Qualcomm First Quarter Results Report $1.17 Billion In Net Income, Up 39% Compared To Last Year

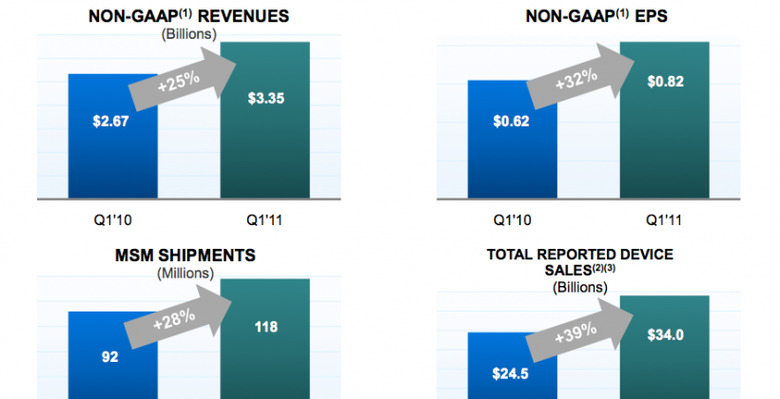

Miraculous. Qualcomm, the folks that bring you Snapdragon chips, the ones going in basically every big-name superphone coming out in the near future. In addition to their First Quarter Results showing a 39% increase in Net Income when compared to exactly one year ago, their Non-GAAP Revenues have gone up 25% as well over the past year, from $2.67 billion to $3.35 billion. Massive amounts of cash flying around here. Why have profits increased so much at this time when smartphones are taking over the mobile market? Why, that's both the question and the answer, of course!

In the conference call surrounding this report, Qualcomm EVP Steve Mollenkopf told investors who were invited to listen in that they've currently got "more than 150 Snapdragon devices in development, including more than 20 tablets." And what of the reported deal Qualcomm recently signed off on with Apple for both iPhone 5s and iPads? Paul Jacobs, CEO of Qualcomm only had one comment having anything to do with Apple: "We're happy to see the Verizon iPhone announcement since it's been the subject of intense speculation, but we have no other comments on that topic." Does this mean they'll be waiting to reveal the truth or falseness of the situation until Verizon and ATT work with Apple to release the 5th generation phone? Who knows?

Take a look at the full press release below:

Qualcomm Announces Record First Quarter Fiscal 2011 Results Revenues $3.3 Billion, EPS $0.71 Non-GAAP EPS $0.82

— Record First Quarter Results, Raising Fiscal 2011 Guidance —

SAN DIEGO — January 26, 2011 — Qualcomm Incorporated (Nasdaq: QCOM), a leading developer and innovator of advanced wireless technologies, products and services, today announced record results for the first quarter of fiscal 2011 ended December 26, 2010.

"We are very pleased to report record revenues, earnings per share and MSM chipset shipments this quarter driven by increased demand for smartphones and data-centric devices across an expanding number of regions and price points," said Dr. Paul E. Jacobs, chairman and CEO of Qualcomm. "In addition, we have resolved one of our previously disclosed licensee disputes, which will be reflected beginning with the second fiscal quarter results. We continue to execute on our strategic objectives as our partners leverage our technologies and solutions to offer leading wireless products and services to consumers around the globe. We believe we are uniquely positioned to benefit from these industry trends and are substantially raising our revenue and earnings guidance for the fiscal year."

First Quarter Results (GAAP)

• Revenues: $3.35 billion, up 25 percent year-over-year (y-o-y) and 13 percent sequentially.

• Operating income: $1.11 billion, up 26 percent y-o-y and 33 percent sequentially. • Net income: $1.17 billion, up 39 percent y-o-y and 35 percent sequentially. • Diluted earnings per share: $0.71, up 42 percent y-o-y and 34 percent sequentially. • Effective tax rate: 12 percent for the quarter.

• Operating cash flow: $48 million, down 96 percent y-o-y due to a $1.5 billion income tax payment.*Qualcomm Announces First Quarter Fiscal 2011 Results Page 2 of 19

• Return of capital to stockholders: $309 million, or $0.19 per share, of cash dividends paid.

Non-GAAP First Quarter Results

Non-GAAP results exclude the Qualcomm Strategic Initiatives (QSI) segment, certain share- based compensation, certain tax items that are not related to the current year and acquired in- process research and development (R&D) expense.

• Revenues: $3.35 billion, up 25 percent y-o-y and 13 percent sequentially.

• Operating income: $1.42 billion, up 25 percent both y-o-y and sequentially.

• Net income: $1.35 billion, up 29 percent y-o-y and 22 percent sequentially.

• Diluted earnings per share: $0.82, up 32 percent y-o-y and 21 percent sequentially.

The current quarter excludes $0.05 loss per share attributable to the QSI segment, $0.07 loss per share attributable to certain share-based compensation and $0.02 earnings per share attributable to certain tax items (the sum of Non-GAAP earnings per share and items excluded do not equal GAAP earnings per share due to rounding).

• Effective tax rate: 19 percent for the quarter. • Free cash flow: $127 million, down 90 percent y-o-y due to a $1.5 billion income tax

payment* (defined as net cash from operating activities less capital expenditures).

*The $1.5 billion income tax payment primarily related to the 2008 license and settlement agreements with Nokia.

Detailed reconciliations between results reported in accordance with generally accepted accounting principles (GAAP) and Non-GAAP results are included at the end of this news release.

