5 Free Notion Templates For Budgeting Monthly Expenses

While retail therapy and ordering takeout every time you don't feel like cooking is among life's many joys, there's also no equivalent to the misery that hits you when you check your bank balance at the end of the month. This is one of the primary reasons why you should try developing a habit of tracking your finances.

Although tracking your finances can be quite time-consuming, especially if you tend to forget stuff quickly, taking the first step is undoubtedly the hardest part. To help make your budgeting journey a tad bit easier, we recommend exploring Notion budgeting templates. From creating to-do lists to planning your day-to-day schedule, Notion is an all-in-one productivity tool that allows you to organize your entire life easily. While you may initially find it difficult to navigate the tool when you first download it, there are numerous tips you can use if you're new to Notion.

Whether you're using Notion for the first time or have been using it for a while, using templates is definitely a good idea. Notion templates are essentially pre-made pages you can start using and customize according to your needs once you download them. Fortunately, there are thousands of free Notion templates available to help you budget your monthly expenses with ease. After trying out numerous templates, we've narrowed down our selection to the top five that stood out as the best.

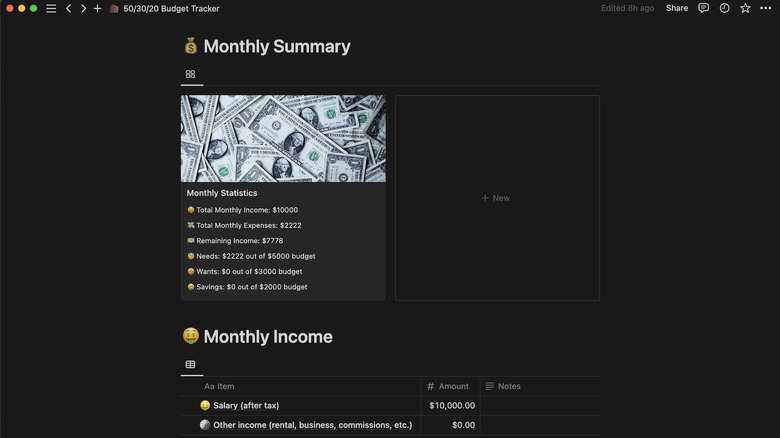

50/30/20 Budget Tracker

According to experts like Elizabeth Warren, who suggested this approach in her book 'All Your Worth' and currently serves as a U.S. Senator, you should split your monthly expenses into three different categories: needs, wants, and savings. The "needs" category includes non-negotiable expenses that you can't compromise on including rent, your college tuition, food, commute, etc. The "wants" category includes non-essential purchases for which you have the flexibility to make compromises, like dining out, entertainment subscriptions, recreational activities, and luxury goods. Lastly, the "savings" category includes funds that you'd like to set aside for your future financial security, retirement savings, and major milestones like a home purchase, education, or travel.

By splitting your major expenses into these three categories, you can leverage Notion's 50/30/20 Budget Tracker to ensure you're only spending money where it needs to be spent, rather than overspending on stuff you don't need. According to this Notion template, 50% of your month's cash inflow must be allocated for your needs, 30% for your wants, and the remaining 20% for your savings.

The template displays a monthly summary of your spending habits, including your total monthly income and expenses. It also highlights the remaining amount for the month and tracks your spending on needs, wants, and savings based on your budget. Once you input your monthly salary, the template automatically calculates the amounts you should allocate for your needs, wants, and savings.

After your monthly budget has been calculated, you can begin recording your expenses under the monthly expenses section. Here, you'll find three different tabs for your needs, wants, and savings. While each tab has some default entries, you can easily customize the table to match your spending categories. As you update the tracker with your expenses, the monthly statistics are updated in real time.

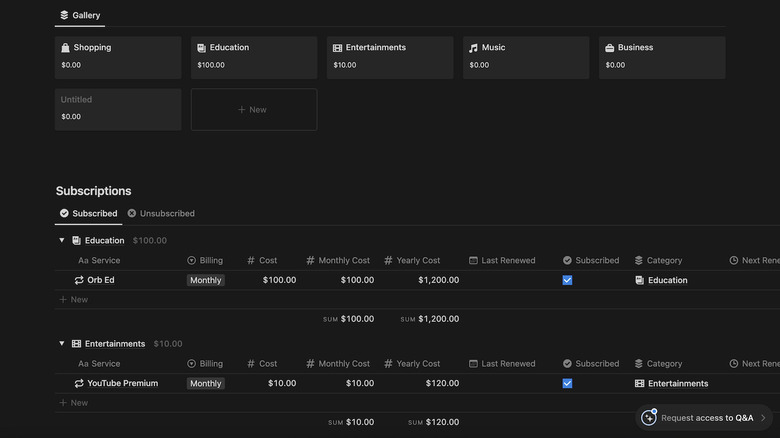

Subscription Tracker

Take a minute to think about how much you spend on subscriptions every month. You're probably subscribed to at least one music streaming service like Spotify or Apple Music, one entertainment subscription like Netflix or Amazon Prime, and the list goes on and on. While binge-watching a show is one of the best ways to relieve any stress work may be giving you, there are many alternatives to Netflix out there, that are most likely cheaper.

If you're trying to cut down on the amount you spend on subscriptions every month, the Subscription Tracker template is definitely one that you'll find particularly useful. This Notion template allows you to categorize all your subscriptions into different sections like shopping, education, entertainment, music, and business. If you're unable to find a section that fits a subscription you have, you can also create your own custom category. Then, list down all your subscriptions for each group.

Along with the subscription's name, make sure to specify how often you renew it (weekly, monthly, quarterly, yearly), its cost, and when you last renewed it. Depending on the information you provided, the amount you spend monthly and yearly on the subscription will be calculated automatically. Not only will this give you a reality check on how much you spend on subscriptions per month, but it's also a good opportunity to figure out which subscriptions you no longer want to renew.

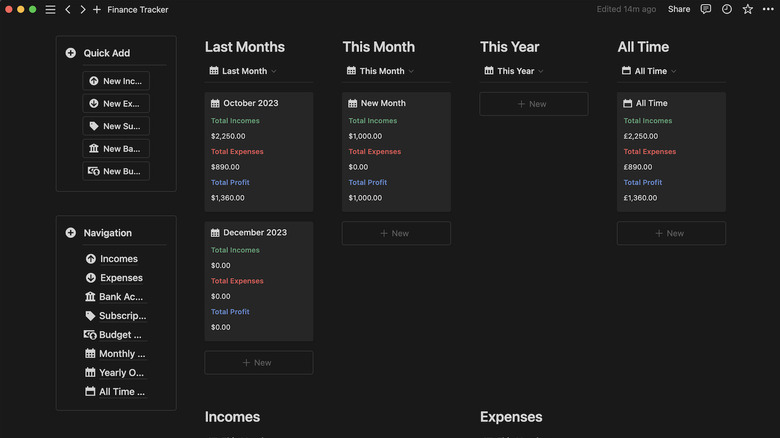

Finance Tracker

While both the templates we've mentioned above do a great job at helping you realize where your money is going, what if we told you that there's another all-in-one template that allows you to track your subscription and other expenses within a single template? The Finance Tracker is yet another great Notion template that is completely free to use and saves you the hassle of managing your finances in multiple templates.

What makes this template stand out from the rest is the fact that this one lets you view not only your current month's income, expenses, and profit but also your spending trends over the past few months, the past year, and even your all-time expenses. While the template may seem intimidating when you first duplicate it, on the left side of the screen, there's a Navigation box that helps you quickly access different sections like your overall income, budget spending, subscriptions, and your monthly, year, and all-time overview.

Additionally, there's a Quick Add box featuring buttons like New income, New expense, New subscription, New account, and New budget. When you make a new purchase or receive payment, simply click the relevant link and input the details. Your month's total income, expenses, and profit will adjust automatically.

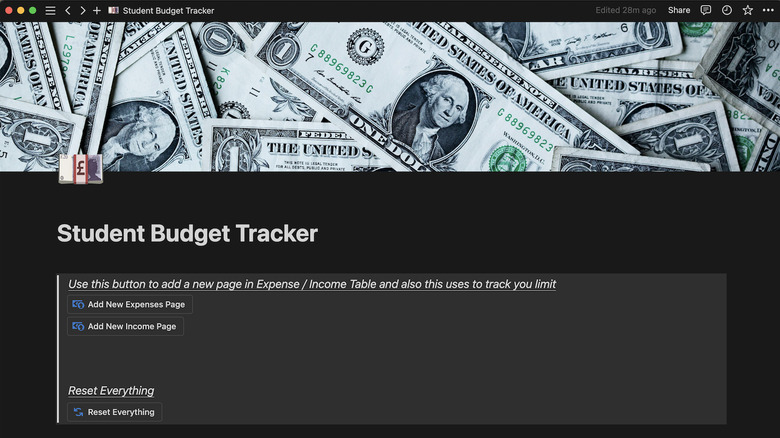

Student Budget Tracker

Whether you're studying architecture or computer science, one thing remains constant for sure — college is expensive. Beyond tuition and textbooks, the life of a college student comes with various other costs like commuting, dorm rent, dining out, groceries, and more. Unless you've discovered a tree that grows money, budgeting is essential for navigating your student finances; otherwise, you might find yourself wondering where all your money went by month-end.

You can use the Student Budget Planner Notion template to track all your income and expenses as a student. On the home page of the template, you'll initially see three buttons: Add New Expense Page, Add New Income Page, and Reset Everything. If you spent money, click the Add New Expense Page button and a new page will be created automatically. You'll now have to fill in how much you spent, the date of your purchase, and the type of purchase. Similarly, if you received a paycheck, click the Add New Income Page button and enter the amount you received along with the date you received it.

Every time you add a new income or expense, it'll automatically be added to either the expenses or income table. Next to the expenses tracker, you can also view a breakdown of your expenses based on the type of purchase you made. This allows you to better visualize how much you spent, when you spent it, and where you spent it. While the template may not be as aesthetically pleasing as some others you might come across, the great thing is that Notion is highly customizable. Ultimately, this means that you can easily tweak it to align with your preferences.

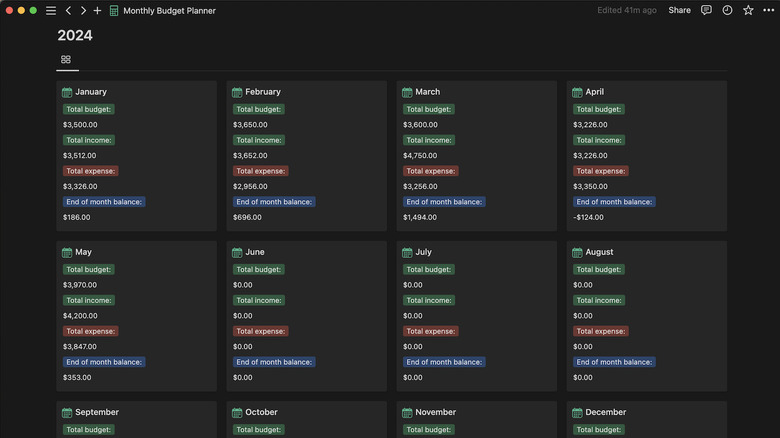

Monthly Budget Planner

If you're someone who likes to plan everything ahead of time, the Monthly Budget Planner template is what you're looking for. Instead of adding your expenses as they accumulate, you can click on the month you'd like to plan and add your expected monthly income to the table on the left.

Here, you'll see the following columns: salary, side hustle, rental income, investment, others, and retirement. Once you fill in all your income details for the month, you can set a budget for your monthly expenses using the table on the right. You'll also see different columns in the Monthly Budget table including housing, transport, utilities, food & grocery, and more. Depending on your needs, you can also customize the columns to make sure they reflect your budget as accurately as possible.

Once you've allocated a budget for each expense, the amount will automatically be deducted from your expected monthly income. After you're done inputting all your estimated expenses for the month, you'll be able to see your remaining budget. You can use this information to allocate your resources more efficiently and ensure you don't overspend. Once the month you've planned begins and you start spending, you can track where all your money goes by filling in the "Amount Spent" column in the Monthly Budget table. If you manage to spend within your budget, your remaining balance will be calculated. On the other hand, if you happen to exceed your allocated budget, the template will prompt you to work on your spending habits.