How Sam Bankman-Fried's Downfall Could Have Been A Big Problem For Elon Musk

Whenever it seems like the media marketplace has hit some kind of cosmic limitation on complicated business pertaining to Elon Musk, somehow reality provides. For instance, it turns out Sam Bankman-Fried of the collapsing, possibly felonious FTX cryptocurrency exchange, could have owned a sizable chunk of Musk's mess had events turned out just a little bit differently.

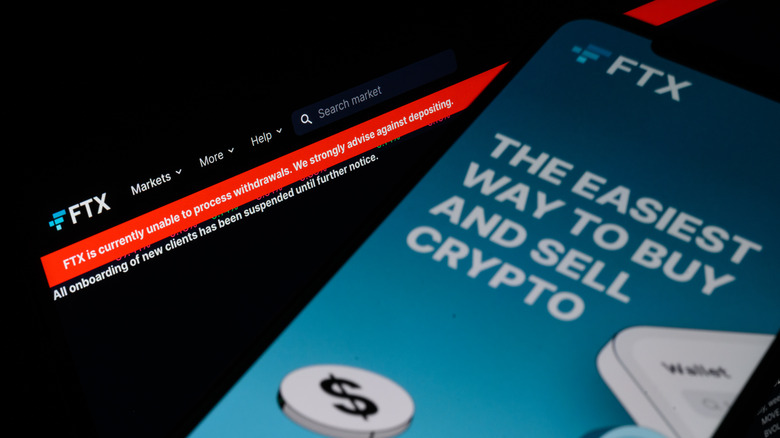

First, a fast recap. Elon Musk bought Twitter. Chaos ensued. Right now, we're hesitant to say whether Twitter will survive the acquisition, let alone prognosticate a probable outcome. Meanwhile, a massive user exodus from the FTX crypto exchange has left the company scrambling for funds to cash out its customers. Sources indicate something to the effect of a $9 billion shortfall. People involved with FTX, particularly Sam Bankman-Fried, are facing serious legal action (via Reuters) and the exchange's best chance of rescue, purchase of its outstanding tokens by competing exchange Binance, just pulled out.

In short, it's been an eventful few weeks for global business, and there's lots of red meat for us lucky suckers in the media. That said, we can only dream of the newsworthy nonsense that might have ensued had those two catastrophes somehow synergized – and it nearly happened.

Chaos, cryptocurrency, and the future of social media

New information regarding Sam Bankman-Fried and Twitter has come to light following the release of formerly private messages in the course of the now-halted lawsuit between Musk and Twitter regarding the former welching on his original purchase offer (per Fortune). Prior to Musk's purchase, he had been vocal on his own Twitter account about perceived censorship (not censorship he likes, naturally, but censorship against him) and the frustrating fragmentation of social media across multiple services.

Sam Bankman-Fried did what he does. He got in touch with Musk and proposed blockchain as a solution. According to sources at crypto news platform Forkast, Bankman-Fried contacted Musk at a frustrating point in his talks with Twitter, offering a partnership going forward. His vision seemed to be a blockchain-based approach to Twitter data security, potentially providing a backbone for a whole suite of services to take on Facebook, Instagram, and other major players in the space. The same sources indicate Bankman-Fried was prepared to put serious skin in the game, offering from eight to $15 billion.

Obviously, as Musk elected to proceed with the purchase of Twitter alone, and Bankman-Fried has since developed serious cash flow problems, blockchain on Twitter will likely remain a "what if?" for the foreseeable future. Still, the idea stands, and even if Musk intends to keep Twitter as a private fiefdom, plenty of other social media outlets enjoy money and could use better security. The future of decentralized social media will have to wait, but the possibility remains.

Musk has long held an interest in cryptocurrencies

Musk's potential collaboration with Bankman-Fried is no surprise, as the world's richest man has been publicly interested in cryptocurrency for a long time. His Twitter account has been littered with crypto-based memes, his companies have dabbled in cryptocurrency trading, and he has even allowed customers to use some of the more prominent cryptocurrencies like Bitcoin to purchase vehicles from Tesla. However, Musk's relationship with cryptocurrencies hasn't all been plain sailing.

His links to the concept have led to his name or the name of one of his companies being hijacked by crypto scammers on platforms like Twitter. Replies to popular tweets are often littered with fake Musk accounts or fake screenshots of Musk promising a huge crypto or NFT giveaway alongside a link to a phishing site or some other scam. Given his open hatred for "bots" and fake accounts, it could even be the prevalence of Musk-themed crypto scammers that inspired him to purchase Twitter in the first place. The real Elon Musk's actual crypto antics have also landed him in hot water. His promotion of Dogecoin, a meme-based and ultimately worthless currency, has led to a lawsuit being filed with the plaintiff accusing him of running a "pyramid scheme."

Twitter may be a no go, but the blockchain could still change social media

Despite the deal between Bankman-Fried and Musk going nowhere, and the current uncertainty around cryptocurrency, it is almost inevitable that blockchain technology will play a large part in the future of social media. To dumb it down, the Blockchain essentially works by storing copies of a dataset, or "ledger" on several computers or other devices. These copies are then checked against each other to gauge what is authentic and what isn't. Changes to a ledger must be agreed upon by the majority of devices in the blockchain, or they are discarded. It's how cryptocurrency currently works, it's how NFTs work, and logically, it's how Mark Zuckerberg's Metaverse is going to work too, if his company doesn't collapse before it actually launches.

Zuckerberg's vision involves people living part of their lives in the Metaverse. All of the things he's talking about currently exist to some degree, but he wants them to become mainstream. This means people will "own" virtual land, apartments, memorabilia, and everyday items like TVs. All of these virtual possessions will essentially be NFTs of some kind, and NFTs only exist because of the blockchain. It's the blockchain that keeps track of which ones are authentic and who owns them. So even though the Metaverse is virtual, there'll be a way of proving your virtual house, virtual car, and virtual Picasso, are actually yours. From a business point of view, it can also prevent people just pirating a bunch of high-end possessions.