First Quarter Key Business Metrics

• CDMA-based Mobile Station ModemTM (MSMTM) shipments: approximately 118 million units, up 28 percent y-o-y and 6 percent sequentially.

• September quarter total reported device sales: approximately $34.0 billion, up 39 percent y-o-y and 20 percent sequentially.

o September quarter estimated CDMA-based device shipments: approximately 165 to 169 million units at an estimated average selling price of approximately $201 to $207 per unit.

Cash and Marketable Securities

Our cash, cash equivalents and marketable securities totaled approximately $19.1 billion at the end of the first quarter of fiscal 2011, compared to $18.4 billion at the end of the fourth quarter of fiscal 2010 and $18.9 billion a year ago. On January 5, 2011, we announced an agreement to acquire Atheros Communications, Inc. for $45 per share in cash, representing an enterprise value of $3.1 billion on that date. The transaction is expected to close in the first half of calendar 2011, subject to customary closing conditions including the receipt of domestic and foreign regulatory approvals and the approval of Atheros' stockholders. On January 14, 2011, we announced a cash dividend of $0.19 per share payable on March 25, 2011 to stockholders of record as of February 25, 2011.

Non-GAAP selling, general and administrative (SG&A) expenses increased 26 percent y-o-y primarily due to an increase in employee-related costs and patent-related costs and other professional fees. QSI SG&A expenses decreased 44 percent y-o-y primarily due to a decrease in selling and marketing costs related to FLO TV.

Effective Income Tax Rate

Our fiscal 2011 effective income tax rates are estimated to be approximately 17 percent for GAAP and approximately 21 percent for Non-GAAP. The first quarter GAAP effective tax rate of 12 percent was lower than the estimated annual effective tax rate primarily due to a $32 million tax benefit recorded in the first quarter of fiscal 2011 related to fiscal 2010 as a result of the retroactive reenactment of the federal R&D tax credit in the first quarter of fiscal 2011. This tax benefit was excluded from our Non-GAAP results.

Qualcomm Strategic Initiatives

The QSI segment manages our strategic investment activities, including FLO TV, and makes strategic investments in early-stage and other companies and in wireless spectrum, such as the Broadband Wireless Access (BWA) spectrum won in the auction in India. GAAP results for the first quarter of fiscal 2011 included a $0.05 loss per share for the QSI segment. The first quarter of fiscal 2011 QSI results included $134 million in operating expenses primarily related to FLO TV.

On December 20, 2010, we announced that we agreed to sell substantially all of our 700 MHz spectrum for $1.925 billion to AT&T, subject to the satisfaction of customary closing conditions, including approval by the U.S. Federal Communications Commission and clearance from the U.S. Department of Justice. The agreement follows our previously announced plan to restructure and evaluate strategic options related to our FLO TV business and network.

Under the restructuring plan, we now expect that the FLO TV business and network will be shut down in March 2011 and are in the process of shutting down the MediaFLO Technologies division. Restructuring activities under this plan were initiated in the fourth quarter of fiscal 2010 and are expected to be substantially complete by the end of fiscal 2012. In the first quarter of fiscal 2011, restructuring and restructuring-related charges related to this plan included in QSI results were $64 million. We estimate that we will incur future restructuring and restructuring-related charges associated with this plan in the range of $300 million to $375 million, of which substantially all are expected to be recorded in fiscal 2011 in the QSI segment.

In December 2010, the loan that was obtained in connection with the India BWA spectrum purchase was refinanced. The new loans are payable in full in Indian rupees in December 2012. At the end of the first quarter of fiscal 2011, the aggregate carrying value of the loans was $1.09 billion.

Business Outlook

The following statements are forward looking and actual results may differ materially. The "Note Regarding Forward-Looking Statements" at the end of this news release provides a description of certain risks that we face, and our annual and quarterly reports on file with the Securities and Exchange Commission (SEC) provide a more complete description of risks.

Our outlook does not include provisions for future asset impairments or the consequences of injunctions, damages or fines related to any pending legal matters unless awarded or imposed by a court, governmental entity or other regulatory body. Further, due to their nature, certain income and expense items, such as realized investment gains or losses, or gains and losses on certain derivative instruments, cannot be accurately forecast. Accordingly, we only include such items in our business outlook to the extent they are reasonably certain; however, actual results may vary materially from the business outlook.

Our second quarter and fiscal 2011 outlook reflects the impact related to the resolution of one of our previously disclosed licensee disputes. Favorable resolution of the Panasonic dispute will be further upside if completed this fiscal year.

In addition to our ongoing operating costs, our business outlook for the second fiscal quarter and fiscal 2011 include restructuring and restructuring-related charges related to FLO TV and the MediaFLO technology division that are currently expected to be incurred.

We have not included any estimates related to the Atheros business in our fiscal 2011 outlook. The transaction is expected to close in the first half of calendar 2011. Excluding amortization of acquired intangibles, we expect the acquisition to be modestly accretive to earnings per share in fiscal year 2012, the first full year of combined operations.

The following table summarizes GAAP and Non-GAAP guidance based on the current business outlook. The Non-GAAP business outlook presented below is consistent with the presentation of Non-GAAP results included elsewhere herein.

The above report is truncated somewhat due to the immense size of its entirety – see the full PDF of the report [here] – Qualcomm Official, where you can also access the investor call.