deposit (CD) with one of its partner banks for the 24-month loan term. You'll commit to making monthly payments towards a set loan amount, and once you've paid off the loan, the Self Credit Builder tracker shows when you'll get your money back, minus any interest and fees. The platform has four credit-building plans, allowing you to choose one that best meets your budget and goals.

Since Self reports all on-time payments to all three major credit bureaus, Equifax, Experian, and TransUnion, you'll see a positive impact on your credit score. Plus, the structure of this credit builder encourages savings, which can help users develop healthy financial habits. You can even pay off the loan early for a small fee. However, there are benefits to sticking it out for the entire term of your loan, including access to the Self Visa Credit card.

Experian Boost

If you've ever ordered your credit report or searched for information about improving your credit, the name Experian has probably popped up. Experian is one of the three major credit bureaus responsible for tracking and reporting individual credit histories. They also have one of the best credit-building apps on the market — Experian Boost, available on Android and iOS.

This app helps you improve your credit score by letting you link your bank accounts and report payments that usually aren't included in traditional credit reports, such as utilities, rent, streaming services, and cell phone bills. Your job is to make regular bill payments and choose which positive payments you want reported. The beauty of this feature is that users can see the impact on their credit score instantly. It's also one of the easiest ways to boost your credit score.

You decide what information gets reported, giving you control over what's added to your credit history. While using this app won't result in a dramatic increase in your credit score, with the average user seeing a 13-point increase in their FICO score, even a slight improvement can make a difference, especially if you're on the cusp of a higher credit tier.

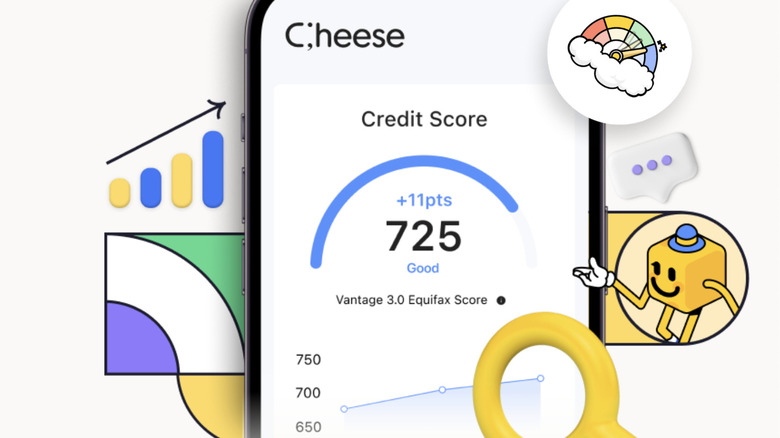

Cheese

Whether you have no credit history or need to rebuild your credit, Cheese Credit Builder can help. Available on Android and iOS, this app is tailored to those with low or no credit history, offering them a structured path to credit improvement. When you sign up for a loan with Cheese, your funds won't be disbursed immediately because this app operates on the secured installment loan model. Instead, your money is held in an FDIC-insured savings account, with the term length being either 12 or 24 months and loan amounts ranging from $500 to $2000, based on your needs.

The idea is to ensure you're committed to making regular payments, which are then reported to the major credit bureaus, including TransUnion, Equifax, and Experian. There are no hard credit checks, and the app has a transparent fee structure, which helps make the credit-building journey straightforward and user-friendly. All of these features make Cheese a relatively low-risk way to improve your credit score.