After Credit Cards, Apple Sets Its Sights On Savings Account Service

In March 2019, Apple announced a credit card in partnership with Goldamn Sachs that lured in users with cash back rewards for buying the company's products and using Apple Pay with partner brands. Now, the two giants are strengthening their partnership with yet another product that turns Apple into a banking institution of its own. Say hello to the Apple Savings Account, which is linked to the Apple Card and promises a "high-yield" in the form of interest.

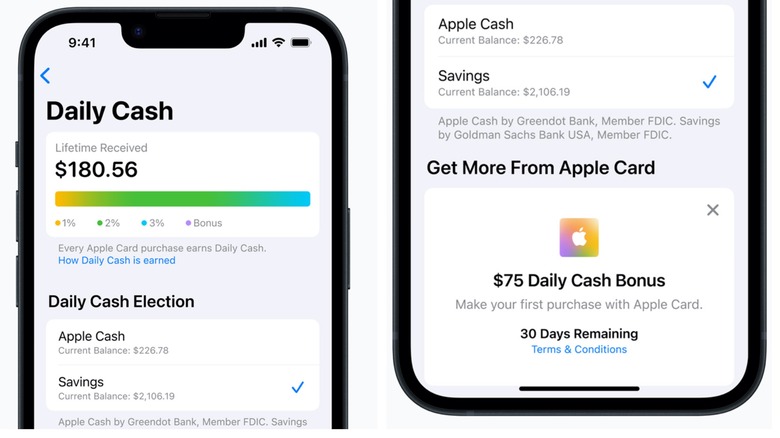

All the benefits are tied to Daily Cash, which is essentially the cash back reward users get when they buy something using the Apple Card. So far, the Daily Cash used to be stored in the Apple Cash account and worked just like cash. However, users will soon be able to funnel that Daily Cash into the Savings account.

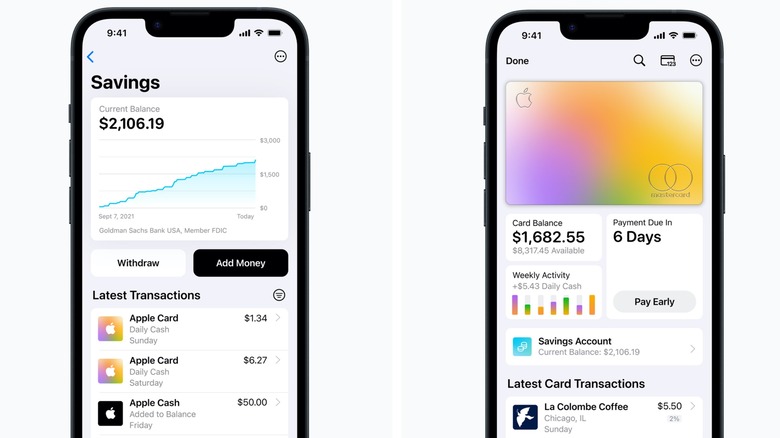

Apple's Savings Account will be no-fee, and there is no hassle in maintaining a minimum balance. Moreover, you don't need to worry about any minimum deposit value. Once the Daily Cash has been pushed into the Savings account, it will be usable just like regular currency from within Apple's Wallet app.

A no-fee transfer bridge for linked bank accounts

Once the account has been set up, users can accrue Daily Cash rewards in the form of Apple Cash, or funds mature in the Savings Account. However, a Savings account tied to spendings from a self-branded, single-service credit card doesn't make a lot of sense. Apple knows that all too well, which is why the company will let you transfer money from your existing bank account to Apple's Savings account.

It will be a two-way process though, thankfully. Apple will allow users to deposit money in their Savings Account from another linked bank account, and will also let them withdraw or transfer it without having to pay any transaction fee. For folks that sign up for the Apple Savings accounts, they will be able to keep a tab on their interest-fuelled financial growth via a dedicated Savings dashboard.

Notably, Apple won't say what exactly "high-yield" stands for in terms of interest rate, though. The company reportedly told CNBC that the interest rates will be "competitive" the same for all users regardless of their spending history. As far as availability goes, so far, we only know that the Savings Account feature will be rolled out in the coming months.