This US-Made EV Battery Nightmare Might Make It Even Harder To Get A Cheap EV

It's been over a year since the U.S. Government began enforcing a law that bars the import of goods made in Xinjiang, China, by companies accused of employing forced labor. Known as the Uyghur Forced Labor Prevention Act (UFLPA), this law primarily focused on goods like solar panels, cotton clothing, and tomatoes.

The implementation of the act had a significant impact on the import of solar panels and related items in the U.S. Buoyed by the effectiveness of the law, it seems the U.S. government is now on the path to bringing more Chinese products under its ambit — and it is increasingly becoming clear that the burgeoning EV space in the country could become its first casualty.

According to Reuters, U.S. Customs and Border Protection (CBP) has received instructions to increase scrutiny on products like lithium-ion batteries, tires, aluminum, and steel sheets originating from suspect facilities in Xinjiang, China. The crux of the U.S. allegation is that many companies operating in Xinjiang use forced labor, which the Biden administration sees as an extension of human rights violations against the local, predominantly Muslim Uyghur population.

With most of these products playing a significant role as raw materials for EVs, any potential ban could have far-reaching ramifications for EV companies in the U.S. To get around potential bans, U.S. automakers must prove that their Chinese suppliers do not have links to regions where the U.S. believes forced labor camps exist.

Reducing dependence on Chinese EV components

While the humanitarian concerns of the U.S. for China's Xinjiang province may be true, the decision to increase the scrutiny on Chinese EV parts could be connected to a larger goal of making the U.S. less dependent on Chinese parts in the future.

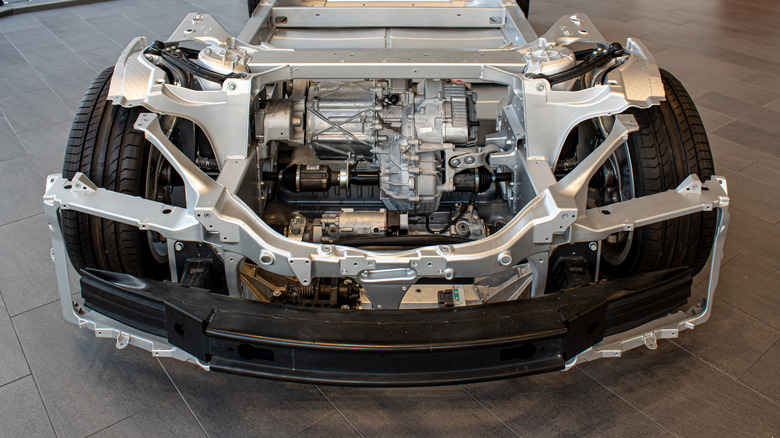

Despite the massive growth of the EV space in the U.S., it is still dependent on Chinese companies for several crucial EV components — including lithium-ion batteries, electric motors, and charging infrastructure. China is also an essential source of materials like cobalt, lithium, and nickel — all of which form a crucial part of the EV industry. Several U.S. companies also still have long-standing agreements with Chinese suppliers for EV components.

With laws like the Uyghur Forced Labor Prevention Act, the U.S. government effectively forces U.S. companies from becoming too dependent on Chinese suppliers for their EV business. In addition, the U.S. government has recently changed the rules around the federal tax incentive on EVs, making it more difficult for automakers to qualify for the incentive if they use Chinese-made components.

Nevertheless, if the CBP does end up strictly implementing the modified UFLPA directive, it may not only result in price hikes and component shortages for EVs, but also further disincentivize U.S. automakers from developing smaller, cheaper EVs.