Why EV Tax Credits Can Be A Serious Headache

In an effort to reduce carbon dioxide emissions in the environment, the U.S government introduced tax incentives for people buying low-emission vehicles. The qualified plug-in electric vehicle tax credit came into effect on January 1, 2010 — plug-in vehicles with a battery capacity of 5 kWh and above, purchased from that date forward, were eligible for the tax credit.

More succinctly, the tax credit ranged between $2,500 to $7,500 depending on the size of the battery. For instance, if you bought a Toyota Prius Plug-in Hybrid with a 5.2 kWh battery, it would be eligible for a $2,500 tax cut. But if you purchased plug-in vehicles like the Chevrolet Volt or the Nissan Leaf with a bigger battery capacity, you would qualify for a federal tax discount of up to $7,500 (via Green Car Reports). Besides that, you could also have been eligible for additional tax credit depending on your state — if you were in California, you could have saved up to $7,000. However, automakers such as Tesla and GM that had sold over 200,000 electric vehicles were not considered for the federal tax credit.

Until August 16, 2022, those were the tax credit laws if you were buying an electric car in the U.S. — now, the battery capacity of your EV is not used to calculate the tax rebate. The determining factor is something entirely different, and it can be a serious headache to figure it out.

The EV battery and materials must be produced locally

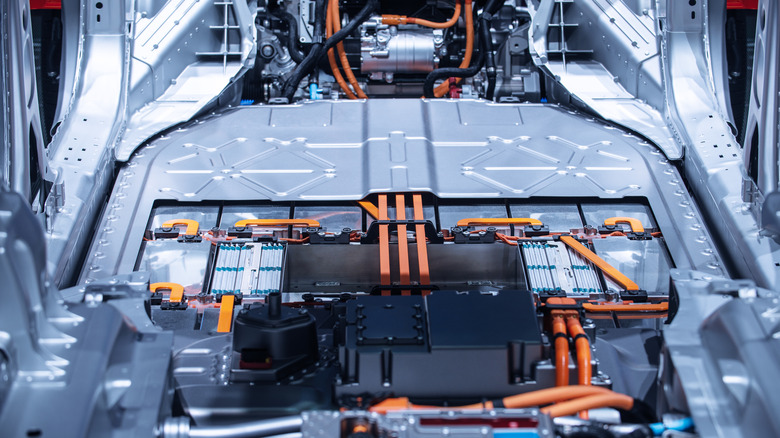

On August 16, 2022, President Joe Biden approved the Inflation Reduction Act into law. As part of a remedy to reduce inflation and overreliance on foreign manufacturing, the new law stipulates that for an electric vehicle to qualify for the tax credit, the battery and critical materials must be produced in the United States. In addition to that, electric vehicles with batteries and critical minerals that were produced in North America or "in any country with which the United States has a free trade agreement in effect" will be eligible for the tax incentive (via Congress.gov).

So how is it calculated? If the battery components of your EV meet the criteria required by the Inflation Reduction Act, you will be eligible for a tax incentive of up to $3,750. Similarly, if the critical minerals used to manufacture your EV meets the specifications outlined in the Inflation Reduction Act, it will qualify for a tax cut of up to $3,750. In other words, if the manufacturer meets all the requirements, you could be eligible for a tax refund of up to $7,500, similar to the previous law.

The new EV tax credit laws also give you a better deal if you want to buy a used electric car since you can claim an incentive of up to $4,000 — this type of credit wasn't available in the previous arrangement. However, you're limited to a used electric vehicle that is older than two years with a price tag that doesn't exceed $25,000 (via Time).

The minimum requirement will increase every year

The new tax credit laws imposed by the Inflation Reduction Act were enforced after August 16, 2022. This means that if you want to qualify for the EV tax reduction right now, the batteries and critical minerals of the electric car you're buying must be assembled in the U.S. or North America. But since there was not enough time for manufacturers to prepare, they only needed to process or extract 40% of the critical minerals in North America to qualify for the $3,750 tax credit (via ARS Technica).

As for the other half, the manufacturer must assemble 40% of the battery components locally to be considered for the tax incentive — according to the Inflation Reduction Act. After 2023, the percentage of battery components and critical minerals will increase by 10% every year (though it stops increasing after 2026 for critical minerals). By 2029, the minimum threshold automakers need to meet to qualify for the tax credit will be 80% of critical minerals and 100% of battery components manufactured in the U.S., North America, or countries that have free trade with the U.S.

Most new requirements will kick off in 2023

People who earn $150,000 or less taxable income per year are eligible for the new EV tax credit under the Inflation Reduction Act. If you're married, you will qualify if you have a joint taxable income of $300,000 or less per year (via Market Watch). However, if you are to qualify for a used EV tax incentive, the minimum entry is capped at half the new EV tax credit income. To put it into perspective, a prerequisite annual taxable income of not more than $75,000 as an individual and $150,000 or less for married partners with a joint tax filing.

Beyond that, brand new electric sedans that will be eligible for the tax cut should have a price tag that doesn't exceed $55,000. But if you're buying an SUV, a pickup truck, or a van, it should cost $80,000 or less to be considered for the tax reduction. On the bright side, there is no limit to how many EVs an automaker can sell to be ruled out. This means Tesla, Toyota, and GM, who were locked out of the previous federal tax credit laws after selling over 200,000 EVs, will be eligible for tax incentives under the Inflation Reduction Act.

But the Treasury Department clarifies that most of the new requirement that considers the taxable income and EV price tag and removes the vehicle sales limit won't come into effect until January 1, 2023. This means that the only additional criterion that needs to be met right now is that the EV needs to be assembled or manufactured in North America. The only exception is if you signed a written agreement with a manufacturer before August 16 to buy an electric car, but it has not yet been delivered.

Fewer electric cars qualify for the new tax credit

After the Inflation Reduction Act was signed into law, fewer electric cars qualified for the tax incentive. However, the Department of Energy has provided a list of electric vehicles that are eligible for the tax credit — and newly released models will be updated to the list if they qualify. In the next few years, we will have more electric cars with tax incentives considering that Honda, GM, and Ford are building electric vehicle assembly facilities and battery production plants in the United States. Volkswagen Group is also planning to open battery production plants in North America (via Car and Driver). Not to mention, Tesla will be back on the menu in January 2023 after the sales cap expires.

If you want to know if your next electric vehicle qualifies for the tax incentive, you can search the NHTSA's VIN decoder to know if it was assembled in the United States. After 2023, it will be possible to get a discount directly at the dealership after deducting the tax credit of an electric car from its original price. For now, if you want to claim your EV tax credit, it can be done when filing your income tax returns.