Google Wallet Physical Card Plans Reportedly Axed Last-Minute By CEO Page

Google has scrapped plans to launch a physical Google Wallet credit card at Google IO next week, it's reported, focusing instead on the digital wallet and NFC functionality baked into Android smartphones. The company had intended to reveal the credit card – which was to be black with a rainbow "W", so AllThingsD reports – at its annual developer event, but wonky run-throughs and concerns from management that the scheme was insufficiently futuristic saw it knocked from the schedule.

In fact, Google CEO Larry Page is said to be responsible for killing off the card plans, something he's believed to have been skeptical about for some time. Page "felt it did not press forward innovation as payments startups like Square have done" AllThingsD's sources claim.

The demise of the Google Wallet credit card hasn't just shaken up Google IO next week, but staffing within the company. Head of Google Wallet Osama Bedier was confirmed to have left the company yesterday, "pushed out" it's said in favor of shifting the division into the ads and commerce team. Sridhar Ramaswarmy is now directly in charge of Wallet.

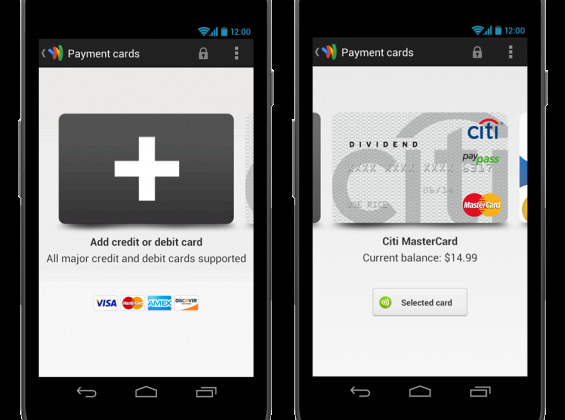

Although the physical card won't see the light of day, for a while if ever, that's not to say Google Wallet is going anywhere. The system will be updated with new rewards, offers, and loyalty points, it's said, with more merchants coming on-board to accept the NFC payments. What won't be happening any time soon is integration with Google Now, though, with the teams described as "siloed" in a way which has prevented data sharing.

Google had supposedly gone so far as to bake physical card support into the new Google Wallet app, and prototypes of the cards had already been produced. As per a usual card, they included a magnetic stripe and raised numbers; despite suggestions that Google would launch its own bank, the actual project was to partner with existing banks, and source behavioral data around shopping patterns through third-parties, rather than directly from Visa and MasterCard